The news of Bangladeshi companies designing chips for big tech companies has broke the internet recently. Taiwan is the semiconductor hub of the world, with countries like India expanding their semiconductor business. What can Bangladesh do for the future?

Bangladesh’s semiconductor companies are now designing semiconductors for tech giants such as Apple, Microsoft and Google. This infant industry in Bangladesh generates USD 5 million per annum due to remaining at a very nascent stage. While semiconductors are powering from our smartphones to artificial intelligence and countries are competing against each other in becoming the leading force in the global semiconductor scene, Bangladesh can potentially position itself as a global semiconductor hub if both public and private support can be ensured. This article discusses how Bangladesh can become a driving force in the global semiconductor market.

$

0

M

Annual Income of Bangladesh’s Semiconductor Industry

Global Semiconductor Industry

On June 18, 2024, Nvidia, a 31-year-old company, ascended as the world’s most valuable publicly traded company which as of June 26 has a market cap of USD 3.10 Trillion. This is the company which produces the chips that powers OpenAI’s ChatGPT. World’s two superpowers, the US and China, are fighting an invisible war that is being fought with legislations and policies in hopes of stopping each other from getting their hands on one of the most critical technologies that the world has ever seen, microchips.

$

0

B

Size of the Global Semiconductor Market

USD 1.2 Trillion

Estimated size of the global semiconductor market in 2030

USD 3.1 Trillion

Size of Nvidia

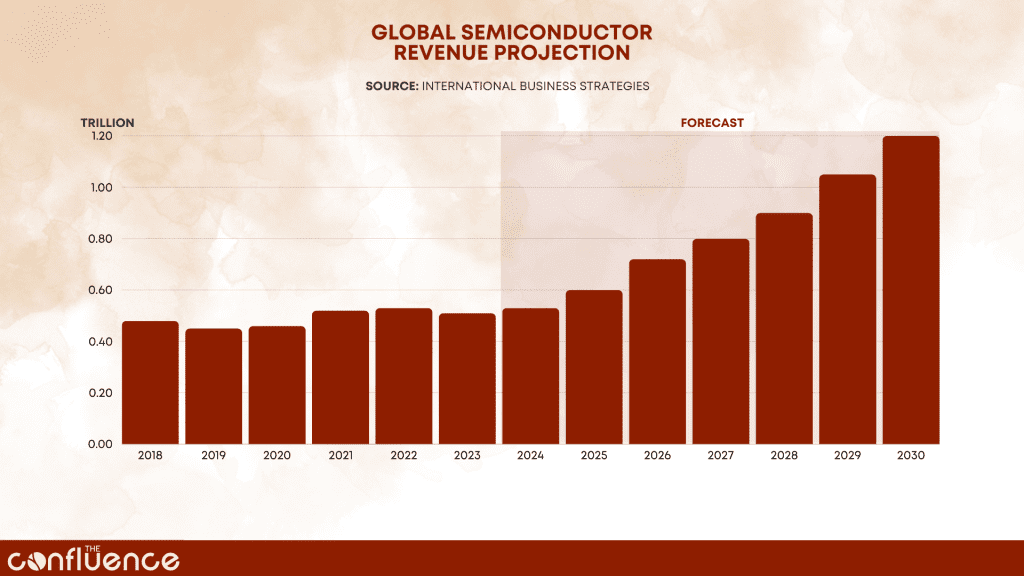

According to the chip-industry consulting firm International Business Strategies, the global semiconductor market which now stands at around USD 600 billion is expected to reach USD 1.2 trillion by 2030.

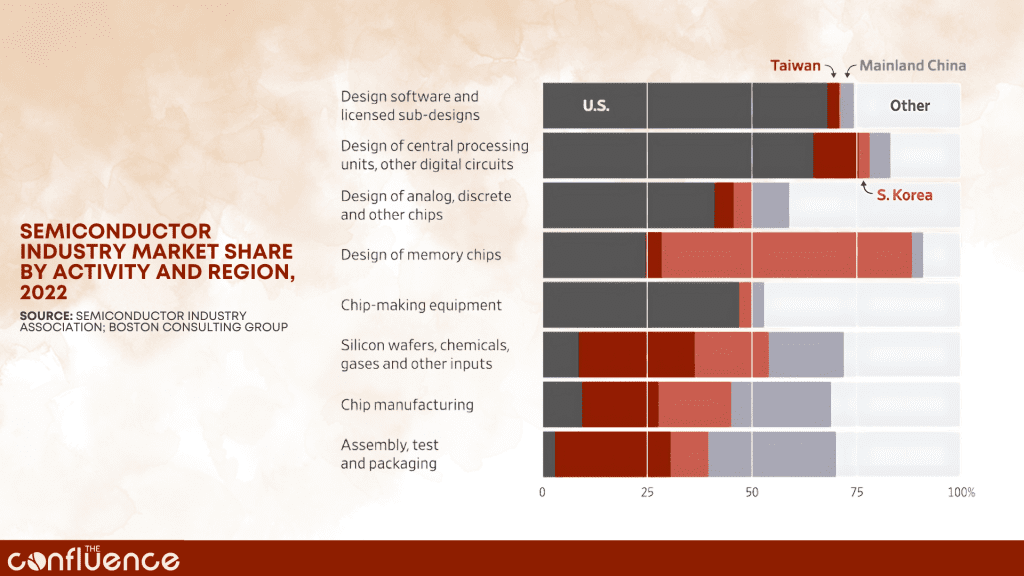

While US companies specialize in chip design, countries such as South Korea, mainland China, and especially Taiwan focus on manufacturing and later production and assembly stages with their state-of-the-art fabs.

0

nm

Smallest Node Technology for Chip by IBM

One of the critical challenges in designing and manufacturing these chips is to produce a microchip that is really small, even much smaller than a virus. IBM’s 2 nanometer chip is the smallest chip ever. And Taiwanese companies like TSMC are really good at manufacturing cutting edge chips at scale. More importantly, as chip manufacturing is pretty expensive, US chip companies hated it and outsourced it to countries like Taiwan. However, amidst diplomatic tensions, weather and other uncertainties, such reliance on Taiwan for chip production can be detrimental for countries like the USA. That’s why the Chips Act came into play under which the US government will be offering billions of dollars to semiconductor companies to set up their fabs in the US so that chips can be produced locally in the US.

Bangladesh’s Infant Semiconductor Industry

Among all the top players in the world, Bangladesh’s semiconductor industry is still at a very early stage. Bangladesh makes around USD 5 million each year from this industry by only offering Integrated Circuit (IC) chip design services, where neighbouring country India earns around USD 60 billion annually from their semiconductor industry. A very few companies are working in this space in Bangladesh, including Ulkasemi, Neural Semiconductor, and Prime Silicon. Bangladeshi giants such as Walton and ACI are also setting their foot in the chip market.

Skill and Infrastructure Gap

Bangladesh simply does not have adequate skilled engineers who are adept at designing and leading all the other stages of semiconductor manufacturing. Each year so many talented engineering students visit countries like the US to pursue masters or PhD programs, and even start working at FAANG (Facebook, Amazon, Apple, Netflix, Google) and other top tech companies. Bangladesh suffers from brain drain by not being able to retain and attract the country’s top talents.

More importantly, the research facilities and labs which are required to learn such a sophisticated discipline are absent. One of the top universities of Bangladesh, University of Dhaka has a Semiconductor Technology Research Centre (STRC), which was established in the mid 1980s to accelerate research on semiconductors. With some funds and a machine (called the Edward E306, which was used for thin film deposition of semiconductors) donated by the Swedish government, STRC began its journey.

However, the labs at STRC are not well-equipped to train cutting edge semiconductor technology to the students. In fact, students get to learn merely the basics, which is certainly not adequate to develop Bangladesh’s infant semiconductor industry. It will take millions of dollars to build labs necessary for semiconductor research, and foreign consultants who can guide and monitor the entire process.

Each year, Bangladesh produces around 22,000 electrical and computer engineering graduates. If Bangladesh can train only 1,000 students every year, the country will witness 10,000 engineers expert at semiconductor design and production in next 10 years. As the eighth most populous nation in the world, the country has a huge demographic dividend. According to the 2022 Bangladeshi census, the working age population of Bangladesh between 15 and 64 years has increased from 2011 to 2022 – rising to 65.5% of the total population. At present, Bangladesh’s youth population is 45.9 million. Thus, reskilling and upskilling some of the Bangladeshi youth for the semiconductor industry can pay dividends in the upcoming years.

What’s critical to note is the knowledge for semiconductor design and production is not readily available on the internet. The gatekeepers of this knowledge are some of the top semiconductor companies in the world. This knowledge is safely guarded by the strong intellectual property protection laws and regulations of countries such as the US, and Taiwan. Hence, unlike fields like computer science, the asymmetry of information and knowledge makes it difficult to learn about cutting edge semiconductor technologies of the world.

Sketching the Blueprint for Bangladesh

Now, the question is how an emerging economy like Bangladesh can transform itself as a leading player in the global semiconductor market, and what lessons the country can learn and to an extent emulate from the successes of countries like Taiwan.

Leveraging Bangladeshi Diaspora

In the 1980s, the Taiwanese government actively enticed and lured back Taiwanese individuals who went to the US to pursue higher education and work at companies such as Texas Instruments (TI), Intel, etc. Taiwan offered them a myriad of incentives to come back to Taiwan and reverse the Taiwanese brain drain. They guaranteed them jobs, paid for their travel expenses, and offered them tax breaks to build their companies. Thousands of engineers returned to Taiwan to settle in Taiwan due to massive government incentives. And one of them was the man who founded Taiwan’s semiconductor industry, Morris Chang. He founded the global semiconductor giant TSMC (Taiwan Semiconductor Manufacturing Company).

There are broadly two types of semiconductor companies. Some companies only focus on designing without worrying about the production of these chips. These are called fabless semiconductor companies. And the ones who focus on the manufacturing and production side by operating expensive, state-of-the-art foundries to manufacture the chips are called fabs. To become cost-efficient and profitable, most American companies in the 1980s were becoming fabless by delegating the production job to fabs. So he saw a huge opportunity in building a fab business in Taiwan, and eventually founded TSMC.

I have broadly THREE recommendations that draw inspiration from Taiwan and even China’s tech industry (because China also did the same for its tech industry):

Database of NRBs

Bangladesh needs to build a robust database of Non-Residential Bangladeshis (NRBs), which must include their information about their alma mater (the school, college and universities they have attended both in Bangladesh and abroad), their past and present work experience (both in Bangladesh and abroad), their expertise and skill sets. I would highly recommend not asking for their income in this database unless the “sending remittance” feature is integrated. Making NRBs feel welcomed is critical in this process. Bangladeshi embassies across the globe can play a pivotal role in building this database.

If needed, the team designated to develop this database can actively look for NRBs using platforms like LinkedIn. It is estimated that over 10 million Bangladeshis are living abroad. Some of them currently work or worked at top tech companies in the Silicon Valley, including semiconductor companies. The database can be the first step in the right direction in establishing active communication with the expatriates.

Incentives

Offering a wide range of incentives is crucial in attracting these skilled NRBs. Some may still not want to settle in Bangladesh. And it’s fine. NRBs can still heavily contribute from abroad by sharing their knowledge and connections with the Bangladesh government, academia and industry.

Hi-Tech Parks

Bangladesh’s Hi-Tech Parks are now offering tax breaks and other incentives to businesses in the semiconductor industry. The government is offering tax holidays to companies which produce semiconductors. Tax exemptions from import taxes on the machinery and raw materials are also granted in these Hi-Tech Parks. These Hi-Tech Parks have the potential to become Bangladesh’s silicon valley if implemented and operated properly. Communicating and informing about Bangladesh’s Hi-Tech Parks with the skilled Bangladeshi diaspora can help the country’s semiconductor industry.

Skilling Bangladeshi Youth

Robust skill development programs are required to prepare the country’s youth for the semiconductor industry. Rigorous academic courses, training centers and state-of-the-art labs are needed to produce skilled engineers.

Bangladesh Hi-Tech Park Authority (BHTPA) is navigating the possibility of sending local engineering talent to foreign countries in order to pursue studies and training for the semiconductor industry. If necessary, scholarships should be provided to the students who want to pursue the semiconductor industry with the condition that they have to return to Bangladesh and work for a certain period of time in Bangladesh. Students first have to get acceptance in top foreign universities, and then the government can provide them scholarships. Government can offer these students free mentorship programs to apply to foreign universities.

At the same time, the Bangladesh government can attract top engineers and academicians from the semiconductor industry of the US, Taiwan and other countries to come and teach in Bangladesh by offering them jobs in our universities. Individuals who won’t be able to come to Bangladesh can teach online to Bangladeshi students.

The government also needs to build state-of-the-art labs and research facilities with the consultation of top global engineers and experts in the field.

Investing in Bangladeshi Semiconductor Companies

The Taiwanese government did not just stop at attracting talent back to their country. They did more than that. They gave ammunition in the form of cash to Morrish Chang to start TSMC. The government not only provided half of the cost for the startup but also connected him to VCs (venture capitals). As Morris Chang himself stated, the Prime Minister of Taiwan even called a rich Taiwanese investor to somewhat force him to invest in TSMC. From its early days, TSMC was a state-owned company.

Bangladesh’s neighbor India makes nearly USD 60 billion per annum from their semiconductor industry. The Indian Government has set up a specialized and independent business division named India Semiconductor Mission (ISM), which endorses the Semicon India Program to provide incentives to companies in the semiconductor industry. Under the semicon program, the government offers fiscal support of up to 50% of the project cost to approved applicants to set up a semiconductor fabrication plant.

The Bangladesh Government should extend the same support that has proven effective in making the Ready Made Garments (RMG) sector a success. And the government has to promote industry-academia collaboration while taking active consultation with the industry insiders to decide where the country has a competitive advantage among all the stages of semiconductor design and production and then focus on building further strength in that stage. For instance, jumping into the fab stage will require billions of dollars of capital investment, which may not be suitable for Bangladesh.

Bangladesh should not jump into this bandwagon or modern-day gold rush of semiconductors without proper planning and strategy. Bangladesh should formulate a National Semiconductor Policy to devise a clear roadmap and action plan. A dedicated semiconductor task force can be created to oversee policy implementation and semiconductor industry development.

About the Author

Shah Adaan Uzzaman is the Blog Administrator at The Confluence, and the Co-Founder & CEO of Dumpy. A former Bangladesh Television Debate Champion and winner of several policy & debate competitions, he is currently a student of IBA, University of Dhaka.