Attracting foreign direct investments and enabling a business-friendly environment inside Bangladesh remain major bottlenecks to transform the country into a trillion-dollar economy. Bangladesh’s Special Economic Zones can play a pivotal role in shaping the economy of the country.

Special Economic Zone (SEZ) is a sphere that is intentionally built to expand trade balance, employment, and effective administration in relation to different countries that have different business and trade laws and practices. Policies such as tax holiday, quotas, reduction in the legal regulations are undertaken by the host country in SEZs to incentivize foreign direct investments (FDI) into the country.

The very concept of Economic Zones originated in Ireland, Taiwan and some other Asian Tiger countries. However, in China during 1978’s under Deng Xiaoping’s rule, the plan of Special Economic Zones (SEZs) was initiated in four coastal cities: Shenzhen, Zhuhai, Shantou, and Xiamen.

The first SEZ, Shenzhen, was established in 1980, designated as an experiment to test market-oriented policies and attract foreign investment. The policies implemented in the SEZ included tax incentives, streamlined regulations, and preferential treatment for foreign investors. After the success of Shenzhen, gradually 260 new SEZs were established with similar policies. Over the years, the SEZs have played a significant role in driving China’s economic growth and transformation, attracting a total of over $1.7 trillion in foreign investment as of 2020 and helping to modernise the country’s industries.

In Bangladesh, the concept of Economic Zones (EZs) was first introduced in the late 1970s under the leadership of the country’s founder, Sheikh Mujibur Rahman. However, due to political turmoil and subsequent changes in government, the initiative did not materialise until the early 2000s. The first Economic Zone, the Chittagong Export Processing Zone, was established in 1983, but the country started to actively pursue the development of EZs after the establishment of Bangladesh Economic Zones Authority (BEZA) in 2010. Prime Minister Sheikh Hasina took the initiative to ensure sustainable economic growth with foreign investment.

The Bangladesh government felt the necessity to take a step towards EZs mainly to avoid the time constraints and administrative hurdles that industrialists go through in order to start a new business enterprise. Similarly, in terms of FDI, it’s difficult for a foreign company to invest in a developing country like Bangladesh without going through extensive paperwork. On the other hand, from centralised Dhaka and Chittagong it was necessary to come up with an industrialised zone in all segments of Bangladesh with the ongoing growing demand of the economy. Hence the initiative of BEZA came as a blessing for Bangladesh.

BEZA (Bangladesh Economic Zones Authority) is a government agency which is responsible for the establishment, development, operation, and management of economic zones in Bangladesh. Export Processing Zones (EPZs), Special Economic Zones (SEZs), and Hi-Tech Parks are the three types of economic zones, currently established. The country plans to expand it up to 100 economic zones by 2030 and create a smoother foreign direct investment process with the ongoing plan of Smart Bangladesh.

Economic Zone

Total 0

EPZ

Planned

Total 0

EPZ

Approved

- Government68

- Private29

Bangladesh needs US$ 15-20 billion investment every year in order to achieve the upper-middle income status and vision 2041. However, the country was getting around US$ 7- 8 billion every year up to 2019. Hence, the BEZA initiative is to attract investment in agriculture, industry, production, service, commercial, technology, tourism, housing, entertainment or power generation sector as well as the ‘Bangladesh Private Economic Zone Policy, 2015’ which will augment the private sector benefit in addition to the government sector.

0

Industries in operation

0

Total Foreign & Local Investors Attracted

0

Industries under Construction

The sectoral benefits that BEZA came up with are

Foreign Direct Investment

0

Billion

CONFIRMED INVESTMENT

- 2017-183157 employments

- 2018-195953 employments

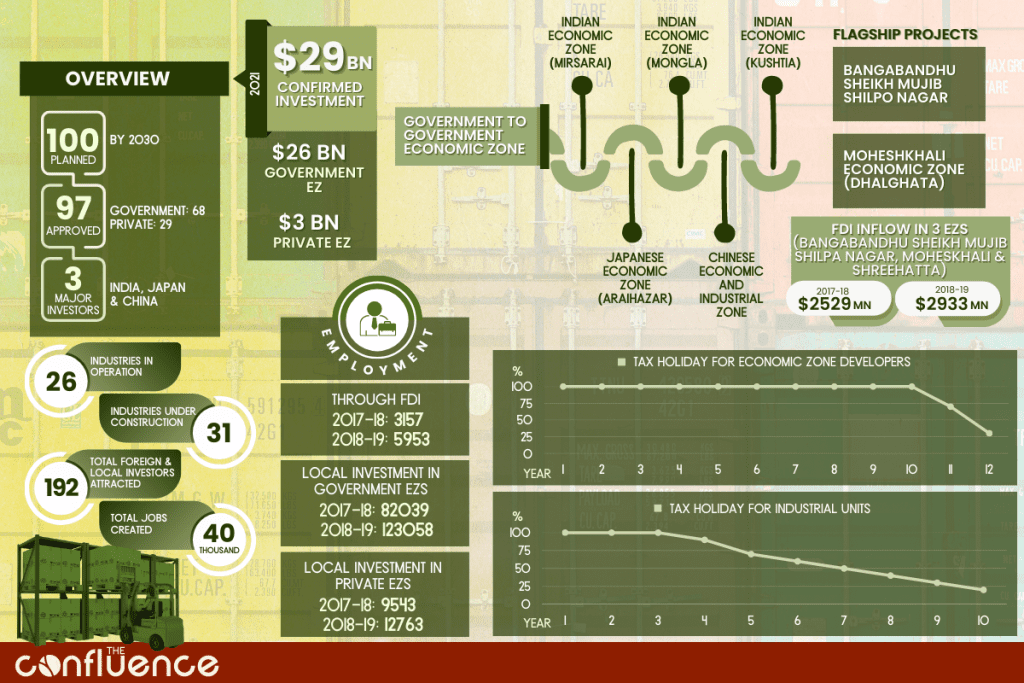

In the FY 2017-18, FDI in 3 EZs (Bangabandhu Sheikh Mujib Shilpa Nagar, Moheshkhali EZ and Shreehatta EZ) was US$ 2529 million and it rose to US$ 2933 million in FY 2018-19 just in a few years of BEZA initiative. In 2023, investment proposals of $26 billion have been signed in all these 97 economic zones. About 14 companies made their commercial debut last year. These companies have already invested about $967.33 million and will invest an additional $331.27 million in future business expansion as contracts are signed. The investment so far has been around $610 million and further investment will be around $1922.39 million coming from 29 under-construction industrial units.

G2G Foreign Investment

-

Japan

-

India

-

China

Government-to-government deals regarding private sector development are increasing while foreign investments are coming from developing Japanese EZ, Chinese EZ and Indian EZ. BEZA is also working to get investors in the UAE (United Kingdom of Saudi Arabia) Economic zone as Executive Chairman of Bangladesh Economic Zones Authority (BEZA) mentioned recently . These 3 countries Japan, China and India have been increasing their investment since the FY 2017-2018. According to the Japan External Trade Organization, 71% of Japanese companies want to increase their operations over the next two years because they see Bangladesh as a promising place to invest. In FY 2017-18, Japan invested only US$ 83.33 Million while after the established economic zone projects in 2023 the number became $457.98 million in foreign investment, making Japan the 12th largest source of foreign direct investment stock of Bangladesh.

Employment Opportunities

0

Employment Potential

EMPLOYMENT THROUGH LOCAL INVESTMENT

In

Government

EZ

- 2017-1882039 employment

- 2018-19123058 employment

In

Private

EZ

- 2017-189543 employment

- 2018-1912763 employment

It was projected that BEZA will bring employment opportunities for 10 million youths, solving the unemployment issue. The investment already came from Japan, China and India is creating employment opportunities for 1 million youth this year. For example, in 29 industrial units more than 6,407 people are already employed with 38,658 additional employment opportunities coming soon in these units. In addition, the eight commercial industries and 70 other industries which are under construction will be bringing 50,000 people under employment opportunities and with an investment of around $4.5 billion.

Fiscal Incentives

Economic Zone Developers are enjoying the exemption on Income-tax payable on all of the designated Economic Zone’s income arising out of its commercial operation. In terms of commercial operations, the tax holiday will start from 100% for the 1st ten years, 70% for the 11th year and 30% for the 12th year. In addition, industrial units inside EZs are having tax holiday at different rates such as- 100% for 1st, 2nd and 3rd year, 80% for the 4th year, 70% for the 5th year, 60% for the 6th year, 50% for the 7th year, 40% for the 8th year, 30% for the 9th year and 20% for the 10th year. Value Added Tax (VAT) and imported duties have also been exempted under this project. Import of raw materials from abroad and the domestic market are possible for the industrial units of any economic zone. Those industries who registered for VAT Act 1991 were able to utilize the electricity, water, gas and procurement of raw materials from the domestic market for usage.

One Stop Service (OSS)

BEZA OSS (One Stop Service) centre is a single window which provides business information and licensing services to save time and bureaucratic red-tapism for the industries. Usually, newly made industries do not have any idea what type of business they need to do, how they will register the company, what type of benefits they will be getting. Hence, OSS centre is built to make the EZs business-environment friendly with greater investment. In 2018, BEZA enacted a law named OSS Act followed by introducing OSS Rules where investors inside the EZs can understand the starting time of business as well as the productivity level.

BEZA OSS (One Stop Service) centre is a single window which provides business information and licensing services to save time and bureaucratic red-tapism for the industries. Usually, newly made industries do not have any idea what type of business they need to do, how they will register the company, what type of benefits they will be getting. Hence, OSS centre is built to make the EZs business-environment friendly with greater investment. In 2018, BEZA enacted a law named OSS Act followed by introducing OSS Rules where investors inside the EZs can understand the starting time of business as well as the productivity level.

there are a few implications which are necessary in the BEZA initiative

- Registration of private enterprise still follows a lengthy process with multiple times of information paper submission. Therefore, the government needs to simplify the registration process further.

- In order to achieve rapidly growing GDP, Economic Zones should focus on high tech industries. They can collaborate with the National Skill Development Authority to enhance the skill of the labour force.

- Currently BEZA renders 11 services of the 37 through online and rest of them are offline hence to make it less time constraint all of the services have to be available online to reduce the administrative cost as well.

Cover photo: Mohammad Minhaj Uddin/TBS

About the Author

A R Tahseen Jahan is the Co-Founder and Head of Policy at The Confluence. An undergrad student of Development Studies at the University of Dhaka, she worked on topics of economic development and public policy analysis.

2 comments

[…] Exemption: The tax break will begin at 100% for the first ten years on capital gains, dividends, royalties, and technical assistant fees, 70% for the eleventh year, […]

[…] from Gelephu, Bhutan’s southernmost city, in the northern portion of the country. The economic zone will open up new possibilities for bilateral investment and trade between the two nations as well […]