In Bangladesh’s road to industrialisation and road to knowledge-based economy, one potential step forward can be the mobile handset manufacturing industry. Many global brands are manufacturing their phones in Bangladesh to meet the domestic demand. Can it be scaled up towards export-orientation?

Bangladesh has developed into a hub for the industry with about 12–13 businesses investing more than Tk5,000 crorein the production of mobile phones. Around 4 crore units is the production capacity of these companies, reducing the dependence on imports. The mobile phone manufacturing industry has contributed to Digital Bangladesh through a market size of mobile hand set of BDT 10,000 crore or more than $1.2 billion in 2020. By ensuring connectivity through 24/7 emergency service, fire service, police, ambulance service and toll-free connectivity during Covid-19 medical services the country is moving towards Smart Bangladesh with this newly growing industry of Mobile Handset Manufacturing. This industry has created employment for 1 lakh people where 98% are Bangladeshi labour.

Whereas RMG sector is contributing 9.25 percent to GDP, Mobile Handset sector is the next leading manufacturing sector with export diversification. Bangladesh has 165.5 million people living there as of January 2021, yet there were 165.8 million mobile connections which is 100.2% of the country’s total population. There are almost 90 million distinct mobile users, and 95% of the population is covered by 4G networks. There’s a noteworthy 67% utilisation difference even with one of the best 4G network coverages in South Asia. In other words, 67% of people who live within a mobile broadband network’s service area do not utilise mobile internet.

The country manufactured over 3.42 crore smartphones in 15 domestic facilities, according to data from the Bangladesh Telecommunication Regulatory Commission (BTRC). It imported an additional 1.52 crore phones in FY21. The mobile device market in Bangladesh is now valued at around Tk 10,000 crore. Importers of handsets incur 38% tax, whereas local producers pay 5% to 15% duty on imported raw materials. In FY21, domestic phone output increased 16.32% over the previous year. The BTRC estimates that there are 7.71 crore 2G smartphone users, 4 crore 3G users, and 5.92 crore 4G users in the nation. In the meanwhile, 59% of Bangladeshis use feature phones and 41% use smartphones, according to GSMA data.

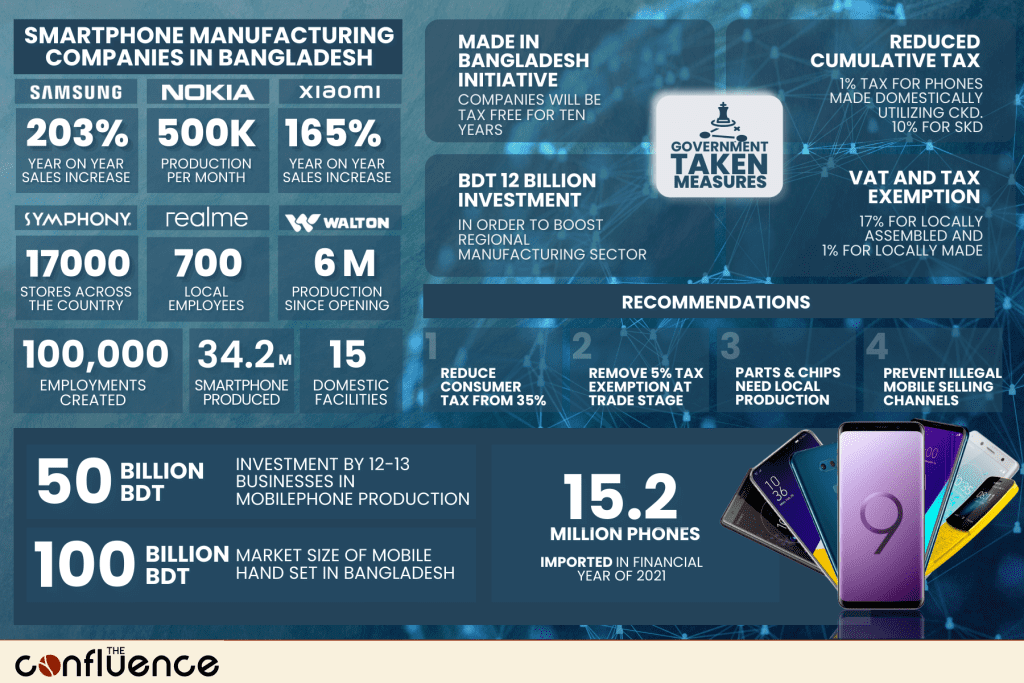

Smartphone Manufacturing Companies in Bangladesh

In 2017, local electronics manufacturer Walton began producing smartphones in Bangladesh under its own brand. Subsequently, multinational businesses like Symphony and electronics behemoth Samsung began producing in the nation. Currently, 12 businesses are authorised to produce mobile phones, according to BTRC. They are: Best Taicool Enterprise Ltd (Brand: Vivo), Walton Digi-tech Industries Ltd., Fair Electronics (Brand: Samsung), Edison Industries (Brand: Symphony), Alamin and Brothers (Brand: 5 Star), Carlcare Technology BD Ltd., Bangla Trinomic Technology (Brand: DTC), Bentley Electronic Enterprise (Brand: Oppo), Okay Mobile, and Mycel Technology.

Bangladesh is a major draw for brands as the country had 175.27 million active mobile phone accounts, placing it comfortably among the top 10 countries in Asia this may. In addition, the substitution of smartphones for feature phones and local smartphone manufacturing were supported by an effective price differential of 15–26% between imported and locally assembled smartphones. Because smartphones are becoming more affordable, people with lesser incomes can now also purchase high-quality mobile phones. Because the factories import small parts and assemble the smartphones, Bangladesh, which was once entirely dependent on imports, is on track to becoming self-sufficient in the production of smartphones. Over 35 million mobile phones are needed annually, of which 11 million are smartphones. Local producers will be able to supply nearly 80% of the demand for mobile phones in the area by January 2021. Over 15,000 jobs have been created by this industry.

Samsung

In Bangladesh’s smartphone market, Samsung, a South Korean corporation, holds the top spot. The company’s sales increased 203% YoY (year over year) in 2019, which allowed it to take the number one position in Bangladesh for the first time. The main drivers of Samsung’s expansion were new product types and efficient local assembly. Samsung benefited from portfolio diversification as its smartphones dominated their respective price points. While the Galaxy A series offers higher mid-range smartphones constructed with somewhat more costly materials, the Galaxy J series targets the entry-level smartphone market with reasonably priced handsets made with inexpensive components.

Nokia

NOKIA company plans to soon begin producing 500,000 smartphones each month. Union Group is the local conglomerate that will manufacture Nokia phones under contract with Espoo, Finland-based brand owner HMD Global.

Symphony

Symphony set out to become the go-to local brand for the broader public. The company’s success has been attributed to a competitive pricing strategy, innovative adaptability, and the largest countrywide distribution network with over 17,000 stores.

Transition and RealMe

Transition, a Chinese company, has been seeking ways to expand local manufacturing. The corporation is pursuing a multiple brand strategy with names including itel, Tecno, and Infinix in order to expand market share. One of Bangladesh’s top three smartphone brands is Realme, a different Chinese business with a 14% market share. At its Gazipur facility, Realme manufactures phones, employing over 700 local workers.

Xiaomi

One of the major foreign companies in Bangladesh’s smartphone market is Xiaomi, based in China. Customers value the brand because it provides the ideal balance of quality and price. This might be seen in the 165% YoY increase in Xiaomi smartphone shipments to Bangladesh in 2019. They can produce 2,000 units a day, or about 30 lakh units annually. There are 260 Bangladeshi workers in the company.

Walton

Walton produces cell phones locally while incorporating features from the top smartphone companies. The firm takes use of local production and assembly, which leads to the availability of less expensive alternatives, to deliver industry-level features at a reasonable price. Since opening the nation’s first-ever mobile phone manufacturing facility in October 2017, Walton has produced 6 million devices, comprising 1.7 million smartphones and 4.3 million feature phones. By 2030, the business wants to export goods valued at $10 billion.

Government Initiatives to Encourage Smartphone Manufacturing

Through the “Made in Bangladesh” initiative, the government has taken action to promote domestic smartphone manufacture and assembly while luring international investment. By raising tariffs on imported phones, lowering taxes on component imports, and removing value-added tax from consumer sales, the government encourages foreign phone companies to enter the market. To support local home appliance manufacturers and the local brands, the government may offer tax breaks. Bangladesh stated that ‘Made in Bangladesh’ brands will be free from taxes for ten years. If specific requirements are met, businesses that make light engineering goods, household and kitchen appliances, and three- and four-wheelers will be excluded.

Prior to 2017, the total amount of taxes imposed on imported equipment used in the assembly and manufacture of smartphones was 37.07%. The Finance Ministry changed the tax laws and reduced the cumulative tax to 1% for phones made domestically utilising the Complete Knock-Down (CKD) method. The total tax rate for regional assemblers using the Semi-Knock Down (SKD) Process is 10%.

The planned extension of the current VAT exemption provision on the production and assembly of mobile phones through FY24 was included in the National Budget for FY 2021–2022. For imported feature phones, the current supplemental duty tariff rate is 10%. A proposal has been made to raise it by 15% to 25%. Another precaution that has not yet been implemented is preventing purchasers of phones that have been smuggled from registering their devices on local networks. This would encourage local producers and limit the unauthorised import of phones into Bangladesh.

In order to boost the regional manufacturing sector and access Tk 12 billion in investments by 2023, the government of Bangladesh intends to build eight more high-tech parks by the end of 2021. Priority is given to international and domestic smartphone makers when deciding how much area to occupy in these tech parks. The parks provide investors a number of unique incentives, such as exemptions from VAT, stamp duty on deed registration, tariffs on the importation of capital equipment and building materials, income tax on dividends, share transfers, royalties and investor technical fees, among other things.

Exporting the Mobile Handset

Symphony is already selling cell phones with the label “Made in Bangladesh” to Nepal; in the following five years, the company hopes to expand to four other nations: Nigeria, Sudan, Vietnam, and Sri Lanka. They are expecting to export the handsets by 2023 and 2024 and produce 95% of the smartphones for the local market.

About 15,000 mobile phones of three different kinds were directly exported by Symphony to the Apex Group in Nepal in October of last year. On January 22, they issued another 10,000 phones. Every month, we want to export 10,000 items from Bangladesh to the Nepali market. They employ 1300 workers in our plant, where they make 10 lakh goods a month and everybody is from Bangladesh.

Increasing Investment in Local Manufacturing

The general rise in smartphone demand has made it possible for regional producers to launch successful enterprises. During the latter quarter of 2018, locally produced gadgets began to join the ecosystem, bringing forth new market dynamics. Customers began purchasing phones built locally when they were looking for value delivery that was efficient and affordable. The introduction of locally made smartphones caused the smartphone market in Bangladesh to grow 45% YoY in the first quarter of 2019.

In Bangladesh, 41 percent of the smartphone market is made up of products that are produced domestically. When compared to imported equipment, locally made products are less expensive. In contrast to older models, the most recent locally made gadgets have a far lower defect ratio.

The administration has been working to support regional manufacturing. Currently, domestic producers are able to benefit from lower cumulative tax rates compared to imported phones. The tax rates for locally made phones are 17% (locally assembled) and 1% (locally manufactured), respectively, in contrast to 34% for imported phones. Nonetheless, both high-end and reasonably priced Chinese companies compete with local names. Lack of a strong backward connection is a prevalent problem in local production and assembly. However, a number of international companies, like Oppo and Vivo, have recently announced plans to keep producing their devices in Bangladesh. This will present local assembly partners with financial prospects.

Better Future of Mobile Handset Manufacturing in Bangladesh

In order to achieve Smart Bangladesh and upgrade the production of mobile handset industry in the export sector there are key recommendations Bangladesh needs to follow to avoid the underlying challenges.

Bangladesh has a greater consumer tax which is 35 percent than its regional counterparts when it comes to Total Cost of Mobile Ownership (TCMO). It needs to be decreased as the tax is 25% and 23% in India and Pakistan.

The budget for the fiscal year 2022–2023 proposes to remove the current 5% VAT exemption at the trade stage of mobile phone sets, which will have an impact on Bangladeshi consumers’ capacity to buy mobile phones. The retail price of the handset may increase for this which needs to be taken care of.

Main components of mobile production are chipsets, displays, and batteries etc which are imported from China, South Korea and Taiwan. Only 15-30 percent value addition occurs in Bangladesh hence the raw material productions are something we should be considering.

Around 10 percent of the mobile phones sold in Bangladesh are through illegal channels which need immediate attention.

To support the growth of the regional mobile phone manufacturing sector, import duties on smartphones are set at 57% and on feature phones at 32%. To prevent the arrival of unauthorised phones, the BTRC should also take disciplinary measures on many occasions.

About the Author

A R Tahseen Jahan is the Co-Founder and Head of Policy at The Confluence. An undergrad student of Development Studies at the University of Dhaka, she worked on topics of economic development and public policy analysis.