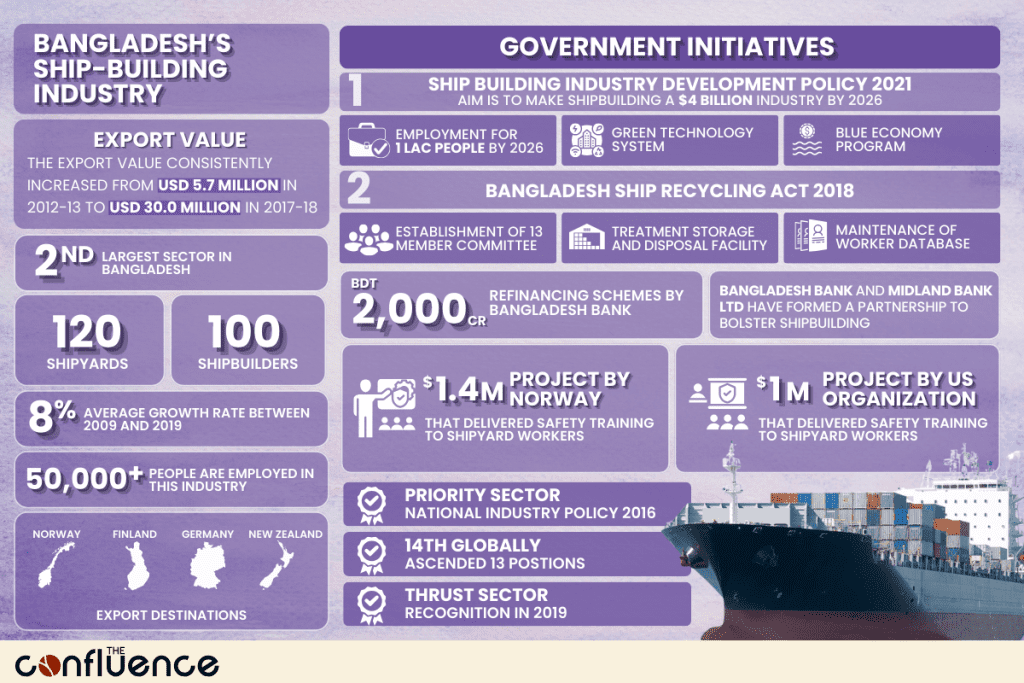

The shipbuilding sector is critical to Bangladesh’s economic growth for various reasons. Having the second-largest share of Bangladesh’s GDP (Gross Domestic Product) among the export-oriented industries, it has a significant influence on the country’s economy.

The World Bank’s economic reports for Bangladesh depicts, from 2009 to 2019, the industry has recorded an average growth rate of 8%. This suggests steady growth, resulting in the creation of new employment and possibilities. More than 50,000 people are employed both directly and indirectly, demonstrating the industry’s contribution to job creation and means of subsistence. In addition, Bangladesh’s expanding influence and competitiveness on the international scene is evidenced by its 0.84% market share in shipbuilding worldwide. Exports are made to nations including Norway, Finland, Germany, and New Zealand, demonstrating the industry’s capacity to meet foreign demand as well as serve the domestic market.

50,000 Employments

Directly and indirectly

0.84% Global Market Share

Of the industry

$ 1 Billion

Market Size

Over 90% of Bangladesh’s USD 110 billion international trade occurs via maritime routes, requiring hundreds of ships annually to meet the demand for freight services. Hence the shipbuilding industry in Bangladesh is essential to boost exports and holds a promising future in terms of export in the era of Blue Economy. Bangladesh, as a new entrant in the shipbuilding industry, has shown promising credibility for future growth by producing high-quality ships and vessels at competitive market prices, with the annual market value currently reaching about USD 1 billion. The export value consistently increased from USD 5.7 million in 2012-13 to USD 30.0 million in 2017-18.

Ships, boats and other floating structures exports (US $)

Source : Export Promotion Bureau (EPB)

No Data Found

BDT 150 Billion

Current Market Size

BDT 1000 Billion

Targeted Market Size by 2041

US$ 4 Billion

Targeted Market Size by 2026

The industry’s prospects can be highlighted by the fact that it currently contributes BDT 150 billion to the country annually, which is expected to rise to BDT 1000 Billion mark by 2041, according to Abdullahel Bari the president of the Association of Export Oriented Shipbuilding Industry of Bangladesh. The government of Bangladesh aims to achieve a sectoral growth of USD 4 billion by 2026 in this industry.

‘’Shipbuilding is a potential export sector for the country. We have expertise in state-of-the-art shipbuilding. We expect this industry to earn from exports close to that of the readymade garment industry in the future.”

Khalid Mahmud Chowdhury

Former state Minister for Shipping

The Trajectory of the Shipbuilding Industry in Bangladesh

Limited Export from 2000 to 2008

Mozambique and the Maldives

Exporting small boats in 2005

Germany and Denmark

Exporting Multi-purpose cargo ships in 2008

Due to its deltaic landscape, the history of the shipbuilding industry in Bangladesh can be traced back to the colonial era. This is a country with 700 rivers where a riverine economy fed the population. Making boats used to be a day-to-day task for many in the rural economy. However, at the beginning of the millennium, Bangladesh started to capitalize on its availability of skilled labor and existing shipyards. According to the World Bank’s ‘Bangladesh: Diagnostic Trade Integration Study’ from 2013, Bangladesh started exporting commercial ships in 2005. However, Bangladesh’s exports were limited to some small boats to Mozambique and the Maldives. Shipyards in Bangladesh achieved a significant breakthrough when they began receiving orders from European countries. German and Danish buyers placed orders for multi-purpose cargo ships, marking a pivotal moment. Even though in a very limited capacity, by exporting these ships to Europe in 2008, Bangladesh gained recognition as a notable shipbuilding nation at first.

Growth Potential from 2009 to 2019

0

%

Average Annual Growth of the Industry

$

0

M

Export Earnings since 2009

20 Vessles

Exported between 2008 and 2012

12% Growth

In 2017-18 Fiscal Year

Between 2008 and 2012, Ananda and Western Shipyards collectively delivered over 20 vessels, amounting to an export value exceeding USD 100 million. Since 2009, Bangladeshi shipbuilders have garnered USD 170 million through the export of small- and medium-sized ships to 14 countries, stated by Engr. Md Sakhawat Hossain, Managing Director of Western Marine Shipyard. In the fiscal year 2017-18, the industrial sector witnessed a growth rate of 11.99%, while the shipbuilding industry maintained an average growth rate of 8%. During this period the skills gap in manufacturing export-oriented classed ships was minimized with knowledge transfer from Bangladeshis who had worked in Singapore and Dubai. Technical assistance in the shipbuilding process was largely provided by ship owners, including training programs, hands-on teaching, and guidance from overseas experts.

Covid Impacts in 2020-2021

The rapid growth of the industry encountered challenges in 2020-2021 due to payment failure, and issues regarding opening Letters of Credit (LCs) as a result of the dollar crisis. Export from this industry saw a set back in these two years, setting back the country from years of progress.

Scenario from 2022 and Onwards

0

Shipyards in Operation

Following two challenging years marked by external shocks and vulnerabilities, the shipbuilding industry has bounced back stronger than ever. It is now one of the most significant sectors in terms of revenue and employment generation and stands as the second largest sector in percentage contribution to GDP. It has more than 120 shipyards and 100 shipbuilders, actively catering to the local and global demands. Currently, Bangladesh has a 0.84% contribution to the global shipbuilding industry. Countries such as Germany, Finland, New Zealand, Norway etc are the significant actors in our export market.

Top 10 Ship Export Destination from FY 2011-12 to 2023-24 (Accumulated)

Source: Export Promotion Bureau

No Data Found

Ship-breaking Industry

$2 Billion

Contribution to the economy

2.5 Million Tonnes of Scrap

Provided by the industry annually

39% Materials of Steel Industry

Sourced from ship-breaking

The ship recycling industry, affiliated with ship breaking, also has a major contribution of around $2 billion to the national economy. Bangladesh is now a leading destination for end-of-life ships. The ship-breaking sector provides approximately 2.5 million tonnes of scrap annually, with an estimated yearly turnover of about $800 million. 39% of the materials in the steel industry are sourced from the shipbreaking sector, marking its remarkable contribution to backward linkages. Over 50,000 individuals are engaged directly and indirectly in the shipbuilding sector.

Initiatives Taken by GoB

Ship Building Industry Development Policy 2021

Objective – $ 4 Billion Industry

By 2026

10 Years

Tax Holiday

1 Million Employment Generation

By 2026

The enactment of the Ship Building Industry Development Policy 2021 brings forward numerous proposals setting a timeline for implementation. The aim is to make shipbuilding a $4 billion industry by 2026. The policy proposes incentives to shipbuilders in the form of cash incentives for ship exports, reduced import duty on raw materials required for shipbuilding, and tax holidays for up to 10 years. Besides, to discourage the import of ships and equipment, the policy proposes banning ships less than lengths of 100,000 meters and mandatory issuance of fishing licenses for imported fishing vessels. The primary strategies include- Partnership, Capacity Building, Market Expansion, Banking Assistance etc. The major objectives of the policy includes:

Employment Generation

Generating Employment opportunity for 1 lakh people within the industry by 2026.

Green Technology System

Adopting the ‘Green Technology System’ in the large shipbuilding and repairing industry with public-private partnership.

Blue Economy Program

Facilitate the implementation of the government’s large-scale projects under the ‘Blue Economy Program’ through shipbuilding.

Bangladesh Ship Recycling Act 2018

Bangladesh Ship Recycling Act 2018 was enacted by the Parliament, which included mandates adopting eco-friendly practices in ship recycling. Drawing inspiration from the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships, 2009, the Act aimed to establish international standard guidelines.

Ship Recycle Board

The Act authorized the establishment of a 13-member Bangladesh Ship Recycle Board to supervise and report on ship recycling processes, ensure labor health, implement safety measures, advise the government on industry improvements, conduct research, and coordinate with national and international agencies on relevant issues.

Worker Database

A chapter of the act is dedicated to ensuring labor training facilities, the maintenance of a worker database, mandatory insurance, and compensation for injuries or fatalities.

Blue Economy Program

Facilitate the implementation of the government’s large-scale projects under the ‘Blue Economy Program’ through shipbuilding.

Treatment Storage and Disposal Facility (TSDF)

The government plans to set up a Treatment Storage and Disposal Facility (TSDF) to manage and dispose of waste generated by the shipyards. A study on the plant has been completed, costing BDT 40 million, and discussions are ongoing with the Japan International Cooperation Agency (JICA) to fund the project, estimated at approximately BDT 5000 million.

Refinancing Schemes by Bangladesh Bank

৳

0

B

Refinancing Scheme

4.5% Interest Rate

Payable in 12 years with 3-year grace period

A refinancing scheme of BDT 20 Billion is to be distributed to banks for refinancing enterprises in the shipbuilding industry. The bank rate is set at 1% while the lending rate is set to 4.5% payable in 12 years with a 3-year grace period.

Public-Private Partnership

Bangladesh Bank, the central bank and Midland Bank have formed a partnership to bolster the shipbuilding sector through a participation agreement in the industry’s refinance scheme. This collaboration allows Midland Bank Limited (MDB) to provide its clients with affordable, long-term financing in shipbuilding, to improve the country’s shipbuilding capabilities and broaden its export range.

International Collaborations in the Shipbuilding Industry of Bangladesh

Norway Implemented $1.4 Million Project

To train shipyard workers

Norway Provided $1.5 Million

To enhance ship recycling

US Organization Conducting Training under $1 Million Project

For 800 workers in collaboration with Bangladesh Marine Academy

Several countries collaborated with the government for the large potential of shipbuilding. In 2016-2017, in collaboration with IMO, Norway implemented a $1.4 million project that delivered safety training to shipyard workers, benefiting 30 individuals. In 2020, Norway provided around $1.5 million towards the Safe and Environmentally Sound Ship Recycling in Bangladesh (SENSREC) project, to enhance the ship recycling sector of the country. An American organization is conducting training for 800 workers under a $1 million project, in collaboration with Bangladesh Marine Academy.

Sectoral Recognition in the Economy

- Priority Sector: In the National Industry Policy 2016, shipbuilding was announced as one of the priority sectors for industrial growth.

- 14th in Global Ranking: According to a United Nations Conference on Trade and Development report, Bangladesh has ascended 13 positions to reach 14th place in the shipbuilding industry within five years, surpassing countries such as the US, India, Singapore, and Spain.

- Thrust Sector: The Bangladesh government acknowledged the shipbuilding industry as a thrust sector in 2019, valuing its potential in the global and local markets.

Underlying Challenges of the Industry

Low Export Incentive

0

%

The current export incentive for the shipbuilding industry in Bangladesh stands at 10% whereas in competitor countries such as India, it is nearly 25%. Due to inadequate export incentives, the industry’s potential as the next high-grossing export industry remains unrealized. The export incentive now stands at 10%, which should be increased for export diversification in the economy of Bangladesh.

Skill Constraints

Bangladesh – 1.67 GT/Year/Worker

150,000 Workers | 250,000 GT/Year Output

China – 3.5 GT/Year/Worker

400,000 Workers | 1,400,000 GT/Year Output

Vietnam – 6 GT/Year/Worker

100,000 Workers | 600,000 GT/Year Output

As the shipbuilding industry is a labor-intensive industry, skill constraint among labor remains a persistent challenge. While approximately 150,000 skilled and semi-skilled workers are employed in the sector, the total output in 2011 was estimated at only about 250,000 gross tons (GT) per year, with a significant portion allocated for the domestic market. In comparison, China, with 400,000 employees across 2,000 shipyards and related industries, achieved a production volume of 14 million GT, while Vietnam, with 110,000 workers, produced 600,000 GT.

Low Site Availability and Poor Infrastructure

Shipbuilding Industry workers face difficulties due to the scarcity and high cost of appropriate sites in terms of establishing large shipyards. Establishing green shipyards to maintain international standards for the shipbreaking industry can cost up to Tk. 200-300 million.

Recommendations

-

Establishing Bangladesh Ship Classification Society: To maintain the international standard and to survive in the highly competitive global market, a classification society dedicated to the shipbuilding industry can be pivotal. It can contribute to ensuring high quality and safety, attract FDI, and broaden the export market.

-

Formulating a registered database for shipbuilding industry workers: A worker database needs to be established for the shipbuilding industry for easy monitoring and training facilities. Along with that, a comprehensive Training Needs Analysis (TNA) should be undertaken to identify the exact skills necessary for the industry’s development.

-

Facilitate utility connections: Shipbuilding requires utilities such as electricity, fuel, water, and other essential resources. Therefore, facilitating utility connections at low cost is essential for the growth of the industry.

-

Emphasizing intelligent shipbuilding with R&D: In order to truly advance in the shipbuilding industry, the industry should focus on increasing efficiency and being innovative with manufacturing. China has taken the lead in this arena by advancing intelligent transformation, for which they now only need 180 days to build a VLCC.

Cover Photo: The Financial Express

About the Author

A R Tahseen Jahan is the Co-Founder and Head of Policy at The Confluence. An undergrad student of Development Studies at the University of Dhaka, she worked on topics of economic development and public policy analysis.

The research for this article was assisted by Nowshin Nawar Prioty, a student of Development Studies, University of Dhaka.