The Houthis of Yemen are attacking seagoing vessels and blocking the Red Sea route in response to the ongoing Israeli invasion and ethnic cleansing in Gaza. How does that create a grave concern for Bangladesh?

On January 29, 2024, Bangladesh’s Department of Shipping instructed oceangoing Bangladeshi vessels to take safety precautions by avoiding the Red Sea. This is due to the ongoing Red Sea Crisis, which began on October 19, 2023, as Iran-backed Houthi rebels from Yemen launched a series of missile and armed drone attacks, initially targeting Israeli ships. So what does the Red Sea Crisis mean to Bangladesh? What are the economic costs the country is incurring due to this ongoing crisis in the Red Sea?

Who are the Houthi Rebels?

From 1990 to 2012, Ali Abdullah Saleh ruled as the President of Yemen and became an authoritarian ruler. In the 1990s, observing massive corruption and irregularities in Yemen under Saleh’s authoritarian regime, the Shia Muslim minority group of Yemen, the Zaidis, formed an armed political and religious group, which was formerly known as the Ansar Allah (Parsians of God).

Houthis are being used and controlled by Iran to serve Iran’s interests in the region. Since Russia is an ally of Iran, the Houthis, directly or indirectly, have become instrumental in furthering Russian interest in the region. Even though Houthis are attacking ships from different countries, as many reports show, they haven’t attacked any Russian vessel crossing the Red Sea. In Yemen, the present government is supported by the United States, Saudi Arabia, and their western allies. And on the other hand, the de facto government run by the Houthi rebels in their controlled regions is backed by Iran and Russia.

Inside the Red Sea Crisis

Until November 2023, the Houthis’ attacks were only confined to Israel, as they only targeted ships that were either headed towards Israel or had some ties with Israel, in terms of ownership. However, the Houthis altered their strategy and started to attack vessels from other countries so that they could coerce other countries to exert pressure on Israel to put an end to the humanitarian crisis caused by Israel in the Gaza Strip.

From November 18, 2023, to the first part of January, at least 25 merchant vessels transiting the Southern Red Sea and Gulf of Aden were attacked by the rebels. In response to the continuous attacks by the Houthis, on January 12, 2024, the United States and Britain, with support of Canada, Australia, Bahrain, and the Netherlands, launched a military strike against the rebels.

Geopolitics of the Red Sea: What Does the Red Sea Mean to Global Trade?

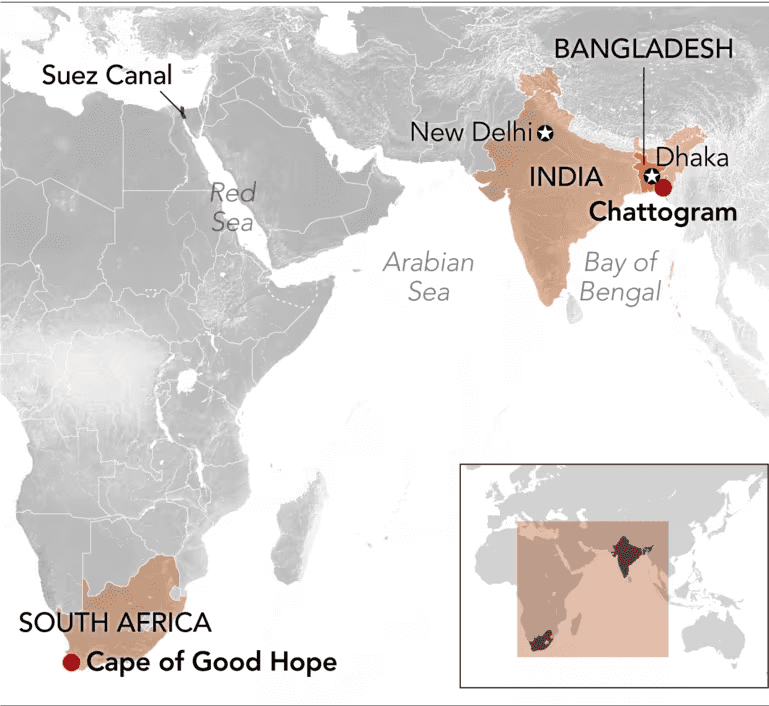

So why is this conflict in one part of the world so critical for global trade and commerce? In 2015, the Houthis seized large parts of Western Yemen. At present, this rebel group controls the capital of Yemen, Sanaa, and the north-west of Yemen, including the Red Sea coastline. Such territorial control of the Houthis has provided strategic positioning for the rebel group to thwart the world economy. There are two critical choke points for world trade in the Red Sea. One is the Suez Canal, and another is the Bab-el-Mandeb Strait. The strait is only 26 kilometers, or 16 miles, narrow at its narrowest part. Due to the control of the Houthis on the Red Sea coastline, they can easily block access to the Red Sea, especially at the Bab-el-Mandeb Strait, and disrupt the huge maritime traffic at the Red Sea.

0

km

Length of Red Sea Waterway

But why is the Red Sea so important for the world economy? For one very simple reason. The Red Sea is the shortest route that links Europe and Asia by connecting the Mediterranean Sea with the Indian Ocean. This 2,250 kms long massive water highway decreases both shipping time and cost for the oceangoing vessels containing billions of dollars worth of goods.

0

Tn

Worth of products carried annually through Red Sea

Daily carriage through Red Sea

12%

of world’s trade volume

30%

of world’s containers

7%-10%

of world’s crude oil

8%

of world’s Liquefied Natural Gas (LNG)

Each year, nearly USD 1 trillion worth of products traverse through the Red Sea. The Red Sea accounts for almost 12% of global trade volume each day. Around 30% of the world’s containers, 7-10% of the crude oil, and 8% of the liquefied natural gas (LNG) are shipped through the Red Sea.

0

km

Additional distance to be traveled to avoid Red Sea

However, if the Suez Canal, Mandeb Strait, or any part of the Red Sea gets blocked, the vessels have to travel all the way down to the Cape of Good Hope in South Africa, go around the entire African continent, and then reach Europe. Following this route, the ships have to travel an additional 8,900 kilometers, which will add an extra 2 weeks to their shipping time. Thus, the Red Sea saves both shipping time, and costs, including fuel and insurance expenses.

Logistical Nightmare in 2021

The last time the Suez Canal route was blocked was in March 2021. For 6 days, a container ship named Ever Given blocked the route, which caused massive supply chain disruptions worldwide. Each day, over USD 9 billion worth of goods couldn’t be delivered through this route, which is tantamount to USD 400 million worth of trade per hour. And in only 6 days, the global economy lost around USD 54 billion worth of trade. Thus, any small disruption to this shipping route can cost the world billions of dollars.

Impacts of the Red Sea Crisis on Bangladesh’s Trade

Bangladesh is reliant on both of its imports and exports to keep its economy running. The country has 99 oceangoing vessels, mostly bulk carriers and oil tankers, which include 8 container vessels. Many of the country’s bulk carriers and oil tankers use the Red Sea route to travel from Asia to Europe. Nearly 61% of Bangladesh’s exports and 8% of imports pass through the Red Sea to Europe and America.

Bangladesh’s Usage of Red Sea Route

0

%

of exports

0

%

of imports

Increased Travel Time and Trade Costs

Due to the ongoing crisis in the Red Sea, Bangladeshi vessels have only two options. Either they have to change the travel route and go through the Cape of Good Hope, or they can send the goods through air freight. Both of these options add extra costs for Bangladeshi exporters. Traveling the extra distance will add 22 more days to the round trip. The alternative route adds an extra 3,000 kilometers and 11 days to the maritime journey.

Additional costs for bangladeshi exporters

3,000 km

additional route to be travelled through Cape of Good Hope

22 days

additional time needed for a round-trip

0

%

Increase in insurance cost

In addition, the vessels have to bear extra fuel costs due to the long alternative trade route. Also, global marine insurers have increased the war risk premium in the Red Sea by at least 250%, making the use of Red Sea more costly.

More importantly, more than 65% of Bangladesh’s multibillion-dollar garment exports are destined for Europe. And Bangladesh’s main competitive advantage is its ability to provide low cost garments products. But surging freight rates and longer lead times lead to a container shortage as well, because the containers are now occupied for longer time than they used to be.

Existing Bottlenecks

The cost of shipping containers from Bangladesh to Europe and America has already increased by 40% to 50%, according to shipping companies. However, those costs will shortly increase by an additional 20% to 25%.

0

Days

Lost in transferring from feeder to mother vessel

In terms of negotiation with the western buyers, Bangladesh already has a disadvantage that shipping products from Bangladesh takes longer time due to the fact that the country’s main Chattogram port is not deep enough for larger ships to dock. Therefore, we have to ship our products with smaller feeder vessels to larger mother vessels at Colombo, Singapore or other ports, increasing the time for shipping by around 15 days. The Matarbari Deep Sea Port in Bangladesh is yet to be fully operational. At least for now, we do not have a viable alternative to cut down lead time.

Due to a lack of backwards linkage industries in Bangladesh, the country has to import inputs such as yarns from other countries like China and Egypt which also requires the same process and takes at least 10 more days before the factories can even begin working on their existing orders.

Therefore, we are already on the backfoot and the buyers provide us one of the cheapest rates due to the higher time difference we incur between receiving orders and delivering products. Hence, even the slightest disruption in the supply chain has a major effect on our industry.

Lack of Viable Alternatives

Many of the major clothing manufacturers are currently losing money or losing orders. Early in the new year, some manufacturers were asked by their European buyers to ship their items via air freight in order to fulfill the traditionally largest demand for garments from the West. But air freight is 10-12 times more costlier than shipping.

The fact that Bangladesh does not have its own freighters aggravates this issue. The Airbus freighters Bangladesh ordered will take at least 3-4 years to be delivered.

Conclusion

At this point in time, Bangladesh does not have a preferable alternative due to its geographical location and existing bottleneck. And as a result the country is losing business. Diplomatic settlements with different stakeholders can be a way to go about it, given that Bangladesh is in no way complicit, rather actively advocating against the Israeli invasion in Gaza. But that is up to the policymakers to decide. All we know right now is that the country’s economy is in turmoil and we can not afford to lose the buyers and the policymakers have an urgent task to take care of.

Cover photo taken from CNN.

About the Author

Shah Adaan Uzzaman is the Blog Administrator at The Confluence. A former Bangladesh Television Debate Champion and winner of several policy & debate competitions, he is currently a student of IBA, University of Dhaka

1 comment

[…] red sea shipping lanes which has sparked another fear that the global supply chain will break off. The Red Sea, which sees 80% of global trade pass through the narrow corridor, has become the battleground between the US and its allies and Iran and its […]