The Leather Industry of Bangladesh started showing immense export potential in the last decade with raw hide and skin prices skyrocketing. In recent times, prices of raw hides have declined and exports have plummeted.

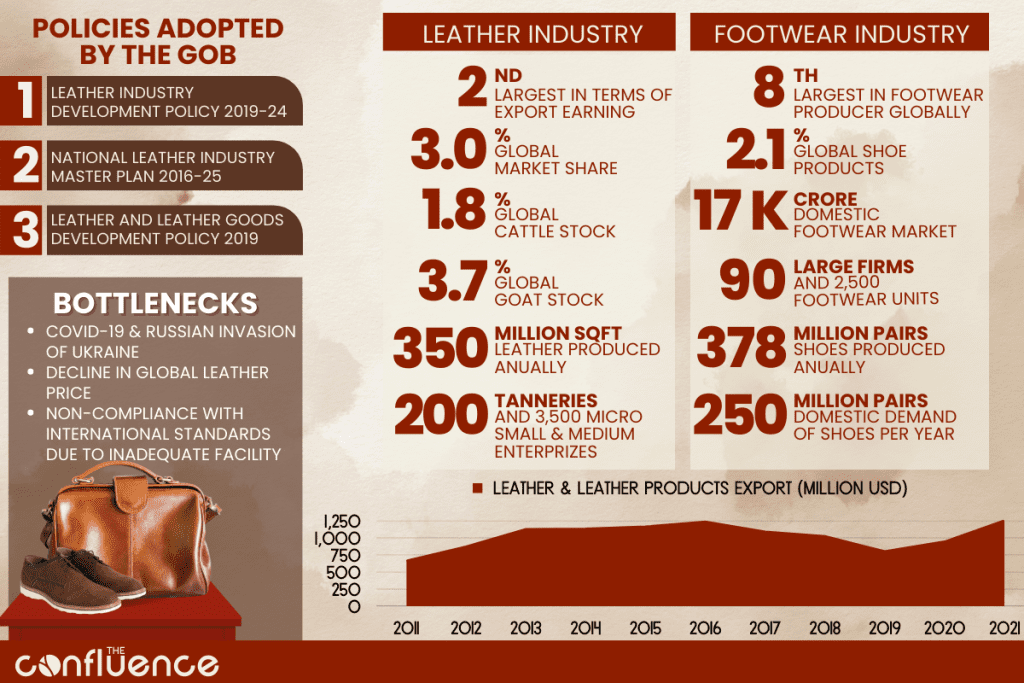

One of the oldest industries in Bangladesh, the leather industry is the country’s second-largest contributor to Bangladesh’s export earnings after the RMG sector. Bangladesh accounts for 3% share in the global leather and products market, with 1.8% of global cattle stock and 3.7% of goat stock. By 2020, the country has become the 8th largest global footwear producer in the world, contributing 2.1% to the global shoe production. The industry has employed around 0.85 million people in which 60% of this workforce is women.

Global Leather & Products Market Share of Bangladesh

Global Footwear Products Market Share of Bangladesh

According to the Export Promotion Bureau (EPB), leather, leather goods and footwear exports from Bangladesh reached a 10-year-high in FY 2021-22, as the leather sector earned a total of $1.25 billion. The reduced dependency of importers on China and Vietnam has increased the demand for Bangladeshi leather offerings which resulted in such a surge in export.

$

0

Billion Export Earnings in FY 2021-22

The Government of Bangladesh (GoB) has declared leather as a priority sector and even declared the FY 2016-17 as the “Leather Year”. A report by EBL Securities Ltd. in August 2019 showed that Bangladesh annually produces 350 million square feet of leather, with only 20 to 25% fulfilling domestic requirements, while the remaining production is exported to foreign countries.

0

Million Sq. Ft Leather Production in 2019

At present, the Bangladesh leather industry is segmented into different categories, with one such segment being the “Tanning & Finishing” sector. The Leathergoods and Footwear Manufacturers & Exports Association of Bangladesh (LFMEAB) has reported the presence of 200 tanneries and 3,500 Micro, Small, and Medium Enterprises (MSMEs) in Bangladesh. Within this domain, tanneries are involved in manufacturing crust leather, finished leather, and wet blue leather. Additionally, the “Footwear” sector, alongside footwear component manufacturing, makes a significant contribution to the overall leather industry. With 2,500 footwear units and 90 large firms, this segment plays a pivotal role in meeting both domestic and outside demand. According to the Dhaka Tribune, the domestic footwear market in Bangladesh was valued at around BDT 17,000 crore in 2020, with an annual production of 378 million pairs of shoes, whereas the local market demand is 200 to 250 million pairs per year.

0

Tanneries

0

Micro, Small, and Medium Enterprises

After meeting the domestic demand, the surplus footwear is exported worldwide. Consequently, globally distinguished brands such as ABC Mart, Adidas, Aldo, Esprit, Hugo Boss, H&M, Kate Spade, K-Mart, Michael Kors. Marks & Spencer, Nike, Steve Madden, Sears, Timberland, and others source their necessary leather goods and footwear from Bangladesh. Moreover, the production of leather accessories including belts, bags, jackets, suitcases, wallets, and various decorative items has become a key segment within Bangladesh’s leather industry.

0

Crore Domestic Footwear Market

0

Million Pairs of Shoes Produced in 2020

Bottlenecks

During the fiscal year 2022-23, the industry generated revenue amounting to USD 1.22 billion, indicating a decline of 1.74% in growth compared to the previous fiscal year. The industry has navigated amidst an export decline in the fiscal year 2016-17, 2017-18, and 2018-19 in which the cumulative leather and leather product exports reached $1.23 billion, $1.09 billion, and $1.02 billion, respectively. The industry then recovered in the FY 2021-22, earning $1.24 billion.

Leather & Leather Products Export (Million USD)

Source: Export Process Bureau of Bangladesh

No Data Found

THREE Key Reasons

There are various internal and external factors that led to such a fluctuating trend in leather exports. Following are non-exhaustively THREE key bottlenecks which have largely affected the Bangladeshi leather industry as well as the leather exports-

COVID-19 & Russian Invasion of Ukraine

In the FY 2022-23, the country experienced a 1.74% reduction in overall exports, largely due to the global economic turmoil triggered by the Ukraine crisis. Within Europe, both leather and footwear exports witnessed a decline ranging from 10% to 15%. The global energy crisis aggravated by the war, severely affected the European economy. As a result, the orders from Europe continued to decline. Likewise, as all the foreign economies were struggling during the pandemic, the demand for Bangladeshi leather exports declined drastically. The pandemic and the Russia-Ukraine War are one of the major exogenous factors that the government as well as the exporters from Bangladesh have very limited scope to influence.

Decline in Global Leather Price

There has been a sharp reduction in the pricing of leather all around the world. For instance, around five years ago, the cost of raw materials for Brazil’s leather industry stood at $1.30 per kilogram, whereas it has currently dropped to $0.20 per kilogram. Fast fashion brands such as H&M and Zara have shifted towards producing fashion items using synthetic or PU leather, which proves more cost-effective and profitable for these fashion houses.

Additionally, animal rights and environmental activists have constantly criticized the use of leather made from animal hides, prompting numerous fashion designers to distance themselves from utilizing leathers derived from animal skin.

However, it’s crucial to note that in Bangladesh leather is not a primary product obtained through the slaughter of animals solely for this purpose. Instead, the leather industry plays the role of a recycling industry. The sustainability of the sector is intertwined with the recycling of leather generated from slaughtering during Eid-u;-Adha each year. These are waste that can potentially bring adverse effects. The leather industry in Bangladesh is, therefore, pivotal for ensuring proper waste management of these wastes from slaughtering and accelerating the country’s economy at the same time.

Non-Compliance with International Standards due to Inadequate Facility

To protect the Buriganga river and stop environmental pollution, the government had taken the initiative to shift all tanneries located in Dhaka’s Hazaribagh after setting up the Bangladesh Small and Cottage Industry Corporation (BSCIC) Tannery Industrial Estate on 200 acres at Hemayetpur, Savar in 2003.

However, the Savar Tannery Industrai Estate has largely failed to meet the necessary international compliant requirements. The industrial Estate has been struggling to manage the huge amount of rawhide generated during Eid-ul-Azha despite an 18-year investment of BDT 1,015 crore. This is due to the incomplete infrastructure, which includes the lack of an adequate and functional liquid and solid waste management systems, a salt purification mechanism, and a common chromium recovery unit (CCRU). As a result, the harmful chemicals discharge into the Dhaleshwari river, destroying the environment.

The lack of readiness of the Central Effluent Treatment Plant (CETP) at the Savar Tannery Industrial Estate is a major hindrance in tapping Bangladesh’s labor export potential. The present CETP has a capacity of 25,000 cubic meters of waste treatment per day. However, during Eid, the demand reaches to 42,000-45,000 cubic meters, and the current facility fails to accommodate such volume. The Estate has implemented a rationing system to manage the increased load of wastewater during Eid. This system restricts all 139 operating tanneries from releasing effluent simultaneously, which would overwhelm the wastewater treatment system.

Inadequate capacity of the Chromium Recovery Unit (CCRU) exacerbates the problem. The current CCRU has a capacity of 1,050 cubic meters per day, which is inadequate to manage the 5,000 cubic meters it receives due to improper effluent transfer and excess water. An absence of a functional chromium drainage system further adds to the problem of chromium recovery.

The government has proposed a number of measures to address this issue. These include: advising large tanneries to establish their own CCRUs, encouraging smaller tanneries to discharge effluents properly, reducing the use of restricted chemicals, and building a chemical warehouse.

An absence of reverse osmosis technology hinders the establishment of a salt treatment unit. Also, the funding constraints stalls the construction of a solid waste dumping yard adjacent to the CETP. This yard is necessary to dispose of the solid waste generated by the tanneries.

Due to the failure of fulfilling the international standards, the US and EU buyers are becoming reluctant to buy Bangladeshi products. Due to this reason, Bangladesh’s raw materials are now sold to China at a much lower price in comparison to what European countries offer. Moreover, wet-blue leather is being illegally sold to India due to the ban on exporting wet-blue leather, which has further hindered the advancement of this industry.

Policies Adopted for the Revival of the Leather Sector

Leather Industry Development Policy (LIDP) 2019-24

The Leather Industry Development Policy (LIDP) 2019-24 aims to increase Bangladesh’s competitiveness in the global market and further sustainable growth. The policy intends to provide investment incentives such as tax benefits, reduced import duties on machinery and raw materials, and access to financing and credit facilities to attract both domestic and foreign investors. Also, the policy mentioned facilitating participation in international trade fairs, negotiating trade agreements, and providing support to exporters to accelerate leather product exports Increasing technical and vocational skills of workers in the leather industry through various skill development programs is also an important objective. Moreover, LIDP encourages environmentally friendly practices such as ensuring proper waste management, pollution control, and the adoption of cleaner production technologies. The policy also supports the creation of quality control mechanisms, testing laboratories, and certification processes to ensure globally standard high product quality.

National Leather Industry Master Plan 2016-25

This plan outlines the government’s strategy for the development of the leather sector. The plan focuses on improving the quality of leather products, increasing market access, and promoting sustainable production practices.

Leather and Leather Goods Development Policy 2019

The Leather and Leather Goods Development Policy aims to build a sustainable environment-friendly compliant industry and ensure improved infrastructure for efficient and effective industrialization. Also, the policy encourages innovation, entrepreneurship and adoption of best management practices Moreover, one of the objectives of the policy is to create a framework supporting joint participation of public and private sectors in development of scientific and technological competencies for the production of more and higher value-added goods for export while positioning Bangladesh in the global market.

Ten-Year Perspective Plan

The Ministry of Commerce is setting a target to increase the leather sector’s export earnings from below $1 billion to $10-12 billion by 2030, which will place Bangladesh in the top ten global exporters of leather.

The Leather and Leather Goods Development Policy (LLG) 2019 aims to improve compliance, waste management, CETP capacity and factory conditions, but implementation difficulties persist.

Advances Made So Far

Leather Products Manufacturing Hub at Hazaribagh

After the tanneries were shifted to Savar, Hazaribagh has become a promising hub of diversified leather products from a rawhide tannery zone in the span of only six years. Shoes, slippers, jackets, office bags, wallets, purses, belts, school bags and ladies’ handbags are being manufactured in Hazaribagh. The hub generates an annual turnover of BDT 100 crore.

According to the Hazaribagh Leather Shoes and Goods Association, among 400 leather factories in Bangladesh, around 150 small and medium factories are in operation in Hazaribagh. Individuals who lost their jobs during the tannery relocation process are now employed in the leather factories in Hazaribagh.

Leather Industrial Park in Savar

The Government of Bangladesh is aiming to establish a new leather industrial park beside the BSCIC Tannery Industrial Estate in Hemayetpur, Savar, in order to set up a full-fledged leather industrial city. This leather industrial park will accomodate tanneris, and backward and forward linkage industries related to leather goods. Around 200 industrial units will be build on 27 industrial plots on around 79 acres of land, 10% of those plots will be allocated to women entrepreneurs to further women empowerment. To build an entire ecosystem, a power plant, two power substations, a gas station, a four-module central effluent treatment plant (CETP), a solid waste management system, a dumping yard, day care centers, clinics, clubs and playgrounds will be set up in the park.

Tannery Villages in Rajshahi and Chattogram

GoB is planning to set up two tannery villages in Rajshahi and Chattogram. A tannery village will be built in the Mirsarai Economic Zone (MEZ) under Bangabandhu Shilpa Nagari (BSN) ‘industrial city’ belt. Another tannery village will be established at Mirsarai, Chattogram.

Recommendations

1. Skilling for Leather Industry

There is a huge skill gap of Bangladeshi workers to meet the demand of an evolving competitive market. The Leather and Leather Goods Development Policy 2019 suggests the establishment of vocational training centers and research institutes to develop a skilled workforce in the leather, leather goods and footwear sector. The policy also outlines to take necessary initiatives to increase the participation of females in the overall supply-chain of this sector. If implemented properly, this policy will be able to solve the scarcity of skilled workers in the industry.

2. Improving Environmental Compliance

The government needs to heavily invest in improving the wastewater treatment system at the Savar Tannery Industrial Estate and other tanneries across the country. The government should take necessary steps to improve solid waste management, chrome recovery units in tannery areas, and other necessary infrastructure.

3. Rebranding Bangladesh’s Leather Industry

The negative perception towards Bangladesh’s leather industry has to be tackled with an effective branding effort to create a strong brand identity for Bangladeshi leather products to buyers around the world.

About the Authors

Shah Adaan Uzzaman Shah Adaan Uzzaman is an entrepreneur, strategist, and politician. He is the co-founder and CEO of the emerging clean-tech startup, Dumpy. He also serves as the Co-Founder and Blog Administrator of The Confluence. Adaan has closely advised and worked with several Bangladeshi policymakers on numerous public policy projects and initiatives at a very young age. He is also a former Bangladesh Television debate champion and is considered one of the best debaters in Bangladesh. He is currently pursuing his undergraduate studies in Finance and Economics at the Institute of Business Administration (IBA), University of Dhaka.

A R Tahseen Jahan is the Co-Founder and Head of Policy at The Confluence. An undergrad student of Development Studies at the University of Dhaka, she worked on topics of economic development and public policy analysis.