Elected officials and bureaucrats distribute social security to disadvantaged homes and individuals. These channels face grassroots corruption and appropriation claims. Tech-enabled delivery has reduced such appropriation and should be scaled up.

“After my husband died five years ago, I was in a lot of trouble with my son and daughter. This allowance saved me from that disastrous situation. However, I used to go to the bank and get the allowance after standing in long queues for two or three days. Now, I will get the allowance in my bKash account sitting at home.”

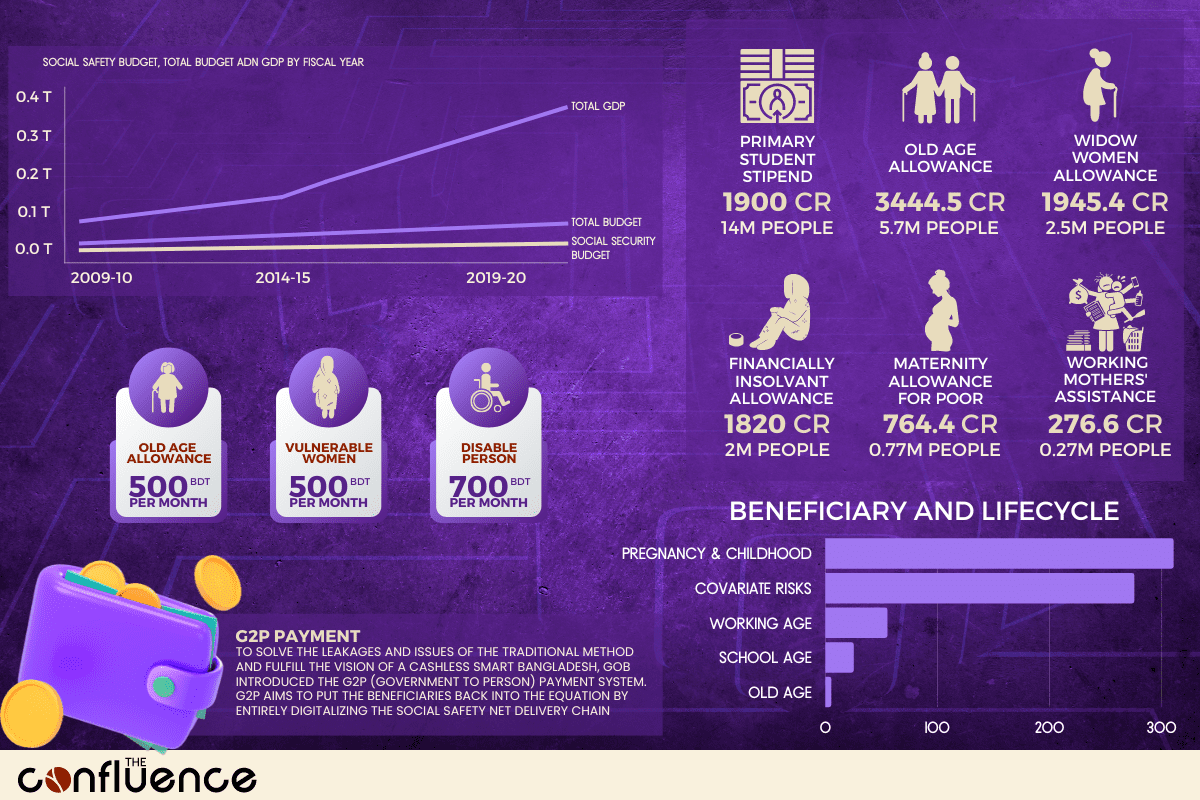

Despite the resource constraints as a developing nation, Bangladesh is committed to the “leave no-one behind” policy under its National Social Security Strategy (NSSS) of 2015 to fulfill its obligation as a welfare state. The strategy is designed to provide social security throughout the entire lifecycle of an individual in different stages and situations- from birth to death – pregnancy & childhood, covariate risks, working age, school age and old age. Currently, there are more than 140 social safety net programmes (SSNPs) being administered by 23 ministries and divisions targeting various underserved segments of the country including chronic & transient poor, women, students, elderly, people with disabilities, minority groups such as hijra (transgender) and bede community.

“Earlier, I had to bring someone else to accompany me to the bank branch to receive the allowance and it was troublesome. But now I can easily cash out my amount through using Nagad.”

Bangladesh’s population is predominantly young. However, the aging population has increased by 1.8% in between consecutive censuses. According to the 2011 census, people aged 60 and above was 7.48% which ascended to 9.28% of the entire demographic as shown in the 2022 census figures. A continued decline in fertility and mortality is one of the main reasons behind this growing aging population. GoB runs the “Old Age Allowance” programme to acknowledge and support the very individuals who served this nation at their peak time of life. This impoverished aged community receives BDT 500 each month. In 2018, 4.4 million elders received old age allowances. The number has increased to 57.01 lakh (5.7 M) beneficiaries who received cash transfers of BDT 3444.54 crore in FY 2021-22. On 24 January 2023, the parliament passed the Universal Pension Management Bill-2022 with the aim to provide a universal pension scheme. In the status quo, government employees are the only recipients of pension. The new pension scheme now will include all citizens between 18 and 50 years, even the expatriates.

In the FY 2021-22, the government has transferred BDT 764.39 crore cash to 7.70 lakh mothers under its “Maternity Allowance Program for the Poor Lactating Mothers.” 2.75 lakh mothers received around BDT 276.65 crore under the “Assistance for Working Lactating Mothers” programme. To ameliorate the woes of widowed, deserted and destitute women, GoB has provided BDT 1495.40 crore to 24.75 lakh women. In order to empower the marginalized groups, around 0.86 lakh beneficiaries from the transgender, bede and different disadvantaged communities received BDT 46.31 crore of cash allowances. For 20.08 lakh persons with disabilities, the government has disbursed BDT 1820 crore. To increase the school enrollment, decrease drop out rate and prevent child marriage, the government provides stipends to students of different educational stages. For instance, 140 lakh primary school students have received a total of BDT 1900 crore in FY 2021-22.

According to the National Budget Speech 2022-23 by the Finance Minister, A H M Mustafa Kamal, already 29% of the households have been covered by SSNPs, and budget allocations have been increased almost eight-fold compared to the allocation made in the budget for FY 2008-09. The government has already implemented the NSSS Action Plan 2016-21 under the NSSS 2015 and has recently started the implementation of the NSSS Action Plan 2021-26.

Traditional Payment Disbursement Method

Since the 1990s the social safety payments of the government were entirely manual, paper and cash based. From the identification of the beneficiaries to the final disbursement of allowances, the entire government payment ecosystem was not digitized. There are non-exhaustively FOUR problems and leakages that plague the traditional cash-in-hand method of disbursing the social safety payments-

First, mistargeting the beneficiaries. Any service delivery chain begins with identifying the individuals who actually need and deserve the allowances. The beneficiary selection process in Bangladesh is filled with inclusion and exclusion errors. According to the Household Income and Expenditure Survey (HIES) 2016 by the Bangladesh Bureau of Statistics (BBS), 71% of worthy individuals remained outside of the SSNPs (exclusion error) while 47% of those included in the safety net were not eligible for the government’s support (inclusion error). Politics at the local level, nepotism and corruption play vital roles in the weak targeting of beneficiaries. An absence of a proper means testing and central database exacerbate the problem even further.

Second, lack of financial literacy and inclusion. The unbanked population of the country lack adequate financial knowledge as well as access to formal financial services. According to IMF (2016), 45% of Bangladeshis are out of formal financial services. People fear hefty paperworks at the banks. A huge number of people do not possess the necessary financial knowledge to be a part of any financial services.

Also, the remoteness of the rural population from the nearest commercial bank branches create a major obstacle to financial inclusion. Currently, there are 61 scheduled banks and 5 non-scheduled banks in the country. These banks do not have branches in most rural areas in the country. To address this problem, the Bangladesh Bank even mandated that if a private bank intends to establish a branch in the urban locations, it must first open two branches in the rural regions. However, even this policy is not adequate to provide physical banking services through bank branches in most places of the country due to the higher costs of running a physical branch.

Third, aggravation associated with time, cost & visit. For a long time, the social safety net payments were disbursed through physical bank branches. Hence, beneficiaries have to travel a long distance to avail these services. The amount of cash allowances is less than USD 7 in most cases which is very small. According to a study conducted by aspire to innovate (a2i) under the Prime Minister’s Office, 14% (USD 1) of the total cash transfer is lost in travel costs for the beneficiaries. If you consider the opportunity cost of travel time, then more money is lost for each beneficiary. As most of the beneficiaries are from the low income class segment, they have to rely on hourly wages for their work. They have to trade off their work time, as a result wages, to travel a long distance to receive their cash allowances.

A national survey conducted by a2i to investigate the merits and demerits of the traditional cash transfer system reveals that 78% of the respondents in the survey identified a lack of information dissemination regarding payment date as a key reason for missing out the payments. 22% state long queue, 4% say other important work, 1% indicate unavailability of cash at the bank and rest 1% share that due to natural disaster they were unable to receive allowance on payment date. Also, individuals with disabilities have to suffer tremendously while traveling to the banks. This lack of choice of cash out points or convenient points of service alienates the beneficiary from the delivery chain.

Fourth, misappropriation or embezzlement. There are numerous allegations against local administrators, politicians, and middlemen who embezzled or misappropriated the money of the beneficiaries. A charmain of an union allegedly skimmed Tk 500 from each of the newly selected beneficiaries by persuading them that this amount would be required to open bank accounts. Those who did not comply were being threatened with exclusion from the SSNP beneficiary list. This prevalence of middlemen and unscrupulous & corrupt individuals massively besets the manual cash-based delivery chain.

G2P Payment System

To solve the leakages and issues of the traditional method and fulfill the vision of a cashless Smart Bangladesh, GoB introduced the G2P (Government to Person) payment system. G2P aims to put the beneficiaries back into the equation by entirely digitalizing the social safety net delivery chain. The G2P method electronically transfers the allowances directly into the accounts of beneficiaries. A study conducted by a2i in collaboration with Pi Strategy reveals that the G2P payments could save up to $15 million annually for the government. A Time-Cost-Visit analysis finds that it could save up to 91 million hours, $20 million in costs and 604 million visits for the allowance recipients annually. In 2015, a study conducted by a2i showcases that 1.5 crore citizens will require 58% less time, their cost will reduce by 32% and number of visits will decrease by 80%. The government will benefit too, as its expenses will decrease by 10%.

The G2P attempts to make the citizen experience better by tackling different citizen pain points in the delivery chain. G2P empowers citizens by providing them the control of the delivery chain. Citizens can now choose their preferred cash out points. They don’t have to suffer in long queues or don’t have to travel long distances at all. Additionally, G2P works as a shield for the beneficiaries as well as the government against corruption and any other leakages as it demolishes the middlemen by decreasing human involvement in the delivery chain.

First Stage – Targeting the Beneficiaries

The first crucial stage in the G2P delivery chain is targeting the beneficiaries. To effectively target the beneficiaries, a central database and unique citizen identification system need to be put in place to identify and deliver the allowances directly to the beneficiaries. The National Social Security Strategy 2015 calls for a National Household Database to identify the underserved segments of the country. The Department of Social Services (DSS) is preparing a central database to identify the actual number of poor individuals under the SSNPs. The World Bank’s Cash Transfer Modernization Project started assisting the DSS in integrating their Management Information System (MIS) with the Bangladesh Bureau of Statistics’ National Household Database. To ensure further security and accessibility of payments, the system is connected to the Finance Division’s centralized payment platform.

The unique feature of G2P is it is a MIS-integrated payment system. Every line ministry and department has its own MIS. When all of their MIS are prepared, the databases can be easily interchanged and inter-crossed under the G2P. At the back end, the G2P facilitates the integration of different national databases and ensures an effective beneficiary targeting process.

One successful evidence of G2P enabled beneficiary targeting system is the COVID-19 allowances. GoB dispensed BDT 2,500 cash allowances (approximately $26) through Mobile Financial Service (MFS) providers to each 5 million households during the pandemic. This huge data of 5 million families was cross-checked with the data from other databases for old-age allowance, pension, widow allowance, and national savings deposit.

One important piece in this jigsaw is the inclusion of Unique National Identification for every citizen to onboard beneficiaries and deliver the SSNP payments at their doorstep. The Election Commission started providing paper based laminated National Identity (NID) cards for electoral purposes from 2008. Now, the National Identity Registration Wing of the Bangladesh Election Commission has repurposed the NID card from voting needs to provide all forms of citizen services by replacing the old NID with biometric and microchip embedded Smart ID cards since 2016. The integrated circuits in this machine-readable pocket-sized plastic card store the data to prevent forgery. These smart cards covered over 95% of the adult population, including over 85% of the G2P beneficiaries. Hence, the NID database has been leveraged for onboarding the targeted vulnerable groups and providing them the allowances.

To integrate all the disintegrated databases, GoB has taken measures to establish a digital ID scheme. The ICT Division is implementing the Integrated Service Delivery Platform (ISDP) to effectively target and monitor the service delivery of SSNPs. The ISDP will enable GoB to develop a single window view of SSNP services per citizen or household. The system will store only service onboarding data (including service duration) of each SSNP programme against a unique ID. There are two core modules of ISDP- Master Client Index (MCI) and Service Manager.

The MCI is analogous to KYC (Know Your Customer) for both individuals and families. It will connect to the Civil Registration and Vital Statistics (CRVS) system of the CRVS Secretariat, Cabinet Division for identification, authentication and form filling purposes. National Household Database (NHD), NID and other databases will be interoperable with MCI to empower line ministries and divisions with effective targeting of beneficiaries and to assess the impacts of the ongoing social security programmes. The MIC will contain various data repositories and functions including but not limited to household data, biometric data, ID mapper, KYC data and demographic data. The Service Manager will contain data only about service enrollment – who is offering which service to whom, where and for how long.

Between 2020 and 2022, three SSNPs (old age allowance, allowances for the widow, deserted and destitute women, and allowances for the financially insolvent disabled) under the DSS have launched an online self-registration system to 262 impoverished upazilas (sub-districts).

Second Stage – Payment Delivery Channels

The second stage is the payment delivery channels. Mobile Financial Service (MFS) providers such as bKash, Nagad, Rocket; agent banking and other digital payment methods have revolutionized the G2P payment architecture. Following are some of the major advances of G2P payments-

- Under the Primary Education Stipends Project (PESP), mothers of around 13.7 million registered elementary level students receive stipends through MFS.

- Bangladesh Bank’s Bangladesh Electronic Funds Transfer Network (BEFTN) was used to disburse BDT 2,500 per month to 38 lakh out of 50 lakh registered unemployed individuals through Electronic Fund Transfer (EFT). The present daily EFT capacity of BEFTN is about 10 lakh. 1 crore EFTs were made to recipients under G2P in FY 2018-19. A Bangladesh Bank platform, Government eTransaction Processing Hub (GeTPH) allows the government to settle transactions made through BEFTN by allowing beneficiaries to get allowances within a day. Approximately 2.67 crore beneficiaries under 16 SSNPs are now receiving cash allowances through GeTPH.

- GoB has disbursed BDT 5,885 crore under the SSNPs through MFS providers and agent banking in 2021. Nagad, the postal department’s digital service arm, has disbursed financial assistance to 2.5 crore recipients in 2021.

- In 2021, DSS disbursed around 76 lakh beneficiaries through Nagad and bKash. bKash, the nation’s largest MFS provider has been actively disbursing allowances under G2P. The number of beneficiaries under the G2P has been increased to 26.3 million in FY 2021-22 due to MFS.

- To ensure that cash-out charge does not woe the beneficiaries, during Prime Minister Sheikh Hasina’s financial support of BDT 2,500 to 17 lakh families in 2020 and 15 lakh families in 2021, Nagad bore the cash out charge of BDT 15 for each transaction of the beneficiaries. For the MFS provider bKash, the government will bear BDT 7 of each cash out transaction charge for all the SSNPs linked to bKash.

Now, beneficiaries just have to go to a nearby agent to open an account in any of the MFS providers. Then, they will receive the financial assistance directly in their account. They can use that money for payments or any purposes through the MFS provider only using their mobile phone. If they want to cash out, they can go to the agent close to their residence and get the physical cash.

To facilitate customer onboarding of the MFS providers, Bangladesh Bank has enabled eKYC (Electronic Know Your Customer). eKYC allows the service providers to automatically cross match the data provided by the beneficiary with the Election Commission’s database. This step has significantly reduced the hassles experienced by both beneficiaries and MFS providers. eKYC saves time of onboarding from 4-5 days to 5-6 minutes and reduces the cost 5-10 times.

Monitoring and tracking the transactions under the SSNPs is also critical to combat corruption. The electronic platform Integrated Budget and Accounting System (iBAS) of the Ministry of Finance enables the supervising capacity of the government of all the social safety payments.

Recommendations

GoB’s commitment to provide a delightful citizen experience and social security through G2P needs further improvements on many fronts. Following are few recommendations to make the G2P payment system more efficient-

- Collecting, storing and tracking all sorts of data – whether it’s citizen data, household data or financial data is key to the entire G2P system. The government has to be more active and take additional measures in centralizing all the data by increasing collaboration among different ministries, divisions and agencies.

- GoB has to be proactive in monitoring and punishing any irregularities on the ground while selecting the beneficiaries.

- A Central Grievance Redressal System needs to be integrated into the MIS to receive and respond to complaints from all the pertinent stakeholders including the beneficiaries for improving the citizen experience.

- Protecting the data and privacy of the beneficiaries is also an important area to consider for which several measures have to be put in place.

- Several initiatives have already been taken by a2i and other line ministries to disseminate information, aware about the SSNPs and provide financial literacy. However, these programs for the beneficiaries as well as citizens and households who are not under any SSNPs need to be organized on a mass scale. Developing both digital and financial literacy of the beneficiaries is critical as a lot of them do not even know how to operate a mobile phone effectively.

- Similar but small SSNPs can be merged into a large SSNP to reduce the obstacles of coordination and cooperation among different agencies and ministries.

- Inspiring citizens to invest in social insurance systems for their future well-being and social safety can be instrumental in protecting people from any future risks and vulnerabilities.

Cover photo: Food distribution at Victoria park Mahmud Hossain Opu/Dhaka Tribune

About the Author

Shah Adaan Uzzaman is the Blog Administrator at The Confluence. A former Bangladesh Television Debate Champion and winner of several policy & debate competitions, he is currently a student of IBA, University of Dhaka.

3 comments

[…] Grappling with Global Inflation Behind Bangladesh’s Successful COVID Vaccination Program Delivering Social Security through Tech Why Bangladesh’s Delta Plan 2100 […]

[…] services became successful in Bangladesh which eventually led to the successful implementation of Government to Person (G2P) payments of Government of Bangladesh (GoB) for social security programs was because a bottom-up approach was […]

[…] the government has implemented measures to directly transfer cash benefits to farmers using mobile banking, with the list of farmers holding cards for agricultural input […]