Bangladesh is heavily reliant on the RMG sector with 9.25 percent of its contribution in the GDP (FY 22). To diversify its economy, reducing its reliance on a single sector, Light Engineering has huge importance with export potential.

Being the major player in global apparels industry, the light engineering industry contributes more than 2% to the country’s GDP of Bangladesh. Along with the export earnings, manufacturing import alternative equipment spares, plant machinery, small tools, toys, consumer goods, and paper products for the domestic market presents an opportunity for the sector to lessen the nation’s dependency on imports.

The industry is known as the “mother of all industries” because it supplies replacement components on short notice to a wide range of industries, including clothing, food processing, railroads, jute, paper, textiles, sugar, and cement. Additionally, it produces a range of spare parts, which is a vital source of assistance for the construction, agricultural, and industrial sectors. If the industry receives the required legislative support, experts estimate that Bangladesh might make $25 billion by exporting light engineering goods to prospective customers in China, the USA, India, Singapore, and Japan.

$

0

Bn

Export potential of light engineering

Light Engineering Industry

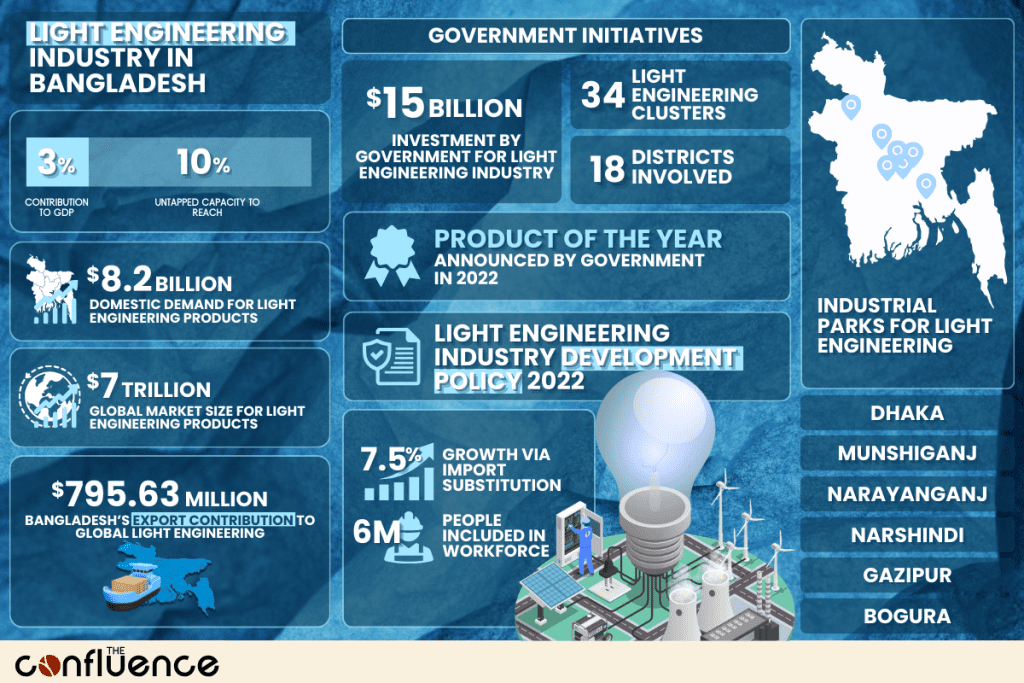

Light Engineering Industry (LEI) has served as a backdrop for the diversification of the manufacturing sector in Bangladesh. The industry produces machinery spares and small tools for automobiles, railways, agro machinery, mills and factories, construction equipment, the shipbuilding industry, etc. It contributes almost 3% to the GDP, with an untapped capacity to reach 10% with planned strategies and implementation.

0

%

Contribution to GDP

0

%

Potential Contribution to GDP

The president of the Bangladesh Chamber of Industries (BCI) stated that the domestic demand for light engineering products in Bangladesh is around $8.2 billion and the local industries meet almost 50% of the demand. Approximately $15 billion has been invested in 34 Light Engineering (LE) clusters across 18 districts. However, the clusters heavily rely on the ship-breaking industry for nearly 90% of their raw material supply. The industry has channeled multidimensional growth via import substitution by 7.5% and by generating a workforce of 6 million people with 5,000 micro-enterprises and 10,000 SMEs. However, in the $7 trillion global market, our export contribution was only $795.63 million in fiscal year 2021-2022, which reflects the industry still has a long way to go.

$

0

Bn

Domestic Demand

Around 50% of domestic demand

met by the local industries

$ 15 billion invested

in 34 light engineering (LE) clusters across 18 districs

90% of raw materials

supplied by the ship-breaking industry

7.5% import substitution

ensured by the industry

6 million people

employed by the industry

5,000 micro-enterprises with 10,000 SMEs

involved in the industry

$795.63 million export contribution

to $7 trillion global market

Potentials of Light Engineering Industry

The light engineering sector was announced as the ‘product of the year’ by Prime Minister Sheikh Hasina in 2022, recognizing its potential to increase the country’s foreign exchange.

In the same year, the Ministry of Industry issued the Light Engineering Industry Development Policy with a 6-year action plan. With the policies and interventions, this industry can create backward linkages to the growth of the economy of Bangladesh.

0

%

growth in FY 2021-22

$489 million earnings

grew by 67% in FY 2021-22

In the 2021-22 FY, the industry achieved remarkable growth by 50.4%, and export earnings from this sector increased by 67% to reach $489 million, making it a priority sector for investment and support in the National Export Policy 2021-2024. Upon realizing its prospects, the government has taken a few initiatives for economic diversification and export potentials with import substitution strategies.

Initiatives taken by the GoB

Light Engineering Industry Development Policy 2022

In order to establish a thorough action plan for the 2022–2027 time period, the Light Engineering Industry Development Policy 2022 has been introduced. The major aim is to foster the growth of the light engineering industry, ensuring its participation in the goal of the industrial sector contributing to 40% of the GDP by 2027.

0

%

Projected contribution of industrial sector by 2027

The Ministry of Industries formulated the policy with 11 strategic targets to achieve by 2027. The targets focus on market & innovation, supply chain, skill development, investments, infrastructure, and technology. The policy sets eleven strategic objectives:

- Infrastructural Development

- Modernization and Development of Technology

- Development of Forward and Backward Linkages

- Human Resource Development

- Market Development and Expansion

- Research and Development

- The establishment of Industry Clusters

- Development of the Common Facility

- Quality Assurance and Certification

- Access to Finance

- Development of Investment Climate

- The policy mandates BITAC to establish a raw material bank, which is usually sourced from the shipbreaking industry, and mentions that the National Board of Revenue would implement buyback management and provide tax incentives for the light engineering industry by 2025.

- From the policy outline, it is expected that the finance division and Bangladesh Bank will establish a venture capital fund to facilitate LE production.

- The policy sets out the plan to provide subsidized loans to encourage entrepreneurs to purchase new technologies and develop existing ones.

- The implementation of the policy will be monitored by an Industrial Development Council of 35 members and will be chaired by the Minister of Industries.

Aims of the policy

- Produce international standard intermediate goods to drive the light engineering sector into the domestic and global market and ultimately establish the Made in Bangladesh

-

Proliferate research and development of light engineering products, and establish a Metal Research Institute.

- To ensure high-quality production of light engineering goods and services, establish necessary infrastructure like an Industrial Park, Industrial Structure, and Common Facility Centres.

BSCIC Industrial Park for Light Engineering

BSCIC started developing the first industrial park for light engineering and electrical goods in 2016, in the Tongibari Upazila of Munshiganj intending to bring all local engineering businesses under a single hub. The park was designed to relocate hazardous chemicals and plastic factories from the dingy alleys of Puran Dhaka. The Industrial Park can potentially benefit from the positive externalities of Padma Bridge with increased connectivity and mobility.

Five New Industrial Parks

The government has decided to set up five industrial parks in 5 districts – Dhaka, Narayanganj, Bogura, Narshindi, and Gazipur.

10 Year Tax Holiday Scheme

In the 2022-2023 FY budget, the government provided a 10-year tax holiday to entrepreneurs who light engineering products for factories. This has made the sector more attractive for investment, potentially leading to more employment opportunities and economic growth.

Additionally, the production and commercial distribution of power tillers, as well as the delivery of locally created light engineering items, are free from VAT.

Light Engineering Product Business Promotion Council

The Ministry of Commerce Established the Light Engineering Product Business Promotion Council (LEPBPC)to stimulate the growth of the Light Engineering sector. The council was formed with the partnership of both private and public sectors. LEPBPC published ‘Sales Kit’ as a promotional tool, which has helped investors and entrepreneurs to have a basic idea about the industry and to engage with the council in promoting LE products.

Sectoral Priority

- High-Priority Sector: LE was declared a High-Priority Sector in the National Industry Policy of 2016.

- Special Development Sector: LE was declared a Special Development Sector in the export policy of 2018-2022.

Diplomatic Initiatives for Light Engineering’s boom

In the European market, Bangladesh benefits from the duty-free status of the GSP facility. The northwestern European countries have replaced the previous GSP scheme with a new scheme called the Developing Countries Trading Scheme. The scheme offers reduced tariffs and simpler rules to facilitate free and fair trade with developing countries.

“The new scheme can be a game changer for Bangladesh to break into non-RMG export sectors, such as light engineering,”

Mohammad Abdur Razzaque

Research and Policy Integration for Development (RAPID)

Currently, Bangladesh’s contribution to the light engineering market of the UK is only 0.02% ($56 Million). With the new scheme’s relaxation of local value addition requirements from 30% to 25%, Bangladesh has the potential to secure a larger portion of the market.

$

0

Mn

Contribution of Bangladesh to the LE market of the UK

However, RMG enjoys duty free market access which has augmented its export potential in the global market. But the government has decided to restrict the duty free market access of RMG after 2025 to facilitate export diversification, which provides great scope to the LE industry to capitalize on the opportunity to be the leading export industry of the country.

Major Challenges of Light Engineering Industries

Lack of Contemporary Technology

The LE industry currently meets 48%-52% of the country’s demand and our export is not even 1% of the global market size. The lack of modern technology and dependence on backdated manual technology hampers the yield of the industry. As outdated technologies require more raw materials for a unit product, 30%-40% of our resources turn out to be wasted.

Informal Sector

According to a study, only 8% of the workers were reported to have formal contracts for their jobs in the industry. This results in a lack of access to government welfare rights and exploitation in terms of wage discrepancy in payment. This is also seen as a bottleneck for the upskilling process.

Lax Value Chain Connection

According to Abdur Razzak, the president of Bangladesh Engineering Industry Owners Association (BEIOA) the overall investment in the LEI is about $15 billion. But due to weak value chain connection, the investment does not lead to efficient outcomes. Lack of value chain increases supply delay, production cost, limits market access and reduces competitiveness.

Import Tax Disparity

The import tax for LE Industry’s raw materials is 30%-40% while the tax on finished goods is only 1%. The stark contrast results in low profit margins and difficulties to meet local demand and in terms of increasing exports. This also causes imported LE products to be cheaper (eg – China’s LE products), which challenges the survival of LE industries of Bangladesh.

“The customs department sets higher values, instead of actual values in the case of raw material imports. As a result, we pay higher taxes and our production costs go up, which ultimately decreases our competitiveness,”

Rashed Mahmud

Managing Director of Kitty Industries Limited

Skill Constraint in Workers

BIDS report identified a 33.6 % skill gap in the Light Engineering sector. Due to high levels of skill mismatch, when firms have to fill vacancies for a particular skill-group, they end up recruiting inadequately skilled workers, which lowers productivity and efficiency.

Disparity in VAT and Tax

According to BEIOA President Abdur Razzaq the small repair services are subjected to a 15% tax while the manufacturers of Light Engineering products enjoy tax exemptions. Currently there are about 40,000 SMEs under the LE industry in Bangladesh. The small repair workshops associated with the industry face operational challenges due to the added burden of VAT, which hinders the long term growth prospects.

Recommendations

- The current local market of LE products in Bangladesh is highly dependent on imports. But if the imported products are replaced with domestic production, the dollar outflow can be reduced for the sector. The yield of the industries need to increase to reduce the reliance on imported goods.

- The tax discrepancy for the import of raw materials and on finished final goods need to be addressed. As the imported raw materials are eligible for tax, the production cost increases and reduces profit margins.

- Greater focus should be given on providing public goods and market information than subsidization and tax holidays. Creating transportation and supply networks, providing market insights can foster a more sustainable industry than subsidy strategy.

- Introducing the ‘Plug and Play’ strategy like that of China by establishing functional industrial zones can generate more businesses within the sector.

- Fostering the Idea intensive light engineering sector is necessary in the age of 4IR. Instead of continuous large scale production of similar products, Bangladesh should focus on innovation and novelty in its LE goods such as bicycles, electronics, battery etc.

Cover photo taken from Financial Express.

About the Author

A R Tahseen Jahan is the Co-Founder and Head of Policy at The Confluence. An undergrad student of Development Studies at the University of Dhaka, she worked on topics of economic development and public policy analysis.