The term ‘de-dollarization’ has been coined to denote the decreasing influence of US dollars in international trade. With Saudi Arabia being open to trade oil in currencies other than the USD and BRICS discussing the possibility of a new BRICS currency, where does Bangladesh stand in this case and what is the future of USD?

One of the mistakes which some political analysts make is to think their enemies should be our enemies

A similar tone to Mandela has been noticed in the French President Emmanuel Macron’s interview to the Politico recently, where he said “[Europe] gets caught up in crises that are not ours, which prevents it from building its strategic autonomy.” while also criticising “extraterritoriality of the U.S. dollar,” adding “If the tensions between the two superpowers heat up … we won’t have the time nor the resources to finance our strategic autonomy and we will become vassals.” How is the world hurting financially and what are the responses? Is the dependence on USD causing the world to suffer?

The US Handling of the Crisis

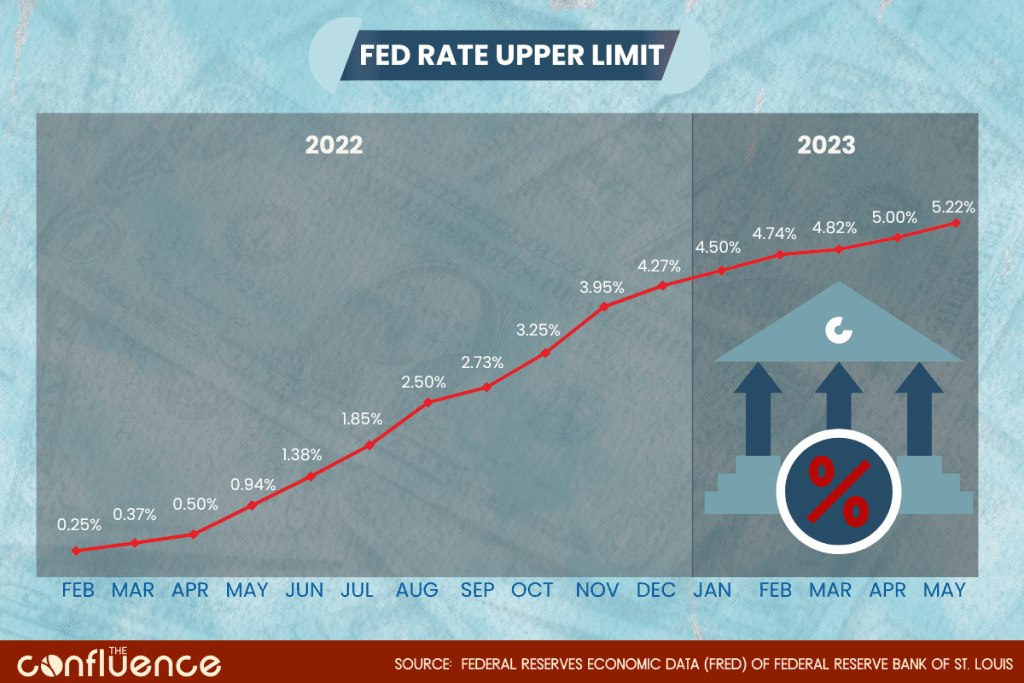

During the pandemic, the US government disbursed a hefty amount of stimulus packages of around USD 5 trillion including the US Rescue Plan Act, 2021 of USD 1.9 trillion which gave rise to demand in the US, while the supply system was still broken – driving inflation to a 40-year high in the US. In order to curb inflation, the US Fed decided to hike the Federal Fund Rate (Fed Rate) continuously and the Fed Funds Target Range is 5% latest in March, 2023 from nearly 0% in 2022 after a series of hikes of which the latest came in late March, 2023, hiking the rate by 25 basis points.

Even though the decision of providing hefty stimulus package without fixing supply side was taken by the US government and not the world, the subsequent hike in Fed Rate did affect the entire world, mostly the emerging economies like Bangladesh and the poor of the world was hurt disproportionately due to the surge in food prices around the world, thanks to Russia’s invasion of Ukraine and subsequent disruption of supply from the world’s ‘food basket’.

Impact on Global Economy

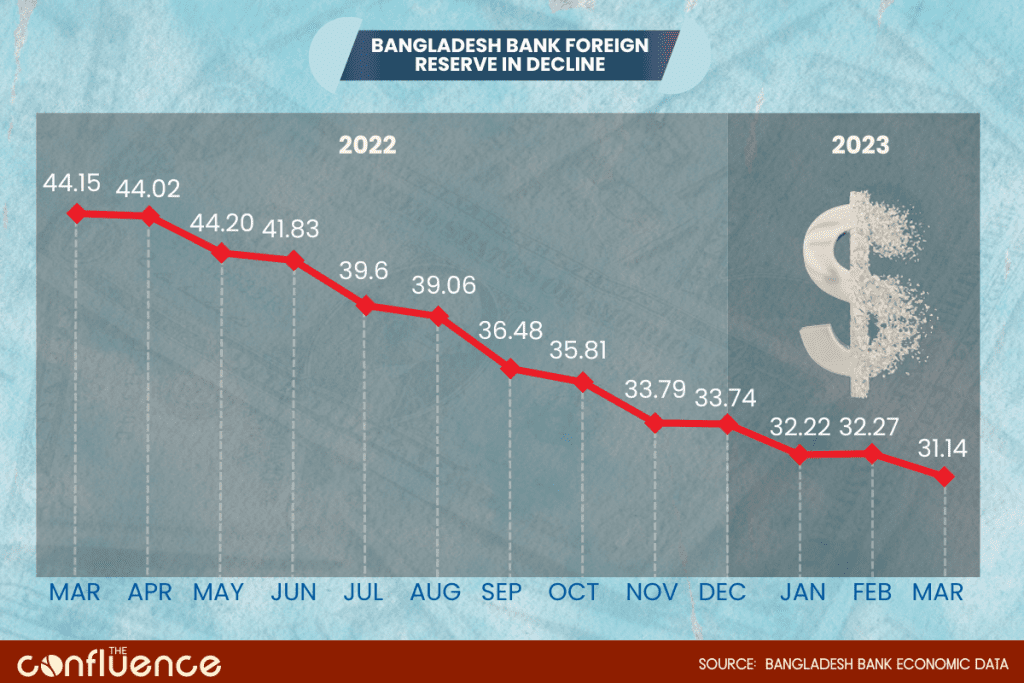

Bangladesh’s currency, Taka (BDT) has devalued against the USD from BDT 86.00 per USD in March 2022 to around BDT 107.00 per USD in March 2023, a decrease in 24.41% of BDT’s value against the USD as a result of USD’s strengthening and subsequently eroding the country’s foreign exchange reserves and giving rise to inflation. This isn’t an issue with Bangladesh only. Many major currencies around the world has also been devalued against the USD. At $1.137 at the start of the year, the EUR/USD exchange rate breached parity for the first time in 20 years in July, a 20-year low. On 27 September, it dropped to $0.960 YTD. Inflation in Europe reached as high as 8.6% in January 2023. Emerging and developing economies are being hurt and their low-income households are hurting disproportionately. January inflation in Turkey was 48.7%. In Brazil, Russia, and Mexico, consumers are seeing outgoings climb fast owing to increasing global energy costs. Last year, inflation was 10%, 8.4%, and 7.4% respectively in the countries mentioned above. Most South Asian countries are also following this upward trend in inflation according to April 2023 World Economic Outlook of the IMF.

A shift away from the USD – A respite for many

I wouldn’t term it as ‘de-dollarization’ like many in the discourse. Because after the fall of the Bretton Woods system, USD has been a major component of world trade and played its part in maintaining stability in world economy. However, trade liberalization around the world and the ever-increasing globalization has made trades complex in nature. The USD is issued by the US Fed and therefore, the primary target of the Fed is to bring stability within the US economy and managing inflation within the country. They are not supposed to sacrifice their prime objective in order to stabilize trading around the world.

On the other hand, Federal Reserve’s decision to hike interest rates in 1997 and 1998, in response to concerns about inflation and the potential for overheating in the US economy, without a shadow of a doubt, exacerbated the 1997 Asian Financial Crisis that required IMF to provide $36 billion to support reform programs in the three worst-hit countries—Indonesia, Korea, and Thailand. Later a second hike was initiated in June 2004. What followed in subsequent years is known as the Great Financial Recession.

However, if the USD has to be strengthened and this means the world gets unfairly penalized, there is no harm for other countries in seeking respite through fair means. While at the same time the battles of the US should not be considered a battle for all, even if it hurts. Currently there are two predominant routes of seeking respite from a soaring USD.

The Reserve Diversification Route

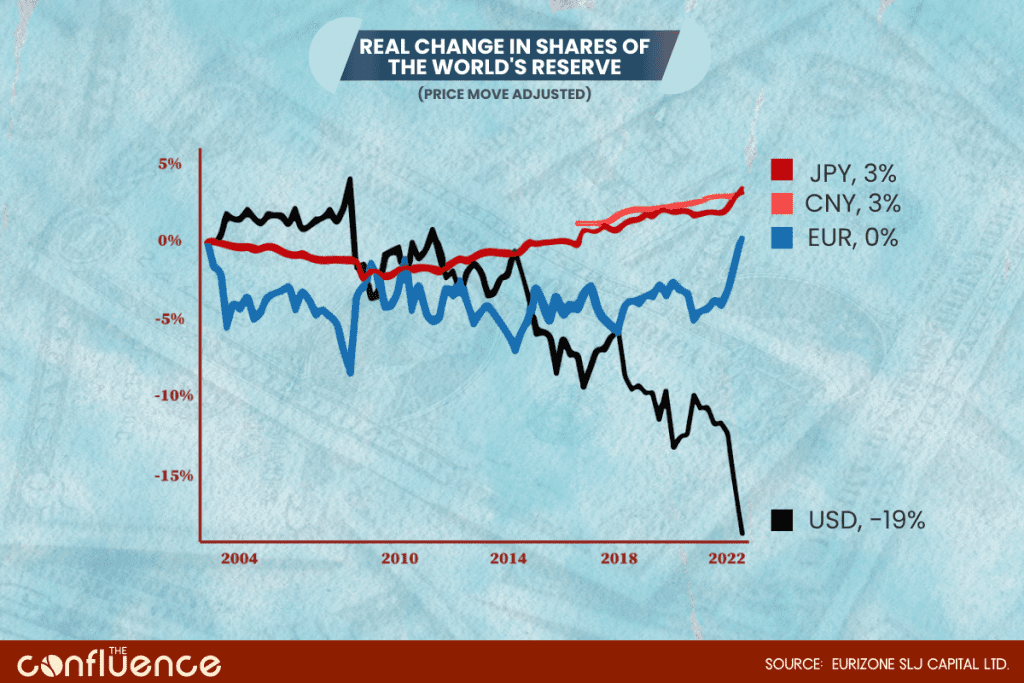

The world is looking to diversify their foreign exchange reserve so that they can manage to pay other countries with a suitable currency other than the USD. In 2001 the USD would account for 73% of the total foreign currency reserves of the world according to IMF’s Currency Composition of Official Foreign Exchange Reserve (COFER) which has come down to 54.09% in Q4 of 2022.

This change in real terms is shown below in the graph produced by Eurizone SLJ Capital Ltd. As visible in the graph, after 2021, the USD is rapidly losing share in the worlds’ COFER whereas Euro, Chinese RMB and Japanese Yen are growing their shares. The Finance Ministers of ASEAN as well as their central banks in a meeting in March 2023, discussed about their dependence on USD and a possible diversification opportunity. On the other hand, in January, China had $1.1 trillion in Treasures, down from $1.3 trillion. From $185 billion in February 2020 to $119 billion in January 2022, Saudi Arabia’s ownership of US treasuries also declined.

The Currency Swap Route

If two countries are trading with each other, they can always choose to pay each other with their own currency but the currency received can only be used to buy products from the other party in the trade. The country with a trade deficit gets fully paid for exports but can’t pay in full for their imports – they take care of the deficit in a third currency, preferably USD, thus decreasing pressure on USD for the entire amount of trade. The US had such swap agreements with countries like the UK, Canada, Japan, Switzerland and the European Central Bank.

But now more and more countries are interested in currency swap deals. Saudi Arabia has shown interest in currency swap deal with China for oil while Saudi is open to discussing selling oil in currencies other than the USD. UAE and India are discussing a possibility of settling non-oil trades in Rupee. India has also signed currency swap deal with Malaysia to be able to trade in Rupees with Malaysia. India is even discussing with Russia to settle trade in national currency. Brazil and Argentina have signed currency swap deals with China worth $30bn and $5bn.

Russia off the Grid

But the fact that to penalize Russia for their invasion of Ukraine, they have been cut off SWIFT and half of their $640 billion reserve has been frozen. Therefore, nobody can effectively trade with Russia using the USD anymore, fearing a secondary sanction. Bank of America analysts led by Michael Hartnett coins it as ‘weaponizing’ the USD. As a result, countries that have trades with Russia are resorting to currencies other than USD. For example, India had their purchase of Russian weapons held off. Bloomberg said that India won’t pay Russia in rouble or US dollars due to concerns about secondary sanctions and the fair price of Russia’s currency on global markets. On the other hand, Indian refiners are paying Russia in Dirham. Using other currencies to circumvent US sanctions is not a new phenomenon for India as they considered accepting Rupee for settlement of export receipts to Iran in 2012 when Iran faced US sanctions. Even now India is considering settling payments for oil imports from Iran with local currency.

On the other hand, deputy chairman of Russia’s State Duma stated in New Delhi in March that Russia is spearheading the development of a new currency for trade between the BRICS countries – namely Brazil, Russia, India, China and South Africa.According to China’s state controlled media, China Daily, Malaysia’s Anwar Ibrahim called for an Asian Monetary Fund to avoid over-reliance on the USD in a visit to China. Similar voice has been raised by Brazil’s leftist president Lula de Silva in a visit to China.

China would obviously love the rise of Chinese RMB against the USD, as an alternative for trade. But development of new currencies might be in the interest of other countries in the BRICS, but not in the best interest of China because that would diminish the possibility of a strong RMB for world trade.

The Bangladesh Perspective

Like all other developing and emerging economies, Bangladesh had to grapple with the global inflation. Despite the growing pressure on the country’s foreign reserve and no sign of the Fed easing their monetary policy, Bangladesh has yet not entered any currency swap deal with any country. Since 2017, Bangladesh’s central bank has started adding yuan to its foreign currency reserves since IMF added yuan to its Special Drawing Rights (SDR) currency basket. And exporters have been allowed to retain export proceeds in yuan too. Due to the fact that Bangladesh is dependent on Chinese imports for raw materials for its industries, having such arrangements ease pressure on the country.

There was a discussion on signing currency swap agreements with Russia after Russia was off SWIFT last year, but Bangladesh finally decided to thwart the plan despite Russia’s call for settling payments in Rouble, in favour of paying with Chinese RMB. During March of 2023, Russia proposed to export LNG and agricultural products like yellow peas, chickpeas, red lentils, green lentils, sunflower oil etc. to Bangladesh and help Bangladesh modernize its power plants built during pre-independence period. However, Bangladesh does not seem to have a keen interest as of yet. Countries like Qatar and Oman are still Bangladesh’s primary source of LNG.

However, Bangladesh has a growing market in the Russian Federation. According to Bangladesh Bank’s Annual Export Receipts of Goods and Services, Bangladesh’s exports to Russia increased from USD 547,000 in FY 2020-21 to USD 551,000 in FY 2021-22 and imports from Russia dropped from USD 482,000 in FY 2020-21 to USD 474,000 in FY 2021-22. There exists a potentially untapped market for Bangladeshi textile exports in the Russian Federation which cannot be utilized to its full potential due to complication in payments to and from Russia.

In terms of adopting the BRICS currency which is yet to exist in the first place, Bangladesh is a member of the New Development Bank (NDB) since 2021. Bangladesh, UAE and Uruguay are 3 countries that have been admitted to the NDB despite being non-BRICS countries. If BRICS initiate a new currency, the issuing authority has to be NDB in which case Bangladesh will be eligible to use the currency as its member. However, this is implied because at the time of applying for membership, Bangladesh could not know of a future drive by BRICS to introduce a new currency. The purpose was collaboration in development efforts in the emerging economy primarily.

On a very important note, Bangladesh has incurred debt worth $500 million to Russia for the preparatory works for construction of two nuclear reactors with the capacity of 1200 MW each at the Rooppur Nuclear Power Plant in Bangladesh. Which is supposed to add 2400 MW of electricity to the national grid, bolstering Bangladesh’s ability to ensure supply of electricity to its growing industries, economic zones and industrial parks. But the credit agreement in this regard was signed on July 26, 2016, when the Russian and Bangladeshi Parties signed an intergovernmental agreement in Moscow to extend a state credit of 11.38 billion USD for the main stage of Rooppur NPP development. According to Russian News Agency TASS, Bangladesh is supposed to pay it back in equal six-month instalments over a twenty-year period which has been hampered due to the unavailability of any means to pay Russia in USD.

Of course, Bangladesh cannot afford to stall the construction of an essential mega project like Rooppur Nuclear Power Plant, neither can it default on the incurred credits to Russia since it has been known for regular settlement of debt payments. Finally, Bangladesh decided to pay Russia $318 billion in Chinese RMB using China’s Cross-Border Interbank Payment System (CIPS).

A few points to be noted

- It’s a one-time settlement as of yet. Will Bangladesh keep paying Russia with RMB using CIPS for the rest of the Rooppur deal? We have to wait for an answer.

- Bangladesh did not enter a currency swap deal with Russia despite Russia’s interest and instead chose to go for CIPS for the time being.

- Bangladesh’s unwillingness to default in Russian credit settlement can be considered a sign for the WB and IMF about Bangladesh’s seriousness in settling its credit regardless of geopolitical complications.

- Due to using CIPS no country has previously been sanctioned; therefore, Bangladesh avoided any possibility of secondary sanctions from the West in this regard, while not reneging on its commitment to repay Russian loan.

Is CIPS an Alternative?

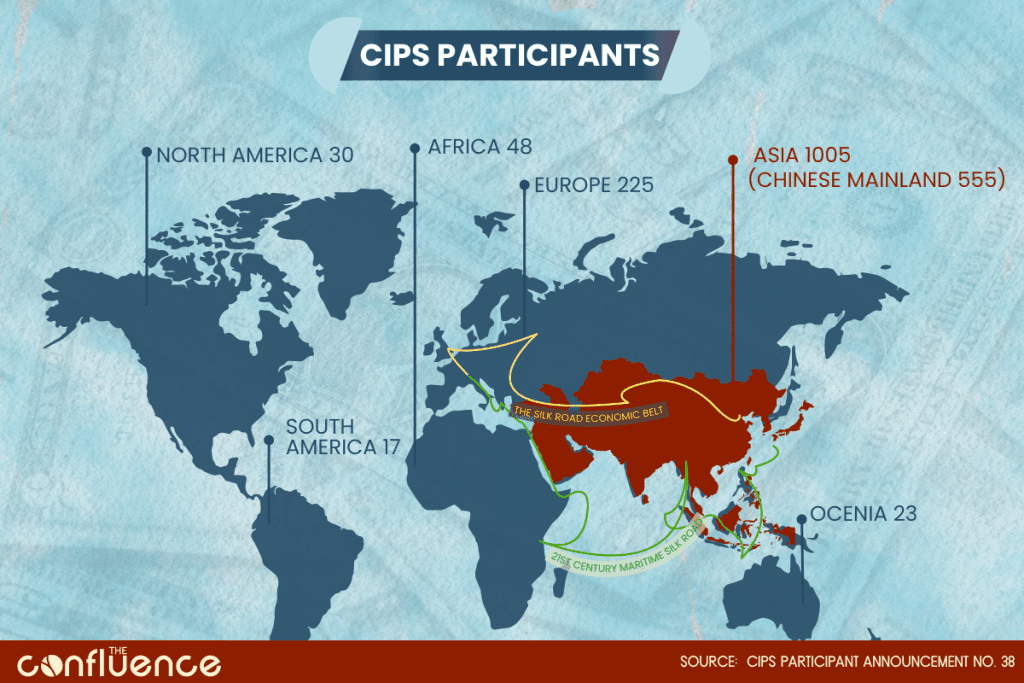

CIPS is a clearing house with its own messaging system whereas SWIFT is a messaging system. Participants of CIPS can opt to use SWIFT for messaging while clearing through CIPS. The mainstream clearing houses include U.S. Clearing House Interbank Payments System (CHIPS) and Clearing House Automated Payment System (CHAPS) in the United Kingdom. While US CHIPS have an average transaction of $1.8 trillion every day, it’s Chinese counterpart CIPS had an average of RMB 451 billion per day, which is around USD 65 billion; significantly less than the US CHIPS.

However, according to CIPS website as of March 2023 “CIPS has 1427 participants with 79 as Direct Participants and 1348 as Indirect Participants. Among Indirect Participants, 1005 participants are from Asia (including 555 from Chinese Mainland), 225 from Europe, 48 from Africa, 30 from North America, 23 from Oceania, and 17 from South America, covering 109 countries and regions around the world.” In contarst, the US CHIPS has around 11,000 financial institutions worldwide, 10 times higher than that of CIPS. However, according to the Center for Strategic and International Studies, most participants of CIPS are overseas branches of Chinese banks. However, no Chinese bank has overseas branch in Latin America, but CIPS shows 17 indirect participants in that region which if true, should be non-Chinese institutions even though CIPS did not disclose names of its direct and indirect participants to maintain confidentiality.

Having a system of payments out of the global dominance of USD is something Russia and its allies would be willing to have as Russia already called for integration of the payment systems of BRICS. Integration of CIPS and Russia’s Rouble, might help Russia in settling payments using China. However, no visible interest has been witnessed so far from China in this regard too.

Caution while using CIPS

Since Bangladesh will be using CIPS, the Chinese clearing house for settlement of Russian debt, a few aspects to be careful of –

- Indirect Participation: Direct participants become member of the clearing house and indirect participants make payments through direct participants. Since it’s a one-time settlement as of now, Bangladesh will be indirect participants presumably, as direct participant has to be incorporated in China. Given China’s transparency records, Bangladesh should be cautious in choosing a direct participant for liaison.

- Messaging: Australia and New Zealand’s ANZ Bank officials have faced difficulties understanding messages in CIPS. The absence of English language messaging in some text fields on the CIPS platform presented a challenge for foreign banks in China. Therefore, in terms of communication, Bangladeshi officials have to be careful of the accuracy of translation.

In conclusion, Bangladesh is not necessarily drifting away from the USD. Bangladesh has secured IMF loans recently for strengthening its possession of USD in the future before any crisis looms in. Bangladesh did not even consider swap deals with Russia or China. Right now, it appears that Bangladesh is primarily concerned with repaying its debt obligations using a temporary settlement like many countries around the world use on a daily basis.

About the Author

Najib Hayder is the Blog Manager at The Confluence. Formerly he has served as the Head of Policy Dialogue at Youth Policy Forum. A former debater, business graduate by chance and policy-enthusiast by choice.