The success of Bangladesh in the future as a development wonder largely depends on attracting investment and diversified industrialization and export basket. This article takes a look at the investment regime of Bangladesh.

Bangladesh, a country of 164 million inhabitants, with an average age of 27.9 years has doubled investments over the past 10 years. The entrepreneurship ecosystem has been benefited by the startling 62% of the youth population. Over the last four years, international venture capitalists and well-known corporate investors have invested over USD 200 million in Bangladesh’s FinTech, Logistics, and Mobility, among other industries.

Currently, there are more than 1,200 active startups and with an additional 200 joining the industry every year in the nation. These are encouraging signals for Bangladesh to take on a more robust role in the 4th Industrial Revolution, attract investment and move forward. For Bangladesh, investment is not only about moving forward, but also about saving an economic backslide. Given Bangladesh’s huge public investment for setting up facilities such as power plants, sea ports, roads and physical infrastructure fueled by foreign assistance, it needs to ensure a profitable return for the economy. And a post-colonial country without previously accumulated capital has a lucrative option of attracting investment from the rest of the world. The Government of Bangladesh has set up different government bodies to facilitate trade and investment. The success of these soft infrastructures will play a significant role in Bangladesh’s accent as an economy in the future.

Investment opportunities have unlimited avenues. For a developing country like Bangladesh, investment can be ensured in public projects, private sector businesses, rising and potential industries etc. Let’s begin with the public sector.

Private Investments in Public Projects

The Padma bridge has earned almost BDT 8 billion in a year, equivalent to almost 73 million USD. For a project costing USD 3.6 billion, at this rate, the payback period is close to 50 years without adjusting for inflation, whereas the bridge’s expected lifespan is a hundred years. That’s how public projects in Bangladesh have a significant earning potential and should be considered a good investment opportunity for the private investors as well, considering it’s a low-risk investment.

However, Bangladesh does not have a capital market stable enough for the government to raise micro-investment from. Even though the national savings papers have been very popular, the popularity comes at the expense of paying higher interest rates than most other savings instruments. Project-based bonds could be introduced, but the probability of it being successful is still questionable given the capital market’s instability and lack of trust.

In an effort to encourage the private sector’s involvement in public projects, the government of Bangladesh announced a 10-year tax freeze on Public Private Partnerships (PPP) in 2017. The government’s 8th Five Year Plan (FY 2021–2025) calls for an infrastructure investment objective of USD 14.51 billion and 8.0% annual growth, with PPPs to carry out 30% of the Annual Development Programme. The government has set an aim of introducing 5.6% finance through PPP by 2030 by attaining the Sustainable Development Goals as well.

A total of 79 projects with an estimated investment value of USD 29.23 billion are now being implemented in the PPP pipeline, according to Public-Private Partnership Authority (PPPA)’s Annual Report 2020–21. The following table summarises the PPP agreements –

In addition, under PPPA the bilateral G2G Framework Agreement or Memorandum of Understanding (MOU) has been signed by the GOB and the other relevant foreign government shall regulate the process for implementing projects under G2G in accordance with the G2G Partnership Policy.

Attracting Investments in the Private Sector – EPZ, EZ and BIDA

Designated Export Processing Zones (EPZs) for Export-oriented Industries

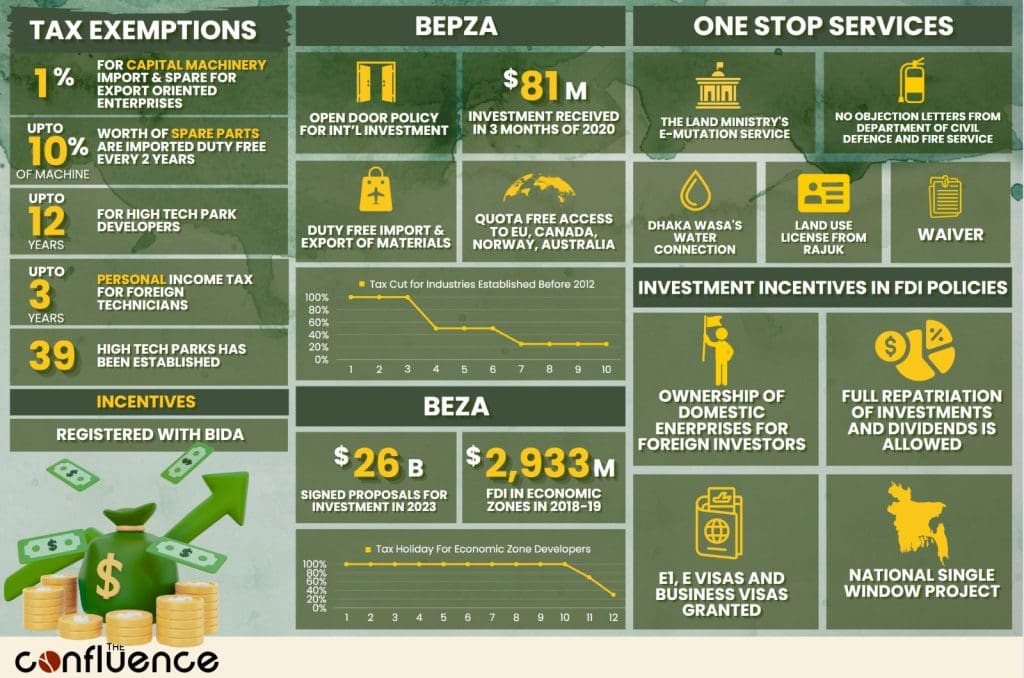

Bangladesh’s government has implemented an ‘Open Door Policy’ to entice foreign investment. The government’s official body responsible for encouraging, luring, and facilitating foreign investment in the Export Processing Zones (EPZs) is Bangladesh Export Process Zone Authority (BEPZA) under the Prime Minister’s Office. An EPZ’s main goal is to create designated regions with welcoming investment environments free of onerous regulations for prospective investors. The eight EPZs in the nation have received investments totaling USD 409.8 million during FY 22, the highest in a single year in EPZ’s history. While export earnings from the EPZs have hit a record USD 8 million, with 64,160 new jobs created in the last fiscal year. Three new EPZs are supposed to be set up in Patuakhali, Jashore and Gaibandha. The one under construction in Bangabandhu Industrial City, Chittagong has already received investment proposals of $215.66 million.

Incentives for Industries in the EPZs

- Tax Exemption: The industries established before 2012 will get 10 years of tax exemption and the ones established after 2012 will have 7 years of tax exemption up to different extents.

- Duty Free Import-Export: They also enjoy duty free import and export of construction materials, machineries, office equipment & spare parts, raw materials and finished goods will be the incentive for investment.

- Access to Low-tax Facilities in Destination Countries: Low taxation at the destination countries, like GSP facilities, quota free access to EU, Canada, Norway, Australia etc is available for the industries under BEPZA.

Specialized Economic Zones for Diversified Industrial Production

The government made the decision in 2015 to establish 100 economic zones (EZs) around the nation in an effort to attract in both domestic and foreign investment, speed up industrialization, generate one crore employment, and export an extra $40 billion worth of goods and services by 2030. The core differences between EPZs and EZs are that EPZs are owned publicly, whereas EZs could be funded and owned by private capital and EPZs focus on export whereas EZs focus on both the domestic market and export. The Bangladesh Economic Zones Authority (BEZA) is the regulatory body that seeks to create economic zones in the underdeveloped and backward areas of the nation. So far, 97 economic zones have been approved, of which 10 have been completed and 29 are under construction. The Economic Zones (EZs) have also started attracting foreign interest. The G2G Economic Zone named Japanese Economic Zone in Araihazar upazila of Narayanganj is the foremost. The Developing Eight (D8) Secretariat has proposed another one for its member countries. Saudi Arabia and Singapore are interested in setting up country-specific EZs for themselves in Bangladesh.

Even though most EZs are yet to begin operation, the existing ones since FY 2017-17 have attracted USD 1.6 billion in investment, with USD 80 million being foreign investment. Even though investment proposals of $26 billion have been signed in all these 97 economic zones. Construction of the EZs requires special attention and speeding up of the process of investment to utilise the EZs up to their potential.

Incentives for Industries in the EZs

- Tax Exemption: The tax break will begin at 100% for the first ten years on capital gains, dividends, royalties, and technical assistant fees, 70% for the eleventh year, and 30% for the twelfth year. Additionally, industrial units inside EZs are subject to varying tax holidays, with rates of 100% for the first, second, and third years, 80% for the fourth, 70% for the fifth, 60% for the sixth, 50% for the seventh, 40% for the eighth, 30% for the ninth, and 20% for the tenth. VAT is exempted and those industries

- VAT Exemption on Utilities: The industries will enjoy 80 percent exemption on value-added tax on electricity, water and gas consumption.

- Access to Local Market and Remittance Outflow: Export-oriented industries are allowed to sell 20 percent of their products in the burgeoning local market and foreign nationals working in the zones may remit 75 percent of their net salaries.

BIDA’s One Stop Service (OSS)

The Bangladesh Investment Development Authority (BIDA) has introduced One Stop Service (OSS), an online platform that unifies pertinent government institutions to offer services to both domestic and foreign investors. By acting as the sole point of contact and single window for investment-related services between the government and investors, the OSS seeks to enhance investment facilitation services in Bangladesh. Broadly the services available through BIDA’s OSS are-

- Availing Banking Services

- Obtaining No-Objection Certificate from Fire Service

- Completing BIDA Registration

- Applying for Electricity

- Obtaining Permits, Licences and Clearances from Regulatory Authorities such as City Corporation, City Development Authority etc.

- Registering a Company

- Environmental Clearances

- Applying for License Renewal, Regulatory Inspection and Compliance

- Applying for Chamber of Commerce Membership

- Applying for Water Supply from WASA and other Utilities

- Registering as Exporter at Export Promotion Bureau

- Obtaining the Ministry of Land’s e-Mutation Service

- Registration for Tax and Obtaining Taxpayer Identification Number (TIN)

- Obtaining Office Permission, Work Permit and Visa Recommendation

Incentives for Investors Registered with BIDA

Bangladesh Investment Development Authority (BIDA), previously called the Board of Investment (BOI), was created to handle issues pertaining to both domestic and international investments. New investments must first have BIDA approval. BIDA registered investments receive several incentives.

-

Tax Exemption on Capital Expenditure: For export-oriented enterprises, there is a 1% import tax exemption on capital machinery and spares. Additionally, spare parts may be imported duty-free for a maximum of 10% of the machinery’s worth every two years. In place of tax exemption on factory, machinery, and plant, newly founded industrial enterprises may be eligible for accelerated depreciation, which is 50% for the first year, 30% for the second year, and 20% for the third year. For machinery and plants, there is also an initial depreciation allowance.

-

Income Tax Exemption: Foreign technicians working in industries included in the Income Tax Ordinance of 1984 are subject to personal income tax for a maximum of three years. However, BIDA registered industries are eligible to be exempted from income tax for 50% earnings from export (unless paying tax at reduced rate).

-

Finance and Other Support: Special bonded warehouses,export retention quota (ERQ), Remittance of royalty, franchise, technical licence etc are given for export-focused readymade clothing enterprises. They are eligible to open back-to-back letter of credit (L/C), and receive loans up to 90% of the value against irrevocable or confirmed L/C sales contracts.

Repatriation of Capital and Outward Remittance Royalty

Bangladesh Bank requires reporting obligations and authorization for profit and capital repatriation. Publicly traded firms’ securities can be repatriated for a maximum amount not exceeding the share market value. Private limited firms and unlisted public limited corporations often require Bangladesh Bank approval. A market valuation is required to determine a company’s fair market worth.

Private sector industrial businesses in Bangladesh must obtain BIDA’s consent before remitting royalties, franchise fees, technical service fees, and payments to EPC contractors abroad. Remittances up to a certain amount (6% of income for royalties and technical fees, for example) may be repatriated without BIDA approval if contracts are pre-endorsed, but any payments beyond this require special clearance. Businesses must also perform an arm’s length examination of outgoing remittances to foreign group organizations and verify the pricing of transactions. Non-BIDA entities may apply to Bangladesh Bank for repatriation permissions.

Tax Exemption for Priority Sectors

Tax Exemption for Priority Sectors

-

- Corporate tax rate reduction of 12% for exported products and services, with a 10% tax rate for LEED certified factories

- No taxes on manufacturing of three- and four-wheelers for ten years

- 100% tax exemption on engineering and home products for the next ten years, with exemptions on domestic production and manufacturing supplies

- Exemption from income tax of 100% on ITES services with a 5% lower VAT rate

- Healthcare services receive a 100% tax exemption on hospital/vocational training revenue for ten years.

- A ten-year tax exemption, decreasing from 90% to 10%, will be granted to specific infrastructure projects that are built between July 1, 2019, and June 30, 2024 but it needs clearance from NBR and BIDA.

- Exemption from taxes for specific industrial projects (across several industries) founded between July 1, 2019, and June 30, 2024. Establishment in Dhaka, Mymensingh, and Chattogram: five years at a 90% to 20% reduction rate. Additional regions mentioned: ten years at a 90% to 10% reduction rate with permission.

Policies for Strengthening Industry and Investment

The National Industrial Policy 2022

The National Industrial Policy 2022 was announced on September 29, 2022. By 2027, the goal of the programme is to raise the industrial sector’s contribution from the current 35 percent to 40 percent. Additionally, it aims to develop diversified export-oriented sectors, foster an environment that supports cottage, micro, small, and medium-sized businesses, and draw in more international and domestic investment.

Bangladesh would no longer have privileged market access in 2026 when it graduates from LDC status, making the policy crucial. Consequently, we will have to transition from market-driven competitiveness to productivity-driven competitiveness. The post-graduation issues have been effectively addressed by the new policy, which also pledges support for collaboration with the corporate sector to address these issues. A five-year action plan has been incorporated in the industrial policy to guarantee efficient growth in the manufacturing and service sectors.

Investment Incentives in FDI Policies

Bangladesh prioritizes foreign investment through the Foreign Private Investment Act, which guarantees legal protection and free repatriation of earnings. Bilateral investment treaties also protect investments from other countries.

Some of the benefits enjoyed by foreign investors are-

- Foreign investors can own domestic enterprises and invest on the domestic stock exchange in Bangladesh

- Profit reinvestment and full repatriation of investments and dividends are allowed with applicable taxes

- Expats are granted multiple entry visas and business visas for business meetings

- International investors may be eligible for capital gains exemptions if a comparable exemption is granted in their native country

Double Tax Avoidance Agreement (DTAA)

The Agreement for the Elimination of Double Taxation with Respect to Income Taxes and the Prevention of Tax Evasion has been signed by Bangladesh. The purpose of this agreement is to combat tax evasion and double taxation while fostering investment and commerce between Bangladesh and its treaty partners. For example, the goal of the Double Tax Avoidance Agreement (DTAA) between Bangladesh and India is to stop income tax evasion and avoid double taxation. Bangladesh and 36 other nations have signed Double Taxation Avoidance Agreements (DTAAs) to shield taxpayers from double taxation and advance international economic cooperation. DTAAs offer tax reduction for various forms of income, benefiting non-resident Indians.

National Single Window (NSW) Project

Bangladesh has introduced National Single Window (NSW) to streamline customs processes for international commerce, led by the National Board of Revenue. It is part of the government’s effort to implement the WTO Trade Facilitation Agreement. The WTO Trade Facilitation Agreement (TFA) aims to speed up the movement, release, and clearance of goods, including products in transit. It includes procedures for efficient coordination of trade facilitation and customs compliance matters. The agreement has been ratified by two thirds of WTO members and has lowered pre-clearance signature requirements. The Bangladesh Customs automated operations in an effort to reduce red tape and expedite release times down from 72 hours in 1999 to 3 hours now.

Bilateral and Multilateral Trade Agreements

In 2022, Bangladesh had a preferential trade agreement with Bhutan. Maldives, Nepal, Pakistan, and Sri Lanka are currently involved in bilateral and multilateral Free Trade Agreements (FTAs). Pakistan, Malaysia, Thailand, China, India, Sri Lanka, Brazil, and Turkey are linked through the Bay of Bengal Initiative, BIMSTEC; Trade Preferential System of the Organisation of the Islamic Conference are signed as well.The following investment accords are in effect: the UK, the US, Indonesia, Denmark, India, Singapore, Austria, Uzbekistan, China; the Belgium-Luxembourg Economic Union; France; Germany; Iran; Italy; Japan; Malaysia; Philippines; Poland; Republic of Korea; Romania; Switzerland; Thailand; the Netherlands; Turkey.

Important duty exemptions are given to foreign investors through multilateral trade agreements like- Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka are members of the South Asian Free Trade Area (SAFTA). The nations that are members of the Asia-Pacific Trade Agreement (APTA) include Bangladesh, China, India, Korea, the Lao People’s Democratic Republic, and Sri Lanka.

Policies Protecting Foreign Investment

Bangladesh is a member of the Multilateral Investment Guarantee Agency (MIGA), a political risk insurance programme for investors. The World Bank’s MIGA investment guarantee agency protects foreign investors from losses brought on by non-commercial risks and promotes FDI. Investors are shielded by MIGA’s guarantee against the dangers of currency transfers, exploitation, conflict, and civil unrest. MIGA is limited to financial restructuring, privatisation, and de-risking new investments.

The US-based Overseas Private Investment Corporation (OPIC) provides insurance for US investments entering frontier countries such as Bangladesh. For international investors, OPIC offers the essential insurance against unanticipated catastrophic catastrophes like civil war, expropriation, and natural disasters. The International Centre Bangladesh for Settlement of Investment Disputes (ICSID), which arbitrates investment disputes between certain governments and citizens of other nations, is an institution that Bangladesh has ratified. The ICSID solves the disputes among government and foreign investors, encouraging the continuous flow of investment.

Conclusion

The recently completed projects like Karnaphuli Tunnel, Padma Bridge Metrorail will bring more investment to the table of Bangladesh. However, in 2021 the FDI investment grew up to 12.1 percent and Private investment is about over 70% of the total investment due to signed multiple treaties. Export industries have seen reaching the peak of USD 52 billion in 2022. With the motto of Smart Bangladesh, Bangladesh can be the next investment hub of South Asia within a few years. However, the measurements need strict negotiation and maintenance so that the ease of business doing index improves with time.

Cover photo © Abdul Awal | Dreamstime.com

About the Author

A R Tahseen Jahan is the Co-Founder and Head of Policy at The Confluence. An undergrad student of Development Studies at the University of Dhaka, she worked on topics of economic development and public policy analysis.