As the world is gradually going cashless, the Government of Bangladesh (GoB) has given a high political priority to digitize all cash transactions by launching its “Cashless Bangladesh” initiative under the Smart Bangladesh campaign. Once a country with a high number of unbanked population, now is making significant strides in providing last-mile delivery of financial services leveraging mobile money and digital inclusion. This article looks into policy measures and initiatives undertaken by the country’s regulators so far in making Bangladesh cashless.

The conventional brick and mortar arrangement of banks has been proven ineffective and in some cases erroneous in banking the population of a developing nation like Bangladesh. Low financial literacy and awareness of the population has created a demand-side problem in providing financial services. Moreover, people are afraid of hefty paperwork which disincentivizes them to access formal financial channels.

The situation gets worse in the rural areas of the country where even the nearest branch of the commercial banks are far from people’s residences and workplaces. Hence, the aggravation associated with Time, Cost and Visit (TCV) discourages the rural population to avail the financial services in the first place. Moreover, the high costs associated with running a physical bank in rural areas also demotivates the commercial banks to set up shops at the last mile.

A cash-based monetary system is vulnerable to corruption and leakages. In contrast, contactless, cashless transactions are faster than the traditional system and can be easily brought under high supervision and scrutiny of the authorities. Even simply traveling with cash itself is a pain point for citizens which can otherwise be solved when all their money will be well-protected and secured in their mobile wallets. Replacing cash with credit, debit cards, mobile wallets and QR codes facilitates faster transactions, increased tax compliance, automated paper trails and data collection.

To address all such bottlenecks, GoB and the country’s central bank, Bangladesh Bank have undertaken several policy measures and initiatives

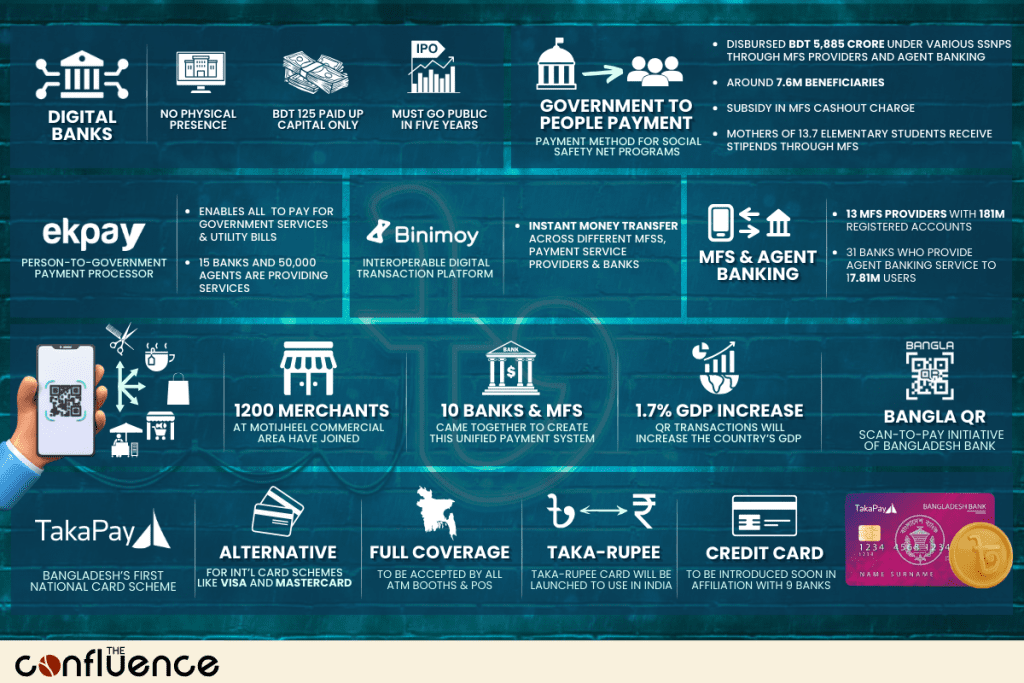

Taka Pay

In the status quo, Bangladesh’s banking system is massively reliant on international card schemes such as Mastercard and Visa to issue credit and debit cards. The commercial banks of Bangladesh have to spend huge amounts of dollars to access membership of such international card schemes. These card schemes manage payment transactions done by credit and debit cards. However, due to such dependency on card schemes, the country has to forgo a massive amount of foreign reserves as the transaction costs of each transfer has to be repaid in US dollars.

To offer a viable alternative of such international card schemes and reduce the expenses of foreign exchange, Prime Minister Sheikh Hasina has launched Bangladesh’s first national card scheme, Taka Pay on November 1, 2023, The electronic payment platform run by the Bangladesh Bank, the National Payment Switch of Bangladesh will be used to provide services of TakaPay. To further extend the services of TakaPay beyond the borders of Bangladesh, Bangladesh Bank is aiming to launch “Taka-Rupee Card” which will enable users to shop in India.

Initially, the card will act as a debit card and will be accepted by all ATMs, point of sale and online platforms across Bangladesh. In the future, credit cards will be introduced. One state-owned bank Sonali Bank, and two private banks City Bank and Brac Bank will start issuing the TakaPay card in collaboration with Bangladesh’s central bank, Bangladesh Bank. Five new banks, including United Commercial Bank, Eastern Bank, Islami Bank, Dutch-Bangla Bank, and Mutual Trust Bank will soon join the national card scheme.

Bangla QR

Quick Response (QR) codes are super handy to make digital payments, especially while shopping. MFS providers like bKash have already introduced QR codes in shops and markets so that customers can easily scan the two dimensional code of black and white squares and pay directly to the merchant’s wallet.

To ensure interoperability among different financial service providers and increase financial inclusion, Bangladesh Bank has launched an interoperable Bangla QR code under its scan-to-pay initiative to embrace contactless digital payments.

The Bangla QR code is a cost effective digital payment solution through which consumers can make payments for their purchase from small businesses including roadside vendors, cobblers, tea stall and barber shop owners by scanning the printed interoperable QR code. MFS providers such as bKash, mCash, and Rocket, card service providers such as MasterCard, Visa, and Annex, and banks have already joined the Bangla QR code initiative to facilitate the aim of a cashless society.

On January 6, 2021, Bangladesh Bank released the guidelines for the Bangla QR to facilitate a secure, safe and fast payment ecosystem at the retail level, especially for micro, small and medium sized businesses. The initiative was launched on January 18, 2023 with the participation of 10 banks and MFSs by bringing 1,200 small merchants at Motijheel CommerciaL Area under the Bangla QR payment method.

0

%

Projected GDP growth for QR transactions

The Bangla QR Code can play a pivotal role in formalizing the country’s micro, small and medium sized enterprises through digitalizing the bill acceptance process. Micro entrepreneurs such as food carts, tea vendors, vegetable vendors, fish vendors, cobblers, barbers, and hawkers have started using the Bangla QR code which is a step in the right direction for maximizing financial inclusion in the country. It is estimated that if implemented properly, QR transactions will increase the country’s GDP by 1.7%.

Binimoy

In providing financial services, interoperability perhaps is one of the most important factors. Let’s say you have a bKash account. Your bKash account allows you to only transfer cash to another bKash account – not to someone who has a Rocket or Nagad account. Here is where the concept of interoperability comes in. Interoperability will allow bKash users to transfer money to Nagad users. This means someone does not have to open accounts in every bank or MFS.

0

Cr

Cost of implementing Binimoy (BDT)

To solve the interoperability issues with the current financial system of the country, the ICT Division’s IDEA Project in collaboration with Bangladesh Bank has launched an Interoperable Digital Transaction Platform (IDTP), Binimoy on November 13, 2022, which will allow transactions and instant money transfer across different MFSs, Payment Service Providers (PSPs) and banks. Drawing inspiration from India’s United Payment Interface (UPI), Idea project developed the platform spending BDT 65 crore.

Mobile Financial Services (MFS) & Agent Banking

Providing last-mile delivery of financial services to the poor unbanked population was inadequate through the conventional banking system. The financial landscape of the country changed when mobile financial services and agent banking were introduced in the country.

MFS agents based on their mom-and-pop shops acted as human ATMs to provide cash-in and cash-out services to the neighborhood. Additionally, being an agent to MFS companies like bKash provided an additional income source to satiate their livelihood. MFS providers in the country offer a wide range of services – from cash transactions to remittance transfers, from utility bill payments to school fees payments – MFSs are gradually becoming a one-stop service for the Bangladeshis.

On the onset of the mobile financial services (MFS) industry in 2011, the government made a choice to establish the industry as an extension of banking and financial services. To facilitate mobile money in Bangladesh, Bangladesh Bank formulated a set of MFS guidelines in 2011. The guidelines ensured that customer’s funds remain protected and the central bank can have full visibility on the operations – thus, high scrutiny over the industry. At present, there are 13 MFS providers in Bangladesh where around 198 million users registered.

0

M

MFS users

To further promote financial inclusion in the country, Bangladesh Bank introduced agent banking in 2013. In 2017, Bangladesh Bank released a comprehensive guideline for agent banking. As of December 2022, 17.47 million registered accounts are receiving services from 31 banks out of 61 scheduled banks through 20,736 agent outlets across the country. Bangladesh Bank’s agent banking report shows that in December 2022, the amount of deposits collected through agent banking was BDT 30,157.9 crore, 76.83% of which came from rural areas.

Government-to-Person (G2P) Payment System

To achieve the vision of a cashless Smart Bangladesh, GoB launched the government-to-person (G2P) payment method for its major social safety net programs (SSNPs). MFS providers such as bKash, Rocket and Nagad are delivering social safety net payments directly to the wallets of the beneficiaries. In 2021, Bangladesh Bank launched a software named “Government e-Transaction Processing Hub (GeTPH)” to act as a system of electronic transactions for G2P payments. In 2011, Bangladesh Bank launched the Bangladesh Electronic Funds Transfer Network (BEFTN) which allows corporate entities to pay salaries and wages to their employees and enables them to make bulk payments. Utility payments, loan installments and insurance payments

In 2021, the government has disbursed BDT 5,885 crore under various SSNPs through MFS providers and agent banking. Under the Primary Education Stipends Project (PESP), mothers of around 13.7 million registered elementary level students receive stipends through MFS. In 2021, DSS disbursed around 76 lakh beneficiaries through Nagad and bKash. bKash, the nation’s largest MFS provider has been actively disbursing allowances under G2P. The number of beneficiaries under the G2P has been increased to 26.3 million in FY 2021-22 due to MFS. To ensure that cash-out charge does not woe the beneficiaries, during Prime Minister Sheikh Hasina’s financial support of BDT 2,500 to 17 lakh families in 2020 and 15 lakh families in 2021, Nagad bore the cash out charge of BDT 15 for each transaction of the beneficiaries. For the MFS provider bKash, the government will bear BDT 7 of each cash out transaction charge for all the SSNPs linked to bKash.

Bangladesh Bank’s Bangladesh Electronic Funds Transfer Network (BEFTN) was used to disburse BDT 2,500 per month to 38 lakh out of 50 lakh registered unemployed individuals through Electronic Fund Transfer (EFT). The present daily EFT capacity of BEFTN is about 10 lakh. 1 crore EFTs were made to recipients under G2P in FY 2018-19. Approximately 2.67 crore beneficiaries under 16 SSNPs are now receiving cash allowances through GeTPH.

Ek Pay

In 2019, Access to Information (a2i) program of GoB launched a Person-to-Government (P2G) payment processor platform Ek Pay which enables all the citizens to pay for government services, including utility bills. Previously, people had to visit banks or electricity offices (for electricity bills) and wait in long queues which wasted both their time and money. Now, citizens can pay all their dues just using Ek Pay. More than 15 banks and 50,000 agents are relentlessly providing services to the citizens and improving their citizen experience.

Digital Banks

Digital banks are financial institutions that do not have conventional brick and mortar arrangement, instead they conduct all their operations and transactions through online challens. In June 2023, Bangladesh Bank approved the Digital Bank Guideline to allow companies to set up their digital branches online. Digital banks won’t have any physical presence except for their head office. These digital banks must maintain a minimum paid-up capital of BDT 125 crore and must go public through initial public offering (IPO) within 5 years of establishment. The guideline also adds that the board of directors should consist of members with high fin-tech and banking knowledge and expertise.

Once the central bank opened applications for digital banks on June 21, 2023, 52 applications were filed by companies. On October 22, 2023, Bangladesh Bank awarded Letters of Intent (LOI) to 2 entities – Nagad Digital Bank PLC and Kori Digital PLC of ACI. A total of 8 entities so far secured approval from the central bank in principle.

Debit and Credit Cards

GoB has promoted the use of debit and credit cards to make cashless Bangladesh a reality. Bangladesh Bank’s data reveals that card usage is growing rapidly in the country. At point of sale (POS), the transaction value through cards increased 58% from February 2020 to February 2023 reaching BDT 2,392 crore, while online/ecommerce payments grew 3.3 times in the same period to stand at BDT 1,072 crore.

About the Author

Shah Adaan Uzzaman is the Blog Administrator at The Confluence. A former Bangladesh Television Debate Champion and winner of several policy & debate competitions, he is currently a student of IBA, University of Dhaka.

2 comments

BDT 125? BDT 125 crore.

and another one is 13.7 elementary students… is it lac or million?

[…] Citizens are often missing from the entire public service delivery chain. One of the reasons agent banking and mobile financial services became successful in Bangladesh which eventually led to the successful implementation of Government […]