KEY TAKEAWAYS

- Bangladesh has positioned itself as one of the top RMG exporters in the world. However, the country needs to diversify its export basket.

- The advances of Bangladesh in the smartphone, consumer electronics, automobile, and other manufacturing industries indicate Bangladesh’s progress in becoming a manufacturing hub.

- A combination of government policies and reforms made all of these advancements possible over the last decade.

- However, the country needs to battle corruption, bureaucratic red tape, the global energy crisis, and other obstacles to succeed in the venture of becoming the next manufacturing hub of the world.

Once known as Henry Kissinger’s basket case, Bangladesh has been an epitome of development that has showcased a steady GDP growth in the past decade. The Annual GDP growth has escalated from 4.1% in the period FY 1973-78 to 6.2% in FY 2008-13. Since FY 2015-16 Bangladesh has experienced more than 7% GDP growth which rose to 8% in FY 2018-19. While many developing nations are suffering from premature deindustrialization, Bangladesh has been able to successfully thrive as an export-driven manufacturing marvel despite a global pandemic and Russia Invasion of Ukraine. From being a country that once rejected the free installation of a submarine cable SEA-ME-WE 3 in 1991, Bangladesh has been able to make significant advances in the smartphone, consumer electronics, and automobile manufacturing. When all the factories across the world are struggling to be eco-friendly, Bangladesh is home to the largest number of green garment factories in the world championing the tagline “Made in Bangladesh”.

The story of Bangladesh begins as a war-torn country, struggling to rise from the ashes of a bloody Independence War in 1971. At that time, the agriculture sector was atthe heart of the economy since Bangladesh was stuck at what Rostow would call a “Traditional Society”. Most people lived under the poverty line with little to no access to education & technology. Even the technologies used at the time were at best rudimentary. The RMG industry was trying to find its place in this new nation. However, what the world saw in the next few decades has become exemplary. Bangladesh is now the second largest RMG exporter in the world, triumphing the brand “Made in Bangladesh”. Currently, the major challenges for Bangladesh are to diversify its export-basket and become a manufacturing hub as experts believe that there is an over reliance on the RMG sector.

Smartphone Manufacturing Industry

Bangladesh’s Smartphone Manufacturing Industry is in the right direction to tackle these issues. In 2017, local tech company Walton inaugurated the country’s first smartphone manufacturing factory. Walton produces around 4 million feature phones and 400,000 smartphones annually. According to Bangladesh Telecommunication Regulatory Commission (BTRC), currently 12 companies have the license to manufacture mobile phones. This industry was able to allure foreign brands such as Samsung, Symphony, Vivo, Lava, Oppo. In 2018, local manufacturer Fair Electronics Limited started a new manufacturing plant at Narsingdi to produce 4G smartphones for Samsung Electronics in Bangladesh. The entire local demand for Samsung phones is currently being met domestically. Xiaomi started assembling smartphones in Bangladesh at its new Gazipur factory which was set up with $10 million in Foreign Direct Investment (FDI) under the “Made in Bangladesh” scheme of the government. As of January 2021, local manufacturers can satiate nearly 80% of the local mobile phone demand. This sector alone has created more than 15,000 jobs.

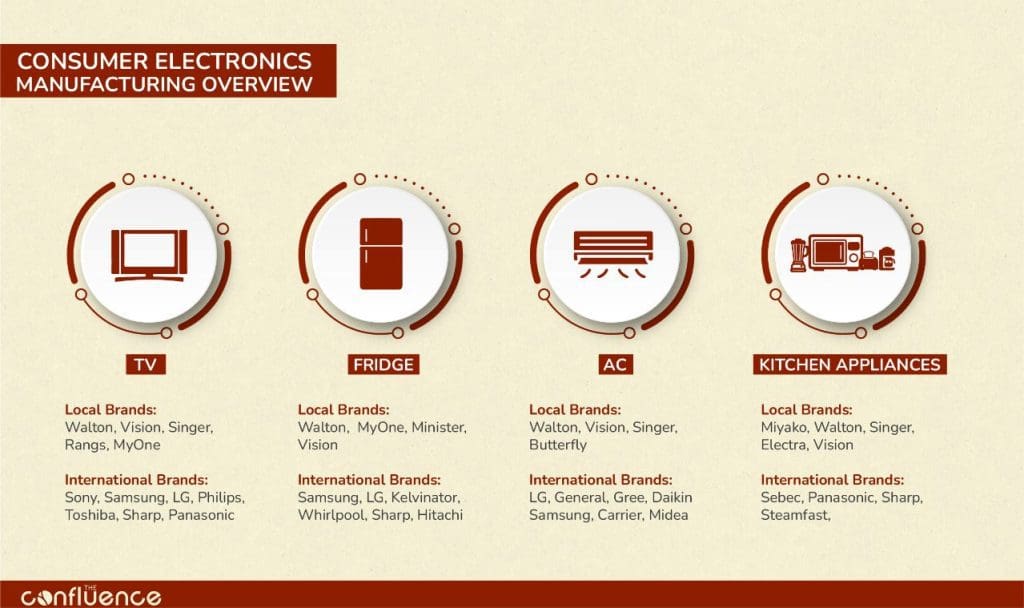

Consumer Electronics Manufacturing Industry

The second emerging sector is the Consumer Electronics Manufacturing Industry. Previously dominated by foreign companies, now local players such as Walton Group, Transcom Electronics, Rangs Electronics etc. have taken a huge piece of the pie by establishing their own facilities. This consumer electronics manufacturing sector was also successful in enticing the foreign bigwigs. Consumer electronics giantssuch as Samsung, LG have already heavily invested in Bangladesh through its local partners. LG, through its Bangladeshi partner Butterfly, has invested $100 million in the country to establish a refrigerator, air conditioner and LED TV manufacturing plant in Bhaluka, Mymensingh. South Korean electronics giant Samsung has invested BDT 10 billion through its local partner Fair Electronics in order to establish a plant to fulfill the aim of manufacturing 300,000 Samsung Smart Television each year. In 2018, they built a manufacturing plant with a capacity of producing 400,000 units of refrigerator each year in Narsingdi. Rangs Electronics will invest $80 million in 32 acres land of Bangabandhu Hi-Tech Park in Sylhet to manufacture home and kitchen appliances along with televisions, refrigerators and air conditioners. Some of the major export markets of these electric products of Bangladesh are India, Japan, Nepal, Singapore, United Arab Emirates, Hong Kong, Australia, Kuwait etc. Bangladesh has showcased a huge potential in exporting televisions. Walton TVs are currently being exported to 35 countries such as Germany, Ireland, Greece, Poland, Spain etc.

The local tech giant Walton even established a computer factory at Chandra in Gazipur in 2018. This factory produces most major components in house – from the exterior plastic to the aluminum interior. They now have two lines of desktop PCs and five lines of laptops including a gaming laptop line. They are also producing Monitors, SSDs, RAMs etc.

Automobile Industry

Bangladesh’s Automobile Industry is also displaying rapid growth in recent times. The Korean automobile giant Hyundai has partnered up with Bangladesh’s Fair Technology and established their factory combining two industrial plots in Bangabandhu Hi-Tech Park to manufacture Hyundai’s flagship SUV-Creta. With the support of Access to Information (a2i) programme of the Bangladesh’s ICT Division, Runner Automobiles Limited will manufacture eco-friendly electric vehicles in their manufacturing plant in Bhaluka, Mymensingh. Indian automobile companies such as Tata Motors, Ashok Leyland, Mahindra and Bajaj Auto are forming joint ventures with local Bangladeshi companies to assemble a huge fraction of their products in Bangladesh. Tata Motors even has a CKD assembly facility in Jessore.

Hi-Tech Parks

A combination of government policies and reforms made all of these advancements possible over the last decade. To appeal local and foreign investors to invest in knowledge based industries of Bangladesh, the Government of Bangladesh has formed Bangladesh Hi-Tech Park Authority (BHTPA) which is responsible for establishing Hi-Tech Parks, Software Technology Parks and IT Training & Incubation Centers across the country in order to promote the development of tech industry and green energy. The government has offered special incentives for investors and park developers such as 12 years exemption of income tax for park developers, 10 years exemption of income tax for investors, exemption of income tax for foreign employees, exemption of income tax on dividend, share, transfer, royalty, technical fees for investors and so on.

Special Economic Zones

The Special Economic Zones (SEZ) of Bangladesh has been pivotal to the nation’s economic transformation. According to the World Bank, between 2011 and 2021, the Private Sector Development Support Project (PSDSP) enabled more than $3.9 billion in direct private investment and the creation of over 41,000 jobs (24% of which are held by women). It supported a regulatory reform process, helped build the Bangladesh Economic Zone Authority (BEZA), and the Bangladesh High-Tech Park Authority (BHTPA), and developed 1,500 acres of land and $407 million worth of last-mile off-site infrastructure and on-site facilities including a 14 km embankment, 26 km of roads, 8 bridges, 3 electric substations, and 2 water reservoirs. Bangladesh was able to attract its first foreign tier-1 anchor investor in the economic zones’ developer-operator market space.

Special economic zones and high-tech parks are targeted to address the elephant in the room. Previously, inadequate infrastructure and bureaucratic red tape thwarted investment in Bangladesh. The government is actively improving the infrastructure of these zones and providing a one-stop service that untangles different application and permission procedures required for new investment and expansion and granting preferential treatment in relation to taxation and other key areas to create a business-friendly ecosystem.

Infrastructural Development

In order for a country to emerge as a manufacturing hub, it’s critical to build the necessary infrastructures to increase connectivity across the country. The mega projects built by GoB such as Padma Bridge, Dhaka-Chittagong Highway, etc. have the potential to increase connectivity among different regions and districts of Bangladesh. The Padma Bridge has connected the once isolated South-West region of Bangladesh with the capital city of Dhaka. The Padma Bridge will significantly reduce the time and cost of transporting goods and services from the 21 southwestern districts and connect the Mongla and Payra port with the capital. The Dhaka-Chittagong Highway has been constructed to strengthen Dhaka-Chittagong Economic Corridor.

Forward-Looking Plans

The government’s “Post COVID-19 National ICT Roadmap” aims to boost export earnings in the ICT sector from the current $1 billion to $5 billion by 2025. The roadmap intends to build capacity of the local digital device manufacturing industry and to brand locally manufactured products in foreign markets to accelerate the “Made in Bangladesh” initiative. During this period, the testing labs will be formed in different universities to ensure quality compliance of IT products. The Ministry of Commerce will take up initiatives to increase exports through bilateral and multilateral international agreements.

To create a competitive and skilled workforce, the government has significantly focused on educating and skilling this huge population. School enrollment, literary rate and women’s participation in education have significantly increased over the past decades. Since Bangladesh has a predominantly young population, the country is well-conditioned to gain from the demographic dividend. To uniform and coordinate all the spasmodic skill development and training programs of 23 ministries and divisions under one umbrella, the government has formulated National Skills Development Policy 2011. The National Skills Development Authority ensures the quality and coordination of these programs. At the same time, the National Human Resource Development Fund (NHRDF) has been formed to provide additional sources of funding.

The Skills for Employment Investment Program (SEIP) is one of the key initiatives to address the skill gap issue. Asian Development Bank (ADB) signed a Multi-tranche Financing Facility (MFF) Agreement with GoB in 2014 to support long-term and comprehensive skills development efforts in the country. The Swiss Agency for Development and Cooperation (SDC) is also co-financing the initiative. With the full support of training providers such as IBA (University of Dhaka), and BUTEX. Brac University, the SEIP has been currently prioritizing 10 sectors including but not limited to readymade garments and textiles, information technology, leather and footwear, shipbuilding etc.

Technical and Vocational Education and Training (TVET) has been a major focus in Bangladesh. In order to popularize this education stream, the Department of Technical Education (DTE) and the International Labour Organization (ILO) devised a year-long campaign strategy in 2021. The government provides free books to all the school students of Bangladesh each year to increase their access to education. Even areas that previously were deprived of educational institutions now have schools, colleges, and universities to educate the youth of that locality.

Certainly, Bangladesh has made significant advances in the venture of becoming a manufacturing hub. However, many obstacles are still foiling its progress. The country has become the victim of a global energy crisis caused by the Russian Invasion of Ukraine. Even though Bangladesh has increased its electricity production capacity, still the country is heavily reliant on foreign energy sources. Most of the energy sources used are coal and natural gas which are non-renewable sources that are not environmentally friendly for the largest delta of the world. Bangladesh needs to diversify its energy basket and move on to renewable energy sources while decreasing its reliance on energy imports. Moreover, many establishments are underutilized and poorly designed which restricts the country to benefit from this infrastructural development. Corruption, red tape, lack of skilled labor, and lack of monitoring pose significant threats to Bangladesh to become a business-friendly destination for both local and foreign companies. In the second part of the series “Bangladesh: The Next Manufacturing Hub?”, we will dig deeper into these problems paralyzing the country and explore the way forward to transform Bangladesh into a manufacturing hub.

About the Author