Bangladesh’s Footwear Industry has seen tremendous growth in the last decade. What policies supported the growth and what remains to be done?

The footwear industry in Bangladesh plays a significant role in the country’s economy, contributing 4% to total exports and 0.5% to GDP. It also serves as a major supplier of shoes to the global market. According to the World Footwear 2023 Yearbook, Bangladesh is presently ranked in the top 10 countries in terms of footwear production.

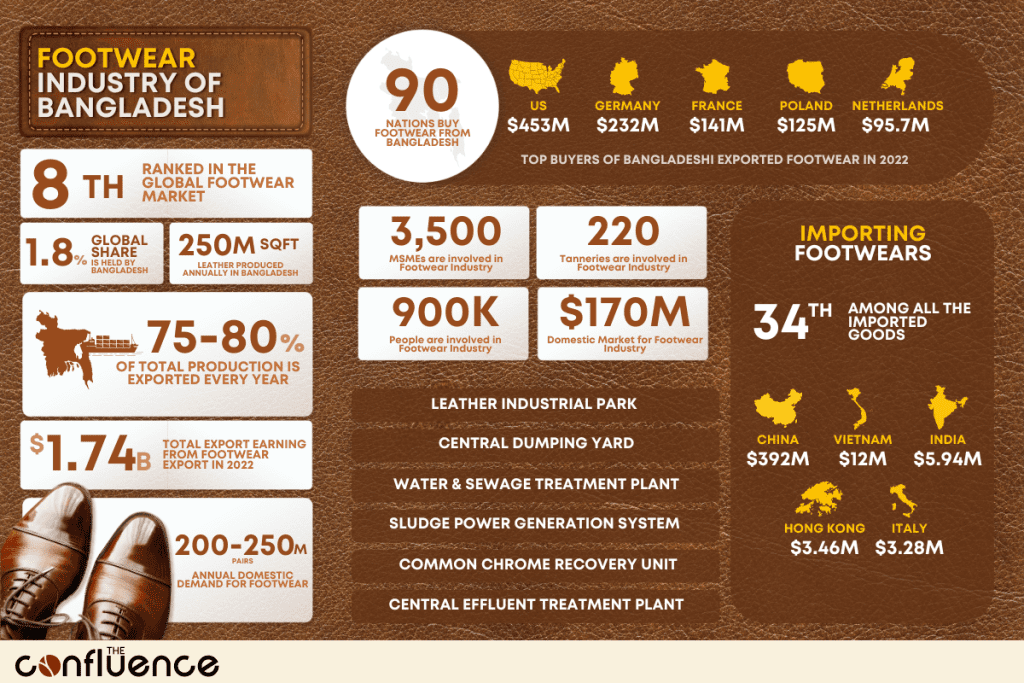

Footwear Industry at a glance

0

%

Global Market Share Held by Bangladesh

4% to Total Exports | 0.5% to GDP

Contribution of Footwear Industry

8th Largest Producer

In terms of production volume

US $ 170 Million | 200-250 Million Pairs

Domestic Footwear Market

20-25% of the Domestic Demand

Met by local production

In terms of production volume, Bangladesh is now placed eighth in the global footwear market. Bangladesh accounts for approximately 1.8 percent of the global footwear market. The domestic market for footwear is approximately $170 million. Domestic demand for footwear is approximately 200 to 250 million pairs per year. Bangladesh’s total footwear output meets 20-25 percent of the domestic demand, with the remaining amount being exported.

Leather Industry at a glance

0

th

Largest Sector Contributing to Export Earnings

3500 MSMEs and 220 Tanneries

Involved in the Leather Industry

900,000 People

Employed in the Leather Industry

US$ 941.6 Million

Export Revenues of the Leather Industry

250 Million Sq. ft

Leather production of the Leather Industry

The Bangladeshi government has recognized the leather industry as one of the thrust sectors where footwear has a significant role. The leather industry generates a significant quantity of foreign currency each year from the export of leather and footwear. In terms of export earnings, the leather sector ranks fifth.

A recent report states that 3,500 MSMEs and 220 tanneries are involved in the production and processing of leather in Bangladesh. During the fiscal year 2021, the leather goods industry employed over 900,000 people, and its entire export revenue was valued at 941.6 million USD. Bangladesh produces over 250 million square feet of leather per year, with supplies peaking during the celebration of Eid Ul Adha.

The footwear sector, which constitutes a huge portion of the leather industry, is now a major player in the global market. After undergoing significant changes over the years, the footwear market is currently seeing stable expansion. Bangladesh imports nearly all of its goods from China and exports mostly to the US and European markets.

The footwear business in Bangladesh is emerging as the next major sector, comparable to the ready-made clothes industry, owing to its growing demand in both local and worldwide markets. The footwear sector in Bangladesh is seeing significant growth because of the country’s low labour costs, increasing domestic demand, favourable government regulations, continuous expansion of the local market, and ample supply of raw materials.

0

%

Annual Growth Rate of the Industry

The sector is expected to continue increasing, especially with increased investments in cutting-edge technology to enhance production efficiency and infrastructure to facilitate expansion and improve competitiveness in the global market. Leather and synthetic materials are the primary inputs in the manufacturing of footwear. The industry’s ability to offer high-quality products at competitive prices is directly influenced by the availability and pricing of these resources.

The Trajectory of the Footwear Industry in Bangladesh

Historical Footwear Industry: 1960-2000

Bangladesh’s footwear industry originated during the colonial era, but it wasn’t until the late 1980s that it underwent modernization. There was no large-scale footwear manufacturing company in East Bengal during the British era. Nonetheless, there was a traditional cottage-style footwear business in the district towns at the time, with few production facilities.

The inaugural large-scale shoe manufacturing plant in Bangladesh was the Bata Shoe Company, founded in 1962 in Tongi. Eastern Progressive Shoe Industries (EPSI) established its manufacturing plant in 1967. The company commenced the shipment of footwear to England, the USSR, and Czechoslovakia. EPSI and Bata dominated the majority of shares in the local footwear market.

Amidst the liberation war, the footwear industry faced a substantial setback, although it subsequently rebounded after achieving freedom. Subsequent to then, further factories were established with the purpose of manufacturing shoes. Apex Footwear, Excelsior Shoes, and Paragon Leather and Footwear Industries are among the notable examples.

The Leather Engineers and Technologists’ Society (LETS’B) was established in 1989 with the objectives of safeguarding the well-being and interests of its members and offering reliable technical guidance to the leather, footwear, and leather products sectors in order to benefit the nation. In the 1990s, significant progress was made in the creation of crust and finished leather.

Modernized Footwear Industry: 2005-2015

Statistics released by the Export Promotion Bureau of Bangladesh indicate that footwear exports experienced a significant growth of 39% from US$61 million in July-November 2007 to $85 million in the corresponding period of 2008. In the initial four months of the 2010 fiscal year, exports reached $98 million, a 65 percent increase from the same period in 2009.

0

%

Year-on-year increase in 2008

Bangladesh’s export expansion was propelled by its competitive advantage in terms of lower manufacturing costs compared to its neighbouring countries, namely China, India, and Vietnam, all of which had already established a robust leather and footwear export industry. In response to fierce competition from prominent footwear exporters like China, firms in Bangladesh’s footwear industry endeavoured to manufacture premium shoes that cater to the demands of consumers both domestically and globally. Bangladeshi footwear is renowned globally for its quality, uniform fibre composition, velvety texture, and inherent lustre.

Year-on-year Growth of Footwear Exports

- 200839 %

- 201065 %

- 201146 %

- 201325 %

Bangladesh exports numerous components of the footwear value chain, encompassing raw materials, work-in-progress items like soles, and finished goods like shoes. This sector has been expanding, with exports rising by 46% in 2011, followed by a healthy 25% increase in 2013. Bangladesh’s footwear exports doubled during 2010-2013 and continued to expand, as seen below.

Growth of Footwear Exports of Bangladesh (Million US$)

Source: Export Promotion Bureau

No Data Found

Bangladesh manufactures superior leather using domestic animals, which is subsequently treated in tanneries situated in the capital city. The inputs are subsequently transformed into final products, such as footwear, which had an export worth of US$ 419 million in 2013 (Source: EPB).

$

0

M

Export Earnings from Shoes in 2013

0.9% in 2013

Share of Global Leather Exports

0.4% in 2013

Share of Global Footwear Exports

0.1% in 2013

Share of Global Leather Goods Exports

In 2013, Bangladesh accounted for 0.9% of global leather exports (raw hides and finished leather), 0.4% of footwear exports, and 0.1% of leather goods exports. The Export Promotion Bureau (EPB) reported a 23.40% growth in the country’s footwear exports for the first nine months of fiscal year 2014-15, in comparison to the corresponding period in the previous year. Bangladesh accrued US$ 354.22 million in revenue from the export of leather footwear during the period from July to March of the fiscal year in question (CPD, 2015).

$

0

B

Export Earnings from Leather Industry in 2013

Year-on-year Growth of Leather Exports

- FY 2010-1142 %

- FY 2011-1217.5 %

- FY 2012-1328 %

- FY 2013-148.6 %

Exports of leather, leather items, and footwear (both leather and non-leather) increased by 42% in FY 2010-2011, 17.5% in FY 2011-2012, 28% in FY 2012-2013, and 8.6% in FY 2013-2014. Total leather industry exports surpassed USD 1 billion in FY 2013-2014, with footwear accounting for around 71% of the total.

Growth Phase of the Footwear Industry : 2015-2024

Bangladesh may emerge as the next prominent global centre for footwear production. CPD data released in 2015 indicates that major retailers have been compelled to move their operations from China to nations such as Vietnam, the Philippines, Bangladesh, and India due to escalating labour expenses.

Global purchasers have been considering diminishing their dependence on Chinese suppliers since the outbreak of the COVID-19 pandemic in order to mitigate the hazards associated with relying just on one supplier. Orders previously destined for China or India were redirected to footwear manufacturers in Bangladesh due to their ability to produce cost-effective yet high-quality shoes. These shoes have now successfully entered important markets in the EU and Japan.

The EU receives 65% of Bangladesh’s footwear exports. Japan and Germany are now important markets for Bangladeshi footwear, although US buyers are becoming more interested in sourcing from Bangladesh. Bangladesh exports footwear to 90 nations around the world. Bangladesh’s main non-leather footwear export markets include Spain, France, the Netherlands, South Korea, India, Germany, and Italy.

Export Destination of Leather Exports from Bangladesh

No Data Found

The European Union (EU) receives 60% of total exports from the leather sector, followed by Japan (30%) and the rest of the world (10%). The primary nations that import leather and leather items from Bangladesh are the United States, China, Spain, India, Italy, Vietnam, Australia, Belgium, Germany, and the Netherlands. The president of the Bangladesh Finished Leather, Leather Goods, and Footwear Exporters Association (BFLLGFEA) stated that three major footwear investors from Taiwan would establish facilities in the Dhaka and Chittagong export zones.

Beyond the domestic market, Bangladeshi manufacturers’ proportion of exports increased about fourfold, from $200 million in 2009 to $968 million in 2018. In terms of non-leather footwear export value, Bangladesh ranked 21st in 2018, and 20th by volume. According to data from the Export Promotion Bureau (EPB), exports of synthetic footwear and sports shoes increased by roughly 20% annually. Bangladesh’s leather sector exported $797.6 million in fiscal year 2019-2020.

Bangladesh’s leather sector exported US$760.92 million in the first ten months of the fiscal year (July 2020-April 2021), representing an 8.56% growth over the same period the previous year. Leather footwear is the leading contributor, accounting for $461.72 million in global exports between July 2020 and April 2021. Revenue from other footwear exports ($277.86 million) went up 13.29% over the same time last year.

$

0

M

Export Earnings from Leather Industry in 2020

In 2020, the footwear sector in Bangladesh suffered a financial loss of around 200 million, and footwear production plummeted by 40% as the price of raw materials for creating footwear increased due to the lockdown. Global supply chain disruptions, decreased product demand, and difficulties in obtaining funding and raw materials all had an impact on the industry. Leather, leather products, and footwear exports totaled $798 million in fiscal year 2020. There was a 21% decline from $1.019 billion in the similar period of 2019.

Export of Footwear From Bangladesh in 2022

- US453 Million US$

- Germay232 Million US$

- France141 Million US$

- Poland125 Million US$

- Netherlands95.7 Million US$

Growth of Footwear Export Markets between 2021 and 2022

- US175 Million US$

- Germany68.2 Million US$

- France69.1 Million US$

Bangladesh ranked 14th worldwide for footwear exports in 2022 with $1.74 billion in exports. Footwear ranked as Bangladesh’s third-most-exported product that year. Bangladesh exports footwear primarily to the US ($453M), Germany ($232M), France ($141M), Poland ($125M), and the Netherlands ($95.7M). Between 2021 and 2022, the United States ($175M), France ($69.1M), and Germany ($68.2M) were Bangladesh’s fastest-growing export destinations for footwear. On the other hand, Bangladesh became the 58th largest importer of footwear in the world in 2022. Footwear ranked 34th among all products imported into Bangladesh that year. The top five countries from which Bangladesh imports footwear are China ($392M), Vietnam ($12M), India ($5.94M), Hong Kong ($3.46M), and Italy ($3.28M). From 2021 to 2022, China ($87.6M), India ($1.98M), and Vietnam ($1.88M) were Bangladesh’s fastest-growing import markets for footwear.

Import of Footwear to Bangladesh in 2022

- China392 Million US$

- Vietnam12 Million US$

- India5.94 Million US$

- Hong Kong3.46 Million US$

- Italy3.28 Million US$

$

0

M

Export Earnings from Leather Industry in 2022-23

The total value of leather and footwear exports in the first nine months of the 2021–2022 fiscal year was USD 540 million, while the value of synthetic footwear exports was USD 340 million. Despite the dire state of the global economy, Bangladesh’s leather and leather products industry expanded by 17.56% in the first five months of FY 2022-23. During fiscal year 2022–2023, Bangladesh exported footwear and leather goods worth $1.7 billion. After ready-made garments, the second-largest export-generating industry, leather, and leather goods, saw a 0.42 percent increase in total exports to $1.12 billion from July to May of 2023. Bangladesh’s leather footwear exports decreased by 33% in the first half of the fiscal year 2023–2024 compared to the previous year, which resulted in a decline in the nation’s total leather exports. The nation exported US $ 257.90 million worth of leather footwear in the first half of the fiscal year 2023–2024. This outcome fell short by 29.01% of the 363.31 million US dollar strategic target that was set for the time. Had the growth continued, the revenue from the Bangladeshi footwear market would reach US$3.33 billion in 2024.

Initiatives Taken by the Government of Bangladesh

In 2017, most leather processing plants and footwear manufacturers were compelled to relocate from Hazaribagh, the capital’s tanning hub, to a modern environment-friendly tannery complex in Savar. The government spent USD 60 million to construct a 200-acre Leather Industrial Park in Savar, in response to criticism of the leather processing factories for their lack of environmental friendliness.

- Leather Industrial Park

- Central dumping yard

- Water treatment plant,

- Sludge power generation system (SPGS),

- Common chrome recovery unit (CCRU)

- Sewage treatment plant

- Central effluent treatment plant (CETP)

and other facilities are to be installed at the new location. Furthermore, the central bank has benefited the leather sector by easing regulations regarding relocation to Savar, which will help the footwear industry grow. The government decided to accelerate the process of obtaining the mandatory international environmental compliance certification from the Leather Working Group (LWG) by allowing individual tanneries within the Savar Tannery Industrial Estate (STIE) to construct effluent treatment plants (ETPs). This move was made to increase the export of leather goods. To fully achieve the enormous potential of the leather industry in the nation, two more leather industrial parks will be established in Chattogram and Rajshahi.

The Ministry of Labour and Employment has granted approval to the National Plan of Action (NPA), which was developed with technical support from the Bangladesh Labour Foundation (BLF) and is led by the Department of Inspection for Factories and Establishment (DIFE) with the aim of achieving social compliance in Bangladesh’s tannery industry. The NPA has implemented a deadline of 2023 for guaranteeing social compliance in tanneries.

The government is providing export incentives for leather items, ranging from 10% to 15%. To encourage both domestic and foreign direct investment, initiatives have been taken to create economic zones and export promotion zones.

Policies to encourage the export of footwear

Fiscal Incentives

Companies that export footwear will receive a 15% cash incentive on the free-on-board (FOB) price. Export-oriented enterprises can import inputs/raw materials and packaging materials from NBR without having to pay any taxes or duties thanks to the benefits of Bonded Warehouse.

Generalised System of Preference (GSP) Scheme

Bangladesh, as an LDC, is eligible for GSP benefits in the majority of product categories (HS 01-97 with the exception of HS 93). Under GSP, footwear exports are eligible for zero import tariffs in 38 countries, including 28 EU nations.

Export Policy

The newest government strategy considered footwear and leather products amongst the country’s top priority sectors. Key features of policy support for the sector are-

- Domestic market sales of up to 20% are permitted for export-oriented firms located outside of EPZs

- Duty-free importation of all sorts of raw materials and machinery for export-oriented sectors

- 90% of loans against letters of credit and funds for export promotion.

Challenges in Further Development

Absence of LWG certification

Leather exporters face difficulties with obtaining Leather Working Group (LWG) certificates because the Bangladesh Small and Cottage Industries Corporation (BSCIC), which manages the Savar Tannery estate, is unable to complete the construction of a central ETP at the site, despite starting the project in 2012. Many well-known multinational brands are hesitant to get leather and leather goods from Bangladesh due to the lack of LWG certification, making LWG certification crucial for the country. This certification is required because EU and US buyers avoid purchasing leather items from non-compliant companies in Bangladesh that have yet to be certified by the LWG.

Skilled labour shortage and lack of technological advancement

The sector is experiencing an adequately skilled labour shortage, particularly in specialised fields like design, technology, and engineering. Developing an international brand image is difficult for the country due to the absence of experienced professionals in product innovation and branding. On the other hand, the sector falls behind other countries in terms of technological breakthroughs, limiting its capacity to compete in quality and cost. The limited use of modern manufacturing technologies and automation can result in higher costs, longer production times, and inefficiencies. One of the biggest problems in the leather footwear sector is the lack of awareness about international quality standards. The industry is unaware of the increasing significance that environmental management regulations, occupational standards, and eco-labeling and packaging have to overseas consumers.

Limited access to finance and local market

A lot of companies in the footwear sector have trouble getting the funding they require to grow, invest in equipment and technology, and participate in international competition. The growth of small and medium enterprises (SMEs) is hampered by inadequate funding. Moreover, due to their limited access to the local market, exporters are highly vulnerable to the risks of stock lots and cancellations. In China and India, up to half of the total output can be sold in the domestic market. Local sales, on the other hand, are heavily taxed in Bangladesh, making them unaffordable for the domestic market.

Supply chain risk

The footwear sector in Bangladesh faces supply chain difficulties related to raw material availability, fluctuating demand, transportation, and labour conditions. The reliance on imported raw materials is approximately 85%. Quality leather, PU, and well-finished PVC synthetic materials result in more lead times and higher costs due to global market conditions and logistics concerns. Poor transportation infrastructure, inadequate ports, and clogged roadways can impede the flow of goods, materials, workmanship, and manufacturing processes. This can lead to customer complaints, dissatisfaction and returns. Dependence on a few suppliers for crucial components creates risks. Supplier disruptions can cause manufacturing delays and shortages.

Recommendations

- Ensuring a diverse supply chain and reducing risk are crucial for the expansion and long-term viability of Bangladesh’s footwear industry. This can be achieved through a range of tactics, such as diversifying raw material sources, strengthening supplier alliances, and improving supply chain management. An effective strategy to reduce supply chain risk is to maintain a diverse network of raw material suppliers, both within the country and internationally. This ensures a consistent and reliable availability of superior raw materials at affordable prices, even in the event that one supplier becomes unavailable. In addition, the industry has the opportunity to allocate funds towards the domestic leather and synthetic materials sectors, thereby decreasing dependence on imports and guaranteeing a consistent provision of superior quality raw materials. An alternative approach involves enhancing the connections with suppliers by means of enduring contracts, collaborative ventures, or other forms of agreements. This can aid in guaranteeing continuous and dependable delivery of raw materials, while also reducing the effects of market volatility or disruptions in the supply chain. Enhancing supply chain management is an additional vital measure. This can involve implementing inventory management strategies, minimising lead times, and enhancing the efficiency of logistics and transportation. To ensure a consistent supply of top-notch raw materials and enhance production efficiency, the industry can achieve this by diversifying its supply chain and implementing optimal supply chain management strategies.

- To overcome obstacles, the industry must prioritise investments in technology, skilled worker training and development, infrastructure enhancement, and financing accessibility. Bangladesh’s footwear industry can expand and become more competitive internationally with sustained government investment and assistance. Additional leather training facilities should be built to educate workers in this field to maintain competitiveness in the global market. Enhancing employee training and skills can improve output effectiveness, product quality, and worker satisfaction. Furthermore, making investments in advanced digital manufacturing technologies like automation and 3D printing can create new possibilities for improving productivity and lowering reliance on labour-intensive procedures. Government funding and programs to promote innovation, like alliances with academic institutions and research centres, can aid in the creation of new technologies and promote business cooperation. Consistent product quality can be guaranteed by strong quality control procedures, such as frequent testing, monitoring, inspections, and technology solutions for real-time tracking. Continued growth requires international certifications, compliant factories, and modern footwear design studios.

- To mitigate the ecological pollution caused by leather industries, the use of eco-friendly facilities can be effective. In order to resolve issues linked to contamination, it is necessary for the central Effluent Treatment Plant (ETP) in the industrial parks to be functioning. By implementing ESG principles and adhering to best practices in environmental and social responsibility, the footwear industry in Bangladesh has the capacity to make a substantial impact on social and environmental sustainability. The footwear industry may achieve a more sustainable future for itself, its workers, and the broader community by implementing these measures. Adhering to international labour and environmental standards can improve the industry’s reputation and ease its access to global markets.

- Local enterprises must make substantial expenditures to enhance their capabilities in order to gain a greater share of the global market, and the central bank can assist in this endeavour. A suggestion has been made to Bangladesh Bank, through the Bangladesh Institute of Bank Management (BIBM), to expand the training programme in order to promote sustainable lending by offering knowledge on the various funding alternatives that are available. Therefore, by simplifying the credit assessment and processes, it may become possible for small business proprietors to obtain access to the Export Development Fund. Obtaining low-interest financing can be a straightforward and effective method to promote business growth and facilitate the creation of new projects.

About the Author

A R Tahseen Jahan is the Co-Founder and Head of Policy at The Confluence. An undergrad student of Development Studies at the University of Dhaka, she worked on topics of economic development and public policy.

The research for this article was assisted by Manfara, a student of Development Studies at University of Dhaka.