Biman was making a loss year after year until FY 2019-20. But the amount of profit has been increasing for Biman every year since then. Whereas Biman counted BDT -594.21 crore loss in FY 2011-12, it has generated a profit of BDT 439.78 crores in FY 2021-22, just 10 years later.

With the opening of a third terminal at HSI Airport, Dhaka, the Bangladeshi premier is seeking for a ‘roadmap’ to transform Bangladesh into an aviation hub. During the state visit of Emmanuel Macron, President of France, Bangladesh has finalized a deal for 10 Airbus A350s.

Biman's Profit/Loss in the Last Decade

BDT Crores (Source: Bangladesh Economic Review 2023)

No Data Found

However, Biman has a fleet of 21 aircrafts, among them are five De Havilland/Bombardier Dash-8, six Boeing 737 (average age 14.2 years), four Boeing 777-300 ER (average age 10.8 years) and comparatively newer six Boeing 787 Dreamliners (average age 4.4 years). No Airbus in the fleet currently. The last time Biman had an Airbus in its fleet was February 2018 when it returned the last A330-200 leased from Wamos Air.

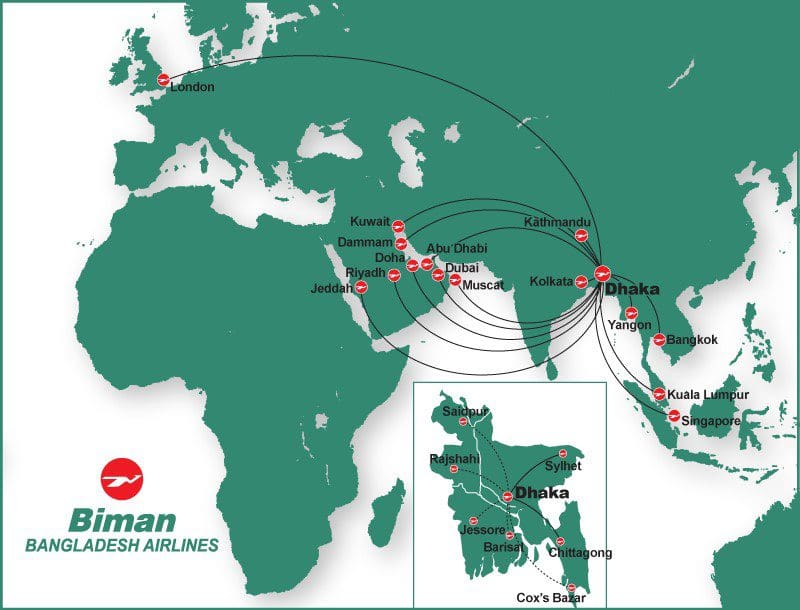

It came as a surprise when Biman decided to order a total of 10 Airbus A350s. Its current operations were going well with the existing fleet. The following is Biman’s route map before it added Dhaka-Toronto and Dhaka-Tokyo routes.

The five Dash 8 aircrafts have a comparatively lower range of around 2000 km. Therefore these are used for domestic flights mostly, including a few international flights to Kolkata, Kathmandu, Yangon etc. The oldest fleet of Boeing 737-800s is used for mid-range flights to Singapore, Kuala Lumpur, Bangkok and at times flights to the middle east, such as Sharjah. But most flights to the middle eastern cities such as Abu Dhabi, Dammam, Dubai, Doha, Muscat, Jeddah, Riyadh, Kuwait City etc. are operated by Biman’s Boeing 777-300ER and 787 Dreamliners. The latest Dreamliners are also used for flights to London, Toronto and Tokyo other than the middle east.

Biman’s Crucial Importance Increases

Biman’s important purpose to the people of Bangladesh so far was to make traveling to the middle eastern countries like Saudi Arabia, UAE, Kuwait, Oman and major asian countries like Malaysia, Singapore etc. easier for the remittance earners of the country, who play an important role in the country’s development. However, rapid globalization and Bangladesh’s increasing trade with the world along with its vision to diversify export of goods and services to non-conventional markets have altogether necessitated two other important roles for Biman to play.

two of Biman's crucial roles

Carrying passengers to North America

Students traveling from Bangladesh to the US has increased 48% in the last 6 years. Bangladesh used to be the country with the 25th highest number of international students in the US in 2016-17, now it’s 13th. Over the past decade, the number of Bangladeshi students in the United States has more than tripled, increasing from 3,314 during the 2011-2012 academic year to 10,597 during the 2021-2022 academic year. Not just the US, the increasing number of international students traveling to Canada and the UK has increased significantly over the past 5 years. Not just students, immigrants and travelers to these countries have also increased significantly. According to booking data, more than 152,000 passengers have traveled between New York (JFK) and Dhaka (DAC) in 2019.Therefore, Biman now has the necessity to expand its operations to the US, even the farthest parts of the US like California. If Bangladesh can afford to operate flights to North America more often, Bangladesh will be able to avoid giving away hard-earned dollars to foreign airlines.

Number of Students Traveling to the US from Bangladesh

Source: Opendoors

No Data Found

Carrying cargoes to land-locked countries

Bangladesh’s major export-oriented products like readymade garments, jutes, fish, leather etc. needs to look for non-conventional markets in order to diversify their export and grab larger global market shares. Currently, Bangladesh’s lion’s share of RMG exports go to the US (crossed $10b in 2022) and the EU. However, to leverage such trade, Bangladesh needs to have its own freighter planes that can potentially allow Bangladesh to decrease transportation costs. For example – recently Bangladesh is trying to increase exports to Uzbekistan by 5 times. However, Uzbekistan is a landlocked country, where cheaper shipping options may not be available.

Developments of Biman and HSI Airport Targeted at Expansion

Dhaka/Sylhet to London Direct Flights: Biman inaugurated Dhaka to London direct flights in 2010. It was an ambitious decision at that time, given Biman’s lack of modern aircrafts that existed back then. Biman used their leased Boeing 777 and 737 to make Dhaka-London direct flights a viable option. Later in 2020, Biman inaugurated direct flights from Sylhet to London as most people who travel to London are originally from Sylhet.

Acquisition of Boeing 787 Dreamliner: Biman has acquired its first Boeing 787-8 Dreamliner in 2018. Prior to 2014, Biman used to have mostly an older Boeing 737-800 fleet (and a few very old DC-10s) along with just one Boeing 777 delivered in 2011. Acquiring Boeing 787s was part of Biman’s modernization. Later, in 2019, Biman finalized a deal with Boeing for two latest 787-9 Dreamliners in 2019 which have already been delivered. The 787s enabled Biman to operate on longer routes.

Dhaka to Toronto Flights: Last year, Biman inaugurated its Dhaka to Toronto flight with a stop at Istanbul twice every week. The flights are being operated by Biman’s fleet of Boeing 787s. It takes around 20 hours to reach Toronto. The distance from Dhaka to Toronto is 12441 km, whereas the range of Biman’s 777 and 787 fleets could allow Biman to fly non-stop from Dhaka to Toronto. But from a profitability point of view, a stop at Istanbul/Heathrow is much more beneficial.

Dhaka to Tokyo Flights: On September 1, 2023, Biman inaugurated its Dhaka to Tokyo direct flight. Biman has flights to Tokyo available 3 days every week. On arrival at Tokyo, the maiden flight was received with a water cannon salute. Flights to Tokyo are also being operated by Biman’s latest 787 aircrafts.

Plans to Reopen US Routes: Given the huge market of Bangladesh to US routes, Biman is planning to expand its operations to the US routes, mainly Dhaka (DAC) to New York (JFK) and Dhaka (DAC) to Los Angeles (LAX). However, flights to the US will require Bangladesh to be listed as category 1 country by the US Federal Aviation Administration. Biman previously operated Dhaka-New York flights which were canceled in July 2006 due to different challenges. The US Federal Aviation Administration (FAA) downgraded Bangladesh to category 2 for not operating flights for four successive years. Bangladesh has recently applied to the US Federal Aviation Administration (FAA) for being considered in category 1.

On the other hand, the point-to-point market of DAC-JFK route has 205 passengers daily each way (PDEW). But there are peaks and slumps, the traffic is not distributed evenly over the year. Because student intake has a seasonal pattern. That makes the route challenging to be economically profitable.

Another significant challenge is Biman’s available resources. To operate a five-day-per-week schedule, Biman is required to occupy one and a half long-haul Boeing 787 at the John F. Kennedy Airport (JFK) whereas Biman only has 6 of them and it has other routes like Dhaka-Toronto, Dhaka-Tokyo and Dhaka-London which require the 787s.

However, Biman is also planning to reach the US west coast, i.e. Los Angeles through code sharing via Japan. Code sharing is a technique which will allow Biman to use a Japanese airline’s codename for the flight (circumventing the necessity of Bangladesh being upgraded to category 1 by the US FAA) and Japanese airlines to sell tickets for the flight. But the distance is still close to 13000 km from DAC to LAX, making it logistically challenging.

Terminal 3 of Hazrat Shahjalal International Airport: A terminal is an important part of traffic management. HSI Airport currently has one terminal (Terminal 1) for arrival and another (Terminal 2) for departure. Including domestic flights, the airport can board/un-board passengers of 8 aircrafts at a time. However, this is a major setback in terms of operating more flights. The establishment of terminal 3 with a higher capacity is supposed to allow more than 20 aircrafts to board/un-board at the same time. The establishment of a new terminal has already started attracting more international airlines to operate flights to and from Dhaka. The Civil Aviation Authority of Bangladesh (CAAB) has already granted permission to Egypt Air and Ethiopian Airlines to operate flights while British Airways and Garuda Indonesia are also known to have expressed interest. Ultra-low-cost carriers such as Wizz Air have already applied for approval, which is also under process. Other airlines such as Fly Baghdad, Tehran Air, Air Canada, Air France, Pakistan International Airlines, Royal Jordanian Airlines are also interested according to CAAB. Earlier in 2021, Korean Air, Iran Air, Iraqi Airways and two airlines from India expressed interest to operate flights.

The Competition

Since Dhaka is increasingly becoming important and the influx of passengers is increasing, it is attracting more competition in the aviation sector. To understand the magnitude of this increase, let’s have a look at the following graph. From 1973 to 2010, the number of air passengers from/to Bangladesh has always been below 2 million. After 2010, in just 10 years, it jumped to 6 million, which increased more than three times in a decade. The industry is supposed to carry 8 million passengers yearly in the coming years. But this comes with a significant threat of foreign airlines taking away Bangladesh’s foreign reserves as air fare if Biman is not upscaled to match increased demand.

Air Passengers (Bangladesh)

Source: World Bank

No Data Found

However, Biman has proven to be pretty price competitive in its long routes. Where one-way Dhaka-Toronto flights on global airlines like Qatar cost around 150K if you book early enough, Biman costs around 110-120K for the same flight. According to booking data, the UK’s busiest airport, Heathrow, achieved an average fare 31% higher per mile from Dhaka than New York, yet it is 37% shorter by distance. Therefore, Dhaka has a competitive advantage in many cases.

But the fruits of this advantage is being ripped by competing international airlines. For example – Biman has around 6 flights from Dhaka to Heathrow every week. Qatar Airways offers at least double the number of flights than that. On the other hand, most flights from Chennai to Heathrow are operated by Air India, not any international carrier based in the Middle East. Therefore, Biman has to be able to carry more passengers and leverage the expansion of Hazrat Shahjalal International Airport and the increasing number of passengers.

The Need for Procuring More Modern Aircrafts

The expansion of Biman’s operations requires more modern long-haul aircrafts like Boeing 787 or Airbus A350. Expansion to the US routes requires more airplanes for sure, even though a low-frequency operation, i.e. once a week can still be viable with the existing fleet. But that also poses the question of commercial profitability. On the other hand, Biman has no freighter planes to carry cargo. To enable exports to non-conventional export destinations and increase market share, Bangladesh will have to procure freighter planes too.

Biman's Airbus Deal : Airbus Offers to Train Manpower in Bangladesh

At the same time, we have to consider the necessity of capable manpower to maintain the expanded operations. Airbus has already signed an MoU with Bangabandhu Sheikh Mujibur Rahman Aviation and Aerospace University (BSMRAAU) to help BSMRAAU design their curriculum, materials and syllabus and agreed to conduct classroom courses during a time of the year by Airbus’s trainers in order to train pilots and engineers in their ab initio school in Lalmonirhat. Airbus also plans to cooperate in air traffic management and airport operations. This gives an advantage to Airbus’s offer.

Comparing the Options

Biman was offered 10 Boeing 787-10s by Boeing in May this year. But Bangladesh has ordered 10 Airbus A350 wide body aircrafts including two A350F freighters, which was announced by Emmanuel Macron during Macron’s state visit to Bangladesh earlier this week. Even though it is not clear whether Bangladesh has ordered A350-900 or A350-1000 because both qualify within the description given by Macron.

Boeing’s 787-8 variant is more in competition with Airbus A330neo and A350-900. Biman has already got a total of four 787-8 delivered. In terms of seating capacity, maximum take off weight (MTOW), range and cargo capacity – the 787-8 variant has proven to be of great use to Biman. And Biman Bangladesh Airlines have chosen a side in the rivalry.

The Boeing 787-9 variant can be compared to Airbus’s A350-900. Biman has procured 2 Boeing 787-9 as of now. In comparison, the 787-9 has a lower capacity of 280 passengers compared to A350-900’s 315 and a lower MTOW of 252,651 kgs compared to A350-900’s 280,000 kgs. However, Biman seems to have traded off passenger capacity for longer range. Boeing 787-9 can fly 15,394 km compared to A350-900’s 14,350km. A difference of around 1000 km.

As per Boeing’s offer of 787-10s, Airbus has its counterpart in A350-1000 variant. Boeing’s 777X is the direct competitor of Airbus’s A350-1000 variant. But the 777X is yet to enter the market. So Boeing is set to compete with 787-10s against Airbus’s A350-1000 for now.

The Airbus A350-1000 provides higher seating capacity, 40 more passengers than the 787-10’s 440 passengers due to A350-1000’s wider and longer fuselage. In terms of fuel capacity, the A350-1000 has a much higher capacity of carrying 158,791 liters of fuel compared to 787-10’s 126,372 liters. That allows Airbus to have a much longer range of 15600 km compared to 787-10’s 11910 km. The A350-1000 beats 787-9’s range comfortably. The A350-1000 provides a higher thrust of 97000 lbf compared to 787-10’s 76000 lbf, which allows Airbus to take off from 200 meter shorter runways. But Boeing’s 787-10 has a cargo capacity of almost the same as A350-1000, which means Boeing allows each passenger to have more luggage than Airbus. At the same time, Boeing’s 787 burns 2.31 liters of fuel per 100 km for each passenger at full capacity, where Airbus burns roughly more than that, 2.39 liters.

Airbus has another option, the A350-900 ULR variant which is an upgrade from A350-900 with the same seating capacity as Boeing 787-10. However, the ULR is an ultra long range aircraft with 18000 km range, which is a mammoth range for Biman.

In terms of freighters, Airbus has the A350F which is comparable to Boeing’s flagship 777-8F. Whereas Boeing’s 777-8F has a slightly higher capacity of holding 31 pallets in the main deck and 13 in the lower deck, Airbus’s A350F has 30 pallets and 12 respectively. But Airbus’s cargo door is a much larger 4.19*3.17 sq. meter compared to Boeing’s 3.27*3.15 sq. meter. Again, Airbus provides a higher range of 8700 km compared to Boeing’s 8167 km. However, Airbus plans to roll out their plane in 2025, whereas Boeing’s plane can enter service two years later in 2027.

As for the proposed 777-8F, while the current estimates suggest that it could offer six percent more volume and seven tonnes more payload than the A350F, this would come with a hefty burden of at least 32 additional metric tonnes (32,000kgs) of take-off weight (Airbus’ initial estimate) – which increases fuel burn, CO2 emissions and airport charges.

If this is true, Airbus has a fuel-efficient option against Boeing. On the other hand, Boeing’s 777-8F has a conventional aluminum fuselage but Airbus provides composite material for a much lighter aircraft to increase its range.

Which one fits us?

If the Airbus deal is for an A350-1000 variant, that fits Bangladesh’s ambition. To operate flights from Dhaka to the US routes, we need an aircraft with considerably higher range than the ones we have now. And the A350-1000 is a much better option in that regard. In the international market, Etihad(71), Qatar (60) and Saudia (52) have predominantly opted for a Boeing 787-10 whereas Singapore (65), Lufthansa(50) and Emirates (50) have opted for A350s. Singapore needs more long-haul flights than anyone else. Our closest counterpart Air India has acquired both 787s and A350s.

As for freighters, Airbus allows taking in larger size cargo due to its larger door and has a longer range as well as earlier launching year. Without any freighter in service right now, Bangladesh can lease a freighter until the ordered two enter service. But for delivery two years earlier, higher range, possible fuel efficiency, possible lower airport charges and larger size cargo Bangladesh has sacrificed a higher cargo carrying capacity (probably). Since the freighters are yet to come to the markets and all orders are pre-orders, we cannot perfectly compare the two. However, Bangladesh seems to be in a hurry to get their aircraft delivered two years earlier and avoid any necessity to lease a freighter for more cost than would be incurred with a freighter owned by Biman.

Lastly, Airbus’s offer to train our manpower is a huge win for Bangladesh. Technological knowledge transfer is priceless for a country like Bangladesh with little expertise in this area.

One Last Concern

The one last concern that still remains is – airlines are not profitable until all seats are filled up for a flight. Every empty seat is a concern for an airline. If Biman plans on expansion of its operations, it has to be price-competitive and needs to provide world class service at the same time, in order to be profitable. Airbus A350s have huge seating capacity. Going for A350s instead of A320s is a huge step. But they must be filled with passengers if Biman wants to count profit.

Estimates are taken from simpleflying.com

About the Author

Najib Hayder is the Blog Manager at The Confluence. Formerly he has served as the Head of Policy Dialogue at Youth Policy Forum. A former debater, business graduate by chance and policy-enthusiast by choice.

5 comments

[…] 2021 and 2022, Biman Bangladesh Airlines claimed profits of around $41 million and $54 million respectively, by accruing unpaid liabilities rather than recognizing expenses when […]

[…] 2021 and 2022, Biman Bangladesh Airlines claimed profits of around $41 million and $54 million respectively, by accruing unpaid liabilities rather than recognizing expenses when […]

[…] 2021 and 2022, Biman Bangladesh Airlines claimed profits of around $41 million and $54 million respectively, by accruing unpaid liabilities rather than recognizing expenses when […]

[…] of Imposing Age Limit for… Karnaphuli Tunnel : The Case for Bangladesh’s First… Bangladesh’s Airbus Deal : Potentials and Promises Menstrual Hygiene Management: Destigmatization for Development Why Bangladesh’s Delta […]

[…] of Imposing Age Limit for… Karnaphuli Tunnel : The Case for Bangladesh’s First… Bangladesh’s Airbus Deal : Potentials and Promises Why Bangladesh’s Delta Plan 2100 Matters Exploring The Dhaka-Cox’s Bazar Railway […]