E-commerce and F-commerce has revolutionized the business landscape worldwide. Female entrepreneurship has been leveraged E-commerce in Bangladesh. Establishing an SME has become easier by offsetting the necessity of a physical store. What challenges can be anticipated for the industry?

E-commerce in Bangladesh is on a meteoric rise having a steady growth rate. With a compound annual growth rate (CAGR) around 7.37%, this industry is expected to grow from US$7.13 billion in 2023 to US$9.2 billion by 2027. This rapid growth underscores the sector’s immense potential and its transformative impact on the economy. Fueled by increased internet penetration, a burgeoning middle class, and shift in consumer habits, the e-commerce industry is reshaping the retail landscape in Bangladesh. However, this promising trajectory is not without its challenges. Issues like inadequate infrastructure, lack of standardization, and regulatory gaps threaten to undermine the sector’s sustainability. As the government steps in with new policies and regulations, the future of e-commerce in Bangladesh hinges on striking a balance between supporting growth and ensuring consumer protection.

0

%

Compound Annual Growth Rate of E-commerce industry

Anticipated Industry Growth of US $2.07 billion in 5 Years

From US $7.13 billion in 2023 to US $ 9.2 billion in 2027

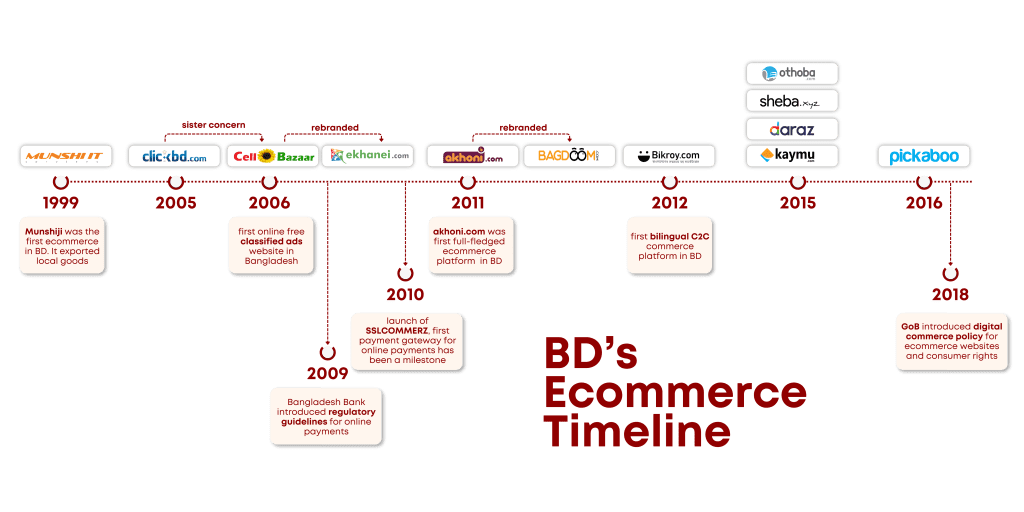

Emergence of E-Commerce in Bangladesh

The roots of e-commerce in Bangladesh can be traced back to the late 1990s, with Munshiji Technology Limited launching Munshiji in 1999, the country’s pioneering e-commerce platform. This platform focused primarily on exporting various local products. Subsequently, in April 2005, ClickBD.com emerged as another significant player, initially providing a marketplace for selling various products and later introducing online stores. The landscape expanded further in 2006 with the launch of CellBazaar, which was later rebranded as ekhanei.com, which marked the inception of free classified ads in the country.

Despite the emergence of several e-commerce ventures, the sector faced significant hurdles due to a lack of regulations and limited internet penetration until 2008. However, the scenario began to change in 2009 when Bangladesh Bank introduced regulations for online transactions, coinciding with the introduction of Wimax Internet services. The establishment of SSLCOMMERZ in 2010 marked as a significant milestone in the development of payment gateways in Bangladesh. This facilitated secure online transactions which helped the ecommerce industry to skyrocket.

The subsequent years witnessed a surge in e-commerce activities, with the founding of akhoni.com in 2011, later rebranded as bagdoom.com, and the launch of ajkerdeal.com. The advent of 3G internet technology in 2012 further propelled internet penetration, leading to the rapid growth of e-commerce platforms such as rokomari.com and Bikroy.com. The momentum continued in 2013 with the celebration of E-Commerce Week and the establishment of E-Cab to address sector-specific concerns and foster growth.

The e-commerce landscape saw notable expansions in subsequent years, marked by the entry of leading platforms like Daraz, Sheba.xyz, othoba.com, and pickaboo.com. The establishment of eCourier and Pathao Courier in 2014 and 2015, respectively, further catalyzed the growth of the sector by enhancing parcel delivery services. Moreover, initiatives like the digital commerce policy introduced by the Government of Bangladesh in 2018 aimed to provide guidelines for e-commerce websites and ensure consumer rights protection, highlighting the growing significance of the sector in the country’s economy.

Factors That Contributed to E-commerce’s Growth

E-commerce Market Size in Bangladesh (in Million)

Source: The Daily Star

No Data Found

Increase in Internet Use

The growth of e-commerce in Bangladesh can be attributed to several factors. Firstly, the increase in internet access across the country has significantly boosted discoverability and adaptability to online shopping. As more people have become connected to the internet, the reach and appeal of e-commerce platforms have expanded.

Courier Service and Delivery Systems

Another crucial factor has been the development of courier services and home delivery systems. This has allowed customers to get the ordered goods delivered directly to the their doorstep. It also allowed customers to pay in the Cash on Delivery (COD) system which has ensured consumer trust. These advancements have made it much easier for consumers to receive their purchases quickly and reliably, enhancing the overall convenience of online shopping

COVID-19 Lockdowns

The most recent and significant surge in e-commerce activity occurred during the COVID-19 pandemic. With the country under lockdown, people had limited options for traditional shopping, making online shopping the only viable alternative. This shift in behavior, driven by necessity, has persisted even after lockdown restrictions were eased, indicating a lasting change in consumer habits.

High Commuting Costs and Traffic

Additionally, the high commuting costs and traffic congestion in major cities like Dhaka and Chittagong have played a pivotal role in driving residents towards online shopping. The convenience of avoiding travel and the associated hassles has made online shopping a preferred choice for many urban consumers.

Bottlenecks of E-commerce in Bangladesh

Infrastructure Issues

0

%

E-commerce payments made with cash

37.6 Million Cards

21.2 million debit cards | 2.2 million credit cards | 4.2 million prepaid cards

Bangladesh is a country with a population over 160 million, where bank cards have been widely popular recently with 31.2 million registered debit cards, 2.2 million credit cards and 4.2 million prepaid cards; transactions on ecommerce platforms have not been super smooth yet. Consumers yet barely pay online through bank cards despite having discount offers on saving the card or paying with the card. Moreover, there is no option to pay with cards at the delivery. Delivery persons bringing POS machines to receive payments via cards at doorstep would have made receiving delivery a lot easier since there’s a scarcity of change notes at every household. Around 90% e-commerce payments are still made through cash.

Additionally, the limited adoption of digital payment methods further exacerbates the problem. While payment gateways like bKash and SSLCOMMERZ are becoming more common, a large portion of the population still relies on cash transactions, preferring cash-on-delivery options. This hesitancy to embrace digital payments creates bottlenecks in the e-commerce ecosystem, impeding the seamless, secure, and efficient transactions necessary for a thriving online marketplace.

Consumer Trust and Payment Systems

Collecting Advance Payment and Non-delivery

Incites fear of being deceived

Consumer trust and payment systems are critical challenges for e-commerce in Bangladesh. For instance, the rise and fall of platforms like Evaly have highlighted significant issues with fraudulent activities, such as collecting advance payments without delivering products, which has severely eroded consumer confidence in online transactions. Many consumers are hesitant to shop online due to fears of being deceived, which significantly hampers the growth of the sector.

Regulatory and Operational Challenges

Uncertainty regarding Compliance Requirements

Incites fear of being deceived

For a long time, e-commerce in Bangladesh lacked proper regulatory guidelines. This industry faces significant regulatory and operational challenges, primarily stemming from a lack of clear regulations and standards governing e-commerce operations. Without well-defined guidelines, businesses operating in the sector often face uncertainty regarding compliance requirements. Moreover, the absence of robust enforcement mechanisms creates difficulties in ensuring consumer rights and protection. Instances of fraud, misleading advertising, and unfulfilled orders highlight the pressing need for effective regulatory frameworks to safeguard consumer interests.

Scams and Fraudulent Activities

As e-commerce platforms operate online, barely having any physical touchpoints, there’s always this question of whom to hold accountable for any fraud or scam. Unlike physical stores which are often raided by consumer court, seeking justice for a fraud on an e-commerce platform is not so convenient. Thus there are many instances of scams happening every day in the name of online shopping.

Lack of Standardization

Without uniform guidelines, there is a lack of consistency among e-commerce platforms, leading to confusion among consumers regarding product quality, return policies, and customer service standards. For example, one online marketplace may have stringent quality control measures and transparent return policies, while another may lack such standards, resulting in disparate experiences for consumers. This inconsistency erodes trust and confidence in online shopping, discouraging potential customers and hindering the growth of e-commerce businesses.

Remedial Initiatives

GoB has taken a number of initiatives to ensure the standardization of e-commerce businesses with an aim to secure consumer right protection in terms on online purchasing.

Unique Business Identification (UBID)

Mandatory Registration

Ban on non-compliance

The government has introduced UBID as a mandatory requirement for all e-commerce businesses operating in the country. Under this initiative, each e-commerce entity will be assigned a unique identification number to facilitate regulatory oversight and accountability. UBID aims to streamline the registration process for e-commerce platforms and improve transparency in the sector by ensuring that all businesses are properly identified and regulated. There has been a ban on businesses running without an UBID.

Central Complaint Management System (CCMS)

Central Platform for Lodging Complaints

For further investigation and dispute resolution

The development of CCMS represents a significant step towards addressing consumer grievances and ensuring accountability within the e-commerce industry. This centralized platform allows consumers to lodge complaints regarding product quality, delivery issues, or any other concerns related to their online purchases. By providing a streamlined mechanism for resolving disputes, CCMS aims to uphold consumer rights and bolster trust in online shopping platforms.

Interoperable Transaction Platform ‘Binimoy’

Financial Transactions across Different Platforms

Example – sending money from bKash to Rocket

Binimoy is an interoperable transaction platform designed to facilitate seamless and secure financial transactions across different e-commerce platforms. This initiative aims to enhance the efficiency of online payments and promote digital financial inclusion by enabling consumers to make purchases using various payment methods, such as credit/debit cards, mobile wallets, or bank transfers. By standardizing transaction processes, Binimoy seeks to improve the overall e-commerce experience for both consumers and businesses.

Central Logistics Tracking Platform (CLTP)

Real-time Updates on Shipment Status

For increased accountability

The government’s plan to launch CLTP underscores its commitment to improving logistics and delivery services in the e-commerce sector. CLTP will serve as a centralized tracking system to monitor the movement of goods from sellers to buyers, ensuring transparency and accountability throughout the supply chain. By providing real-time updates on shipment status and delivery schedules, CLTP aims to address logistical challenges and streamline the fulfillment process for e-commerce transactions.

Regulatory Body

In 2021 GoB has planned to establish a regulatory body and enact a new e-commerce law to address widespread fraud in the sector. This initiative will introduce stringent monitoring and regulation, requiring every e-commerce firm to obtain a unique business identification number from the Commerce Ministry. Additionally, amendments to the Digital Security Act and the Money Laundering Act will strengthen legal actions against fraudulent companies. The new e-commerce law will also establish a central complaint cell, providing consumers with a formal mechanism to report grievances. This comprehensive approach aims to restore consumer trust, ensure ethical practices, and support the legitimate growth of the e-commerce industry in Bangladesh.

Recommendations

-

Strengthen consumer protection laws with rigorous enforcement and establish clear, standardized return and refund policies across all e-commerce platforms.

-

Ensure all e-commerce platforms obtain and display their Unique Business Identification (UBID) for better regulatory oversight and transparency.

-

Introduce stricter regulations for digital payment gateways to prevent fraudulent activities and enhance consumer trust while promoting digital literacy nationwide.

-

Enhance logistics and delivery regulations to ensure timely and reliable order fulfillment, and implement a robust grievance redressal mechanism through the Central Complaint Management System (CCMS).

-

Implement robust data privacy laws to protect consumer information, and encourage public-private partnerships to drive innovation and improve e-commerce infrastructure.

-

Conduct regular audits of e-commerce platforms to ensure compliance with regulations, identify potential fraud, and foster collaboration between regulatory bodies and law enforcement agencies.

-

Support the growth of interoperable payment solutions like Binimoy to facilitate seamless transactions, and provide incentives and support to small and medium enterprises (SMEs) to help them navigate the e-commerce landscape.

About the Author

Hamim Mubtasim is the Brand Manager at The Confluence. He is currently pursuing his undergraduate studies at the Institute of Business Administration, University of Dhaka. A business student by choice and marketing geek by passion, he aspires to manage big brands someday.