Shark Tank is coming to Bangladesh for the young entrepreneurs. Take a look at how the startup ecosystem of Bangladesh has fared since the last decade.

In the past decades, Bangladesh has witnessed a rapid growth in startups in sectors such as fintech, edutech, health, logistics and e-commerce. The country currently has more than 2,500 unique startups, with over 200 new startups being developed each year. The Bangladeshi startup eco-system has generated more than 1.5 million employment opportunities, which has enabled individuals to fight unemployment. This article looks into what policies, measures and initiatives undertaken by the Government of Bangladesh (GoB) are contributing to making the next generation of youth entrepreneurs in Bangladesh.

Startup Ecosystem Disablers

There are non-exhaustively FOUR major bottlenecks that disable the young entrepreneurs and their startups.

Access to Finance

Access to finance is one of the biggest hurdles to turning an idea into a million-dollar enterprise. A new startup can finance itself either through debt financing or equity financing. For debt financing, entrepreneurs can reach out to banks and microfinance institutions (MFI) to provide them with loans. However, banks hesitate to provide loans to young entrepreneurs as they perceive startups as highly risky. Also, businesses that have trade licenses of under 3 years cannot get loans from banks. As a result, startups and SMEs fail to access debt capital from banks.

The debt financed by the MFIs are extremely limited and inadequate for future growth and expansion of the startups. Moreover, high expense and risk of MSME debt, limited branch network and profits generated only from large and medium debts provide MFIs less incentive to finance startups. Since MFIs have relatively small portfolios as opposed to banks, MFIs have limited ability to reduce the risks and costs of defaulting on their loans. Regulations on MFIs that limit MSME loans to 50% of all outstanding loans, require 10% of member reserve funds as deposits, and require MFIs to maintain liquidity reserves of 15% of deposits further make it difficult to obtain MFI financing as a young entrepreneur.

When it comes to equity financing, most young entrepreneurs originating from low and middle income class backgrounds have to rely solely on angel investors, venture capitalists to finance their dreams. However, the number of angel investors have been comparatively lower in Bangladesh as opposed to its neighbors such as India, Vietnam and Indonesia.

The financing situation gets even worse for female entrepreneurs and entrepreneurs from minority communities. Women and minority communities experience inadequate access to debt and equity financing due to archaic institutional and cultural reasons. Entrepreneurs based in rural areas suffer hindrance in finance knowledge and awareness to access such fundraising facilities in the first place due to insufficient education and technical training. Therefore, providing access to finance in the form of both equity and debt financing is pivotal in building a startup ecosystem in Bangladesh and developing the youth entrepreneurs.

Bureaucratic Red Tape

Starting and operating a business in Bangladesh has long been filled with lengthy bureaucratic processes which hinder the ease of doing business for youth entrepreneurs of the country. The Global Entrepreneurship and Development Index 2020 positioned Bangladesh 132nd among 137 countries. Bangladesh ranked 168th according to the World Bank Ease of Doing Business Index 2020. The red tapes for obtaining business registration, license and operation have hindered the business climate of the country which made the country unattractive to set up businesses.

Skills Crisis

As the eighth most populous nation in the world, Bangladesh is home of a huge working age population – 65.5% of the country’s population are of young and working age. However, for long the country couldn’t tap into the full potential of this huge demographic dividend.

0

%

Youth Unemployment (LFS 2016-17)

The Labour Force Survey (LFS) 2016-17 of the Bangladesh Bureau of Statistics (BBS) showed that, while the national unemployment rate is 4.2%, youth unemployment is as high as 10.6%. The share of unemployed youth in total unemployment is 79.6%. More importantly, the unemployment rate among youth possessing tertiary level education is 13.4% (BBS, 2018).

This huge unemployment is not only caused by a lack of jobs in the market but also by an acute skill gap among the youth. Most education institutions including the universities fail to provide their graduates with industry-driven knowledge and skills that are very much in-demand in the job market. A lack of industry-academia collaboration has made so much teaching content of the tertiary education institutes outdated.

This skills gap, certainly, has an adverse impact on the entrepreneurship scene in Bangladesh as most of the young individuals do not have the necessary skills and knowledge to build an innovative product or service that would be the foundation of their startup.

Risk Averse Mindset & Absence of Entrepreneurial Culture

The social norms and cultural values of the Bangladeshi society are not nurturing and conducive to the young entrepreneurs. Entrepreneurs or individuals who start their own business are viewed as misfits and risky-takers – towards which the society shares a strong aversion. The societal norm and familial expectations, in the vast majority of instances, suggest that after graduation someone should look for a steady, stable income providing employment instead of starting their own venture as it exposes them to uncertainties and risks. This tendency of risk aversion and a lack of embraced entrepreneurial culture in the country discourages the talented youth to take up the challenge and start their own business.

Initiatives and Policy Measures by GoB

The Government of Bangladesh (GoB), has taken different measures and policies to address all such disablers, aiming to create an entrepreneurial environment in the country. Measures and Initiatives of the GoB is described below.

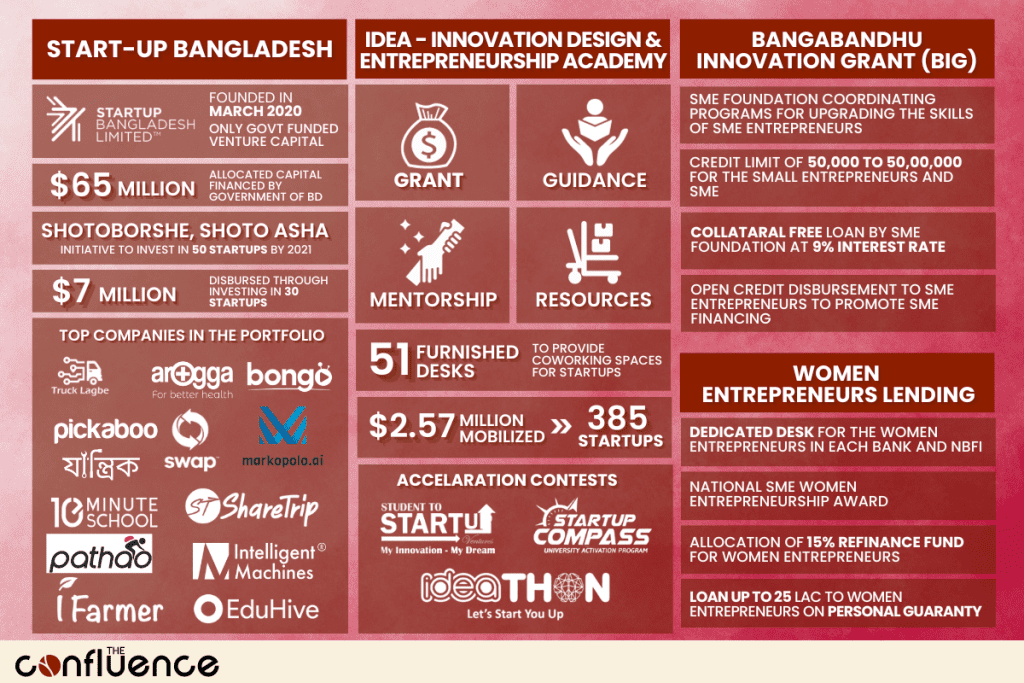

Startup Bangladesh Limited

To solve the financing issues of early startups, the ICT Ministry of GoB has established Startup Bangladesh Limited in March 2020 with an allocated capital of USD 65 million (BDT 500 crores). This is the first and only venture capital fund financed by GoB. The venture capital provides investment in the form of equity, convertible debt and/or grants in pre-seed, seed and growth stage startups. It invests through co-investments, as a fund-of-funds and asset manager and provides a wide range of in-kind support to startups and pertinent stakeholders.

Startup Bangladesh Ltd. launched an initiative called “Shotoborshe, Shoto Asha” to invest in 50 startups by 2021. The company has already made 30 investments across the country and disbursed more than USD 7 million to facilitate innovation and entrepreneurship in Bangladesh.

The company has a diverse pool of startups in its portfolio, including Truck Lagbe, Arogga, Bongo BD, Markopolo, Pickaboo, Swap, Share Trip, Zantrik, Shuttle, iFarmer, 10 Minute School, Pathao, Chaldal, EduHive, and Intelligent Machines.

Shark Tank is coming to Bangladesh which will be powered by Startup Bangladesh to facilitate innovation and entrepreneurship in the country.

iDEA – Innovation Design and Entrepreneurship Academy

To foster innovation and entrepreneurship among young entrepreneurs, the Innovation Design and Entrepreneurship Academy (iDEA) Project was launched by Bangladesh Computer Council (BCC) under the ICT Division of GoB. The iDEA project assists young entrepreneurs by providing grants, guidance, mentorship and pertinent resources to build a startup ecosystem in Bangladesh. The project provides idea stage and pre-seed grants to startups. Utilizing its network of expert mentors, the project offers guidance and mentorships to young entrepreneurs and their startups. The project also offers courses for young entrepreneurs across different industries. Also, iDEA project guides and supports startups to protect their legal and intellectual property rights. More importantly, the project provides coworking spaces for startups through 51 furnished desks.

So far the project has mobilized USD 2.57 million in grants to 385 startups through the Bangabandhu Innovation Grant (BIG) and other programs such as iDEAThon, Student 2 Startup, and Startup Compass.

A Letter of Intent (LOI) between the iDEA initiative and Microsoft was inked in order to encourage deep technology startups and advance indigenous ideas in Bangladesh. By granting access to the Microsoft for Startups Founders Hub initiative, Microsoft has promised to promote regional startups. By providing resources like free access to Microsoft technologies and platforms like Visual Studio, GitHub, M365, Power Platform, and Dynamics 365 to help company founders turn their ideas into reality, this borderless platform is designed to empower the aspirations of startup founders. To overcome obstacles and advance, Bangladeshi entrepreneurs who qualify will get access to professional advice, including individualized technical advisory sessions and round-the-clock technical support. Additionally, they will receive individualized mentoring through the Microsoft Mentor Network as well as events, learning paths, and content that have been specifically created to assist founders in moving on to the next phase of their business experience.

In 2019, the iDEA project launched Bangabandhu Innovation Grant (BIG) marking the birth centenary of Father of the Nation Bangabandhu Sheikh Mujibur Rahman. In order to build a startup ecosystem, the platform offers grant, mentorship, and networking opportunities for startups across various sectors. In BIG 2023, a total of BDT 6 crores were awarded to the most brilliant startups where the champion startup received BDT 1,00,00,000 as BIG Grant and the rest of the 50 startups were awarded with BDT 10,00,000 as a grant from the iDEA Project.

Bangladesh Hi-Tech Park Authority

The Bangladesh Hi-Tech Park Authority (BHTPA) was formed in 2010 which intends to develop a business and investment-friendly environment and accelerate employment opportunities by empowering high-tech industries. GoB has established 39 Hi-Tech Parks, Software Technology Parks, and IT Training and Incubation Centers across Bangladesh to facilitate innovation, entrepreneurship and business.

The hi-tech parks will provide free internet, electricity, free utilities and various benefits to the young entrepreneurs to run their startups. To bridge the skill gap, outreach training programs, workshops, seminars and mentoring sessions will be offered for the young entrepreneurs. Quarterly sessions with venture capitalists and accelerators/incubator networks will be arranged to assist startups to secure funding for seed and growth stage. So far, more than 100 startups have received one-year in-house incubation facilities from the BHTPA. The incubation centers like Sheikh Kamal IT Training and Incubation Center in Natore under the BHTPA will provide training and all the required facilities to help startups to grow and thrive.

In order to develop a startup ecosystem and entrepreneur supply chain in Bangladesh, BHTPA has undertaken the following initiatives-

BHTPA Startup Idea Pitching

Mostly, young entrepreneurs based in urban areas such as Dhaka and Chattogram get to access most funding, accelerator/incubator programs and other facilities provided by the government and private entities – leaving young entrepreneurs from peri-urban and rural areas behind. Thus, targeting MSME owners and young entrepreneurs from the regional level is instrumental in decentralizing growth.

BHTPA has introduced the “BHTPA Startup Idea Pitching” competition to develop an entrepreneurial culture in the country at the regional level. The first season of the competition has connected more than 2000 startups from 5 regions (Rajshahi, Jessore, Khulna, Chittagong and Sylhet) from which 143 startups have received free space and utilities in the parks located in their respective cities. BHTPA will also provide one-year long mentorship assistance, curated communications with the potential venture capitals to transform these startups into sustainable businesses. Additionally, to build a potential list of future entrepreneurs based on region and plan supporting programs years ahead, BHTPA is skilling, grooming and mentoring the rest of the participant startups from the competition.

Unibator (University based Incubator)

With the slogan “Turning University Reports into Real Life Venture” the Unibator program by BHTPA aims at utilizing the tertiary education sector of the country. Each year, final year university students submit a thesis or academic project to complete their graduation. However, these brilliant ideas remain confined in papers for years without ever utilizing them or turning them into reality. As a consequence, university students also remain very reluctant and dispassionate about their final submission in university, often plagiarizing the work or asking someone else to write it for them. The UNIBATOR program by BHTPA intends to bring a change in the thinking process of universities and students and foster innovation and entrepreneurship in the country.

Digital Center Entrepreneur – a2i

Under the Aspire to Innovate – a2i program, the GoB has established 8,280 digital centers across Bangladesh where around 15,000 entrepreneurs are offering more than 300 public and private services, including banking e-commerce and banking. Till 2021, these entrepreneurs have delivered 60.50 crore services from these digital centers. These entrepreneurs based on the digital centers are ensuring last-mile delivery of government services including birth and death registration, national identity card, passport, social safety net programmes registration and so on.

EkSheba, EkPay & EkShop

EkSheba is a government portal for all the digital center entrepreneurs of the country. The portal is a one-stop service provider platform where entrepreneurs can provide various services to their customers. An app called “Digital Center Uddokta (Entrepreneur)” has also been launched under EkSheba to facilitate entrepreneurs.

EkPay is the government’s largest bill payment processor service which provides services to entrepreneurs, established business owners and customers. a2i has taken the initiative to build a central E-payment system – a P2G (Public to Government) platform.

GoB has established an integrated E-commerce platform, “ekShop” to include SME entrepreneurs to the online marketplace.

BSCIC One Stop Service

Bangladesh Small and Cottage Industries Corporation (BSCIC) under the GoB has launched the One Stop Service online portal by enacting the One Stop Service Law, 2018 to attract both local and foreign investors. Bangladesh Investment Development Authority (BIDA), Bangladesh Economic Zones Authority (BEZA), Bangladesh Export Processing Zones Authority (BEPZA) and Bangladesh Hi-Tech Park Authority (BHTPA) were previously providing one stop services. By launching this initiative on 13 June 2021, BSCIC became the 5th government one stop service provider entity in the country.

Through this One Stop Service, BSCIC provides 29 of its own services and 13 other services from other agencies and organizations. The portal provides not only courses for entrepreneurs but also allows entrepreneurs to register and access various government services and information related to business and investment.

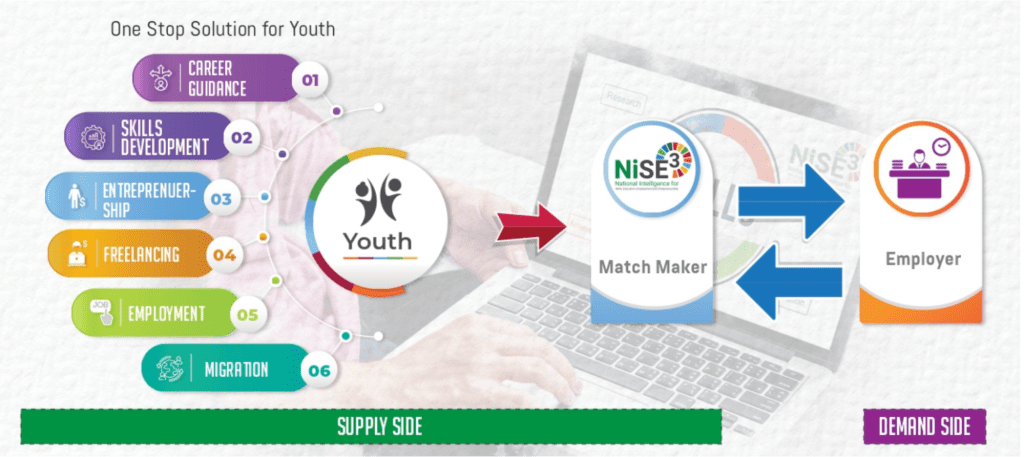

National Intelligence for Skills, Education, Employment and Entrepreneurship (NISE)

The a2i with support from UNDP Bangladesh has built a one-stop data platform, National Intelligence for Skills, Education, Employment and Entrepreneurship (NISE) which acts as a matchmaking platform to ensure balance between the supply side and demand for skills, education, employment and entrepreneurship.

32 government departments under 23 pertinent ministries and 13 thousand skills service providers are the major supply side actors. The NISE has inked partnerships with most of the existing job platforms including Bangladesh’s largest job portal BDjobs.

The NISE offers the following unique services-

Supply Side

- Through NISE, the nation’s public and private skills service providers can access real time data for job forecasting and analyze market driven occupations; establish linkage with industries, supervise course-by-course enrollment, accept online payments, organize and manage enrollment, and develop data driven policy and planning.

- The youth participants in different programs by skills service providers including entrepreneurs, job seekers, skills seekers, migrants, and apprentices are automatically included in a central youth database in NISE which enables them to access career counseling, job forecast, apprenticeship opportunities, business and migration advice and entrepreneurship guidance etc.

Demand Side

- NISE plays the role of an integrated job recruitment platform for job providers and recruiting agencies. The platform makes life easier for recruiters in several ways. It is easier to sort and recruit candidates through NISE as the platform allows to publish centralized job circulars to avoid duplication of job application, automatically filter out candidates based on skills requirements and offer interview and apprenticeship management features.

- The 4IR dashboard of the platform allows to effectively monitor and assess the advances made by various industries for 4IR initiatives. The dashboard provides data about the job opportunities in the evolving job market which facilitate effective decision-making.

NISE’s model and success has been recognized by various international actors. Somalia replicated NISE’s model and launched their own platform called “Shaqo Abuur” in which a2i provided advisory support. Jordan emulated NISE as “Digi Maharat” to support 2.8 million youths of their country.

Entrepreneurship & Skill Development Project (ESDP)

BIDA introduced an investment project named Entrepreneurship & Skill Development Project (ESDP) based on Job Creation instead of Job Seeking. ESDP aims to create skilled entrepreneurs for supplier and linkage development industries providing training to potential young people on the regulatory regime and business procedure to contribute to the Sustainable Development Goal 8 (decent work and economic growth) and to reach the target of private investment (34% of GDP). The project was implemented in 64 districts to train 24,000 youth entrepreneurs.

EDGE – Enhancing Digital Government and Economy

The Enhancing Digital Government and Economy – EDGE project by the Bangladesh Computer Council (BCC) under the ICT Division aims to facilitate integrated, cloud computing digital platforms for all government agencies. The EDGE project has 10 Research and Innovation Centers (RIC). The project has provided training to more than 150,000 individuals and created more than 100,000 new jobs.

Startup Friendly National Budget

The National Budget FY 2022-23 welcomed some provisions to bolster the startup ecosystem of the country. Following are the notable provisions that are quintessential for the Bangladeshi startups:

1. Ease of Reporting Compliance

Except for filing their income tax return, startups are exempted from the majority of reporting requirements.

2. Increase in the number of years to carry-forward losses

Startups are now permitted to carry-forward losses over a period of 9 years.

3. Ease on expenditure restrictions

Startups are now allowed to make business expenses as needed without a defined ceiling or area of expenditures.

4. Decrease in turnover tax rate

Startups are now allowed a turnover tax rate of 0.1%.

5. Introduction of “My e-commerce, My own business” project

Under this focused program, e-commerce entrepreneurs and small and medium-sized businesses can access the essential business skills.

6. Startup sandbox for new entrepreneurs

Startups incorporated in 2017 or beyond will benefit from the startup sandbox, providing they meet the requirements for eligibility.

GoB Sponsored Competitions & Accelerator/Incubator Programs

GoB has sponsored many competitions and accelerator/incubators programs such as Connecting Startups Bangladesh, ICT Expo, National Hackathon, Student to Startup, Connecting Startups Bangladesh, She Loves Tech, etc.

Bangladesh Bank

Bangladesh Bank has introduced a financing scheme worth BDT 1 billion to boost the entrepreneurship development project initiated by Dhaka Chamber of Commerce and Industry. Under the entrepreneurship development project, the DCCI has already started to develop 2,000 new entrepreneurs to bolster Bangladesh’s small and medium enterprises sector. The refinance fund will offer loans at a lower interest rate to the new entrepreneurs.

- According to the policy of SME & Special Programmes Department as regards financing women entrepreneurs Banks/FIs must maintain 10% of their total CMSME loan portfolio and the percentage will have to be raised at least 15% by the year 2024. This will include more women in the financial system which will ultimately expedite women’s economic empowerment.

- The size of Bangladesh Bank’s own source fund ‘Small Enterprise Refinance Scheme’ has been increased from Tk850 crore to Tk1500 crore to include more entrepreneurs especially women entrepreneurs from remote areas in the financial activities. The eligibility criteria of availing CMSME Refinance Facility by the state owned commercial Banks has been relaxed to expedite the process.

- To encourage women entrepreneurs for taking CMSME initiatives, Refinance Facility is being provided at a lower rate of interest. Bank & Financial Institutions can avail Refinance Facility at 3% interest rate(which was earlier 5%) from BB against their disbursed CMSME loan so that the customer can avail the same at 7% interest rate (which was earlier 9%).

- To tackle financial challenges due to the outbreak of COVID-19 pandemic Govt. announced stimulus packages of BDT Tk 20,000 crore for the CMSME sector in the country. Under this package, the banks will provide working capital support to the CMSME sector at 9% interest rate, of which the entrepreneurs will pay 4% and the rest 5% will be reimbursed by the government to the Banks & Financial Institutions as subsidy. Banks/FIs should disbursedat least 5% of their total allotted portion of thesaid package annually to the Women Entrepreneurs.

- BB also introduced Tk 10,000 crore Refinance Scheme (Revolving) to provide working capital facility for the CMSMEs within these stimulus packages. Banks & Financial Institutions can avail this refinance facility up to 50% of their disbursed amount against stimulus packages at 4% interest rate. Women Entrepreneurs can also avail these facilities.

- Minimum 15%of all refinance windows of SME & Special Programmes Departmenthas been allotted for the women entrepreneurs.For greater inclusion of marginal and home based women entrepreneurs loan limit has been set up to BDT 10,000/- and group based lending of up to BDT 50,000 is permitted.

- Regulatory provision for collateral free loan for women entrepreneurs against personal guarantee up to BDT 25 lac has been made. Banks & Financial Institutions have been advised to consider social security, personal guarantee & group guarantee, also advised not to put any pressure on or compel them for guarantee of specific person viz high officials, well-off relatives & husband.

- Bangladesh Bank Introduced Simplified Loan application Form in Bengali for CMSME Entrepreneurs including Women Entrepreneurs to reduce difficulties in meeting documentation requirements. Banks & Financial Institutions have been advised to give information to the CMSME entrepreneurs within 10 working days of receiving a complete loan application.

- Bangladesh Bank advised all Banks & Financial Institutions to provide 03-06 months grace period facility for the term loan (1yr-5yr) in Favor of Cottage, Micro & Small (CMSME) Entrepreneurs including women entrepreneurs based on Banker-Customer relationship.

- To extend credit facilities to new women entrepreneurs instruction has been given to all branches of Banks and Financial Institutions to find out at least three women interested in having enterprise or becoming women entrepreneurs ‘within the catchment area for imparting training in the field of their interest for capacity building and above all extend credit facilities to minimum one of those training receivers.

- To strengthen monitoring activities of women entrepreneur’s development initiatives Banks and Financial Institutions are advised to set up Women entrepreneurs’ Development Unit (WEDU) in all of their Head Offices including Regional Offices (if any).

- To ensure prompt services for Women Entrepreneurs Banks and Financial Institutions are advised to set up separate “Women Entrepreneur’s Dedicated Desk” in each branch of Banks and NBFIs. The desk is advised to provide support to prospective women about the preparation of loanable business proposals, marketing strategies etc.

- Recently Bangladesh Bank issued Lead Banks Guidelines (15 January 2020) & developed a Lead Bank Calendar to disseminate CMSME related information at the grassroots level through discussion, seminar & view exchange programmes (Virtual Meeting through Zoom App.) This Lead Bank will also work for the implementation of Govt. stimulus packages, BB Refinance Schemes & women entrepreneurs development activities.

- Instruction has been given to Banks and Financial Institutions for prioritizing women entrepreneurs in extending credit facilities and to take capacity building initiatives for their existing and prospective women clients.

- Bangladesh Bank has also made several remarkable initiatives to create entrepreneurs, especially women entrepreneurs. BB is working on a Credit Guarantee Scheme to create greater access to finance to SMEs, especially to women entrepreneurs, in different cluster areas.

- If any women entrepreneurs face problem or harassment in availing CMSME loan facility or interested to know CMSME related information, advice, consultation they can directly contact Problem Solutions Centre of SME & Special Programmes Department through +88029530220, submitting written application etc.

SME Foundation

SME Foundation arranges a skills training program to upgrade the skills of SME entrepreneurs as well as to generate new entrepreneurs. Using its own funds, the foundation has started a ‘credit wholesaling program’ as a pilot scheme. The foundation offers collateral free loans at 9% interest rate to SME entrepreneurs, specifically targeting technology based SME manufacturing industries and agro-based industries.

The National SME Entrepreneurship Award is given to the best performing and potential SMEs of the country. Since the award’s inception till 2022, 50 micro, small, medium and special entrepreneurs have received the National SME Entrepreneurship Award. It includes 29 women, 20 men and 1 third gender entrepreneur.

Other Efforts

The SCITI has trained roughly 40,000 people since the institute’s founding up until June 2013. The following six faculties make up the Institute’s training and research divisions: General Management, Research and Consultancy, Industrial Management, Financial Management, Marketing Management, and Entrepreneurship Development.

A seven-year tax exemption and a VAT rebate are also offered by the GoB to registered IT firms and online marketplaces, respectively.

The nascent startup ecosystem is being strengthened by important regulatory initiatives by the Bangladesh Securities and Market Commission (BSEC), including the Alternative Investment Funding Rule (AIFR) and small-cap stock market rules.

The Registrar of Joint Stock of Companies (RJSC) has created a digital commerce business ID in an effort to regain public confidence in e-commerce websites and to safeguard consumer interests.

Recommendations

After analyzing the current status of the startup ecosystem of Bangladesh and other countries who have been able to build an entrepreneurial nation, in my opinion, following are the policy measures and initiatives the Government of Bangladesh can undertake to facilitate youth entrepreneurship and youth-led innovation in the country-

- One-Stop Government Portal for Entrepreneurs

GoB can develop an online portal, including a mobile application where all the required government services to start a business including bureaucratic processes, paperworks, legal and regulatory compliance will be digitized, fast tracked and made available in one place so that entrepreneurs can easily register and conduct their business. This initiative will allow the country to improve in the global indexes such as Ease of Doing Business and Global Innovation Index as the online portal will significantly reduce bureaucratic red tape from the process.

- Formulation of National Startup Policy and Action Plan

A national startup policy should be developed by GoB to drive build a sustainable startup ecosystem in the country. Even though such policy is already in the cards, the formulation process has to be expedited and the policy has to be robust as well as comprehensive.

In the status quo, there are two disablers which halt the advances made by Bangladesh in developing youth entrepreneurship. First, despite contributing to the rapid growth of startups, the fragmented policies and strategies taken by various ministries and government agencies to approach entrepreneurs cause inconsistency. Policies such as National Youth Policy 2017, ICT Policy, SME Policy 2019, Gender Action Plan 2018-2021, etc. include measures and initiatives to improve the startup ecosystem. However, a comprehensive startup policy and action plan with the coordination of all the relevant ministries can be vital in helping the next gen of entrepreneurs.

The second disabler is the lack of formal national definition for startups which often led to difficulties in understanding new, innovative business models and facilitate them. Thus, a national startup policy and action plan will be a timely initiative.

- Teaching Entrepreneurship from School

If entrepreneurship can be taught from primary and secondary education stages, students will not only get hand on experience in starting their own business but also a drastic change in the risk averse mindset of the people can be facilitated which will help in developing entrepreneurial mindset in children. Perhaps, starting a lemonade shop for kids school project is a good start.

- Proper Monitoring, Supervision and Utilization

The various government measures should be thoroughly monitored and supervised to ensure the initiatives are meeting their key performance indicators (KPIs) and objectives. The existing government facilities such as hi-tech parks, special economic zones etc. should be properly utilized.

About the Author

Shah Adaan Uzzaman is the Blog Administrator at The Confluence. A former Bangladesh Television Debate Champion and winner of several policy & debate competitions, he is currently a student of IBA, University of Dhaka.

1 comment

[…] face challenges in accessing market information and understanding the regulatory environment [1]. This lack of knowledge can hinder their ability to identify viable business opportunities and […]